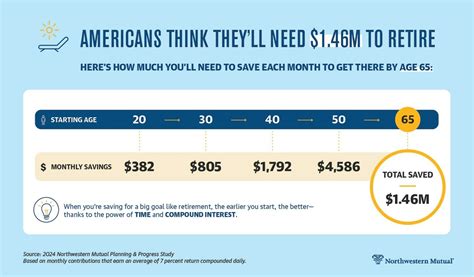

To retire comfortably in 2025, Americans are now estimated to need $1.46 million, a daunting figure that remains out of reach for the vast majority, according to a recent analysis. Mounting inflation, increased longevity, and inadequate savings rates contribute to the widening gap between retirement aspirations and reality.

The benchmark figure, reflecting data and projections analyzed by financial experts, underscores the escalating costs associated with maintaining a desired lifestyle throughout retirement. “While $1.46 million might seem like a huge number, it’s what many Americans will need to have saved to retire comfortably in 2025,” the original report stated. However, the median retirement savings for Americans falls far short of this goal, leaving many vulnerable to financial insecurity in their later years.

The confluence of factors impacting retirement preparedness is complex and multifaceted. Inflation, which has surged in recent years, erodes the purchasing power of savings, requiring individuals to accumulate even larger nest eggs to cover essential expenses. Increased longevity means retirees need to fund a longer retirement period, further straining their resources. Simultaneously, stagnant wages and rising living costs make it challenging for many to save adequately for the future.

“People are living longer, healthcare costs are rising, and the traditional three-legged stool of retirement—Social Security, pensions, and personal savings—is becoming increasingly unstable for many,” explains a financial planner. “Relying solely on Social Security is no longer a viable option for maintaining a comfortable retirement lifestyle.”

The implications of this retirement savings shortfall are far-reaching, affecting not only individual financial well-being but also broader economic stability. As more Americans enter retirement without sufficient resources, they may be forced to rely on government assistance, delay retirement, or significantly reduce their standard of living.

The Rising Cost of Retirement:

The $1.46 million target isn’t an arbitrary figure; it’s a calculated estimate based on several key assumptions. Financial advisors typically recommend aiming to replace approximately 80% of pre-retirement income to maintain a similar lifestyle in retirement. This replacement rate accounts for reduced expenses such as commuting costs and payroll taxes, while also factoring in potential increases in healthcare costs and leisure spending.

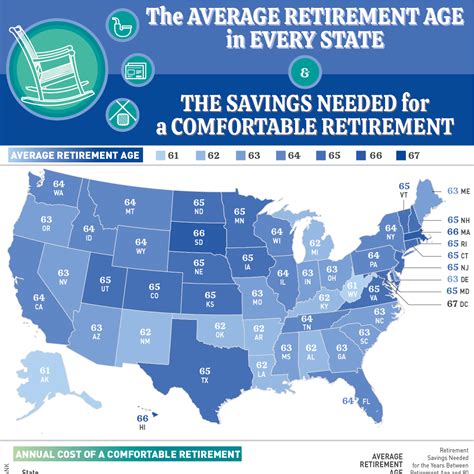

The actual amount needed for a comfortable retirement will vary depending on individual circumstances, including lifestyle preferences, geographic location, health status, and expected longevity. However, the $1.46 million benchmark provides a general guideline for assessing retirement readiness.

Inflation plays a significant role in determining the required retirement savings. As the cost of goods and services increases, the purchasing power of savings diminishes. Recent inflationary pressures have significantly increased the retirement savings target. The report highlights the impact of current economic conditions on retirement planning, stating, “Inflation is making it harder for people to save, and it’s also eroding the value of existing savings.”

Healthcare costs are another major consideration. Medical expenses tend to increase with age, and retirees may face unexpected healthcare needs. Long-term care expenses, in particular, can be substantial and can quickly deplete retirement savings. Planning for these potential healthcare costs is crucial for ensuring financial security in retirement.

The Savings Gap:

While the $1.46 million target represents a significant challenge, the reality is that most Americans are far from reaching this goal. According to various studies and surveys, the median retirement savings for Americans across different age groups falls considerably short of what’s needed.

Data from the Federal Reserve indicates that the median retirement savings for households aged 55-64 is significantly lower than the recommended target. This suggests that many near-retirees are at risk of experiencing financial hardship in their later years.

Several factors contribute to the savings gap. One major obstacle is the lack of financial literacy and planning. Many individuals lack the knowledge and skills necessary to effectively manage their finances and make informed retirement savings decisions.

Another challenge is the competing financial priorities that many Americans face. Stagnant wages, rising living costs, and student loan debt make it difficult for individuals to save adequately for retirement. Many are forced to prioritize immediate needs over long-term financial goals.

The decline of traditional pension plans has also shifted the responsibility for retirement savings to individuals. While 401(k) plans and other defined contribution plans offer valuable savings opportunities, they require individuals to actively manage their investments and make informed decisions.

Strategies for Closing the Gap:

Despite the challenges, there are several strategies that individuals can employ to improve their retirement readiness and close the savings gap.

-

Start Saving Early: The earlier you begin saving for retirement, the more time your investments have to grow through the power of compounding. Even small contributions made early in your career can have a significant impact over time.

-

Increase Savings Rate: Gradually increase your savings rate over time. Aim to save at least 15% of your income for retirement, including employer contributions.

-

Take Advantage of Employer Matching: If your employer offers a 401(k) plan with matching contributions, be sure to take full advantage of this benefit. Employer matching is essentially free money that can significantly boost your retirement savings.

-

Diversify Investments: Diversify your investment portfolio across different asset classes, such as stocks, bonds, and real estate. Diversification can help reduce risk and improve long-term returns.

-

Seek Professional Advice: Consider consulting with a financial advisor who can help you develop a personalized retirement savings plan tailored to your individual circumstances.

-

Delay Retirement (If Possible): Working for a few additional years can significantly boost your retirement savings and reduce the number of years you’ll need to fund your retirement.

-

Reduce Debt: High levels of debt can hinder your ability to save for retirement. Prioritize paying down high-interest debt, such as credit card debt, to free up more cash flow for savings.

-

Consider Downsizing: Downsizing your home or moving to a more affordable location can free up significant financial resources for retirement savings.

The Role of Government and Employers:

Addressing the retirement savings crisis requires a collaborative effort involving individuals, employers, and the government.

Employers can play a crucial role by offering robust retirement savings plans with matching contributions and financial education programs. Auto-enrollment and auto-escalation features can help increase participation rates and savings levels.

The government can also take steps to promote retirement savings through policies such as tax incentives, expanded access to retirement savings plans, and improved financial literacy programs.

Strengthening Social Security is also essential for ensuring a secure retirement for all Americans. While Social Security benefits alone may not be sufficient to maintain a comfortable retirement lifestyle, they provide a crucial safety net for many retirees.

The Psychological Aspect of Retirement Planning:

Beyond the numbers and financial strategies, there’s a significant psychological component to retirement planning. Many people struggle with the transition from working life to retirement, experiencing feelings of anxiety, uncertainty, and loss of purpose.

It’s important to plan not only for the financial aspects of retirement but also for the emotional and social aspects. Consider how you’ll spend your time, maintain social connections, and pursue your passions and interests in retirement.

Conclusion:

The $1.46 million retirement savings target for 2025 serves as a stark reminder of the challenges facing Americans as they prepare for retirement. While the target may seem daunting, it’s essential to take proactive steps to improve your retirement readiness. By starting early, saving consistently, and seeking professional advice, you can increase your chances of achieving a comfortable and secure retirement. The combination of individual responsibility, employer support, and government policies is crucial for addressing the retirement savings crisis and ensuring a brighter future for all Americans. It is important to not be discouraged. It is still possible to live comfortably in retirement with less than the projected amount by adjusting expectations and prioritizing needs versus wants.

Frequently Asked Questions (FAQs):

1. How was the $1.46 million figure calculated for a comfortable retirement in 2025?

The $1.46 million figure is an estimated benchmark based on several factors, including the need to replace approximately 80% of pre-retirement income to maintain a similar lifestyle, projected inflation rates, anticipated healthcare costs, and estimated longevity. It’s a general guideline, and the actual amount needed will vary based on individual circumstances. Financial advisors use these factors to project the amount of savings needed to generate sufficient income throughout retirement, considering potential investment returns and withdrawal rates. The analysis usually incorporates assumptions about inflation, investment growth, and life expectancy to arrive at the target savings amount.

2. What are the main reasons why so few Americans are on track to reach this retirement savings goal?

Several factors contribute to the retirement savings shortfall. These include:

- Inadequate Savings Rates: Many individuals are not saving enough of their income for retirement due to competing financial priorities such as housing costs, student loan debt, and childcare expenses.

- Stagnant Wages: Wage growth has not kept pace with inflation, making it difficult for many to save adequately.

- Lack of Financial Literacy: Many people lack the knowledge and skills necessary to effectively manage their finances and make informed retirement savings decisions.

- Decline of Pension Plans: The shift from traditional defined benefit pension plans to defined contribution plans like 401(k)s has placed more responsibility on individuals to manage their own retirement savings.

- Unexpected Expenses: Unforeseen medical expenses, job loss, or other financial emergencies can derail retirement savings plans.

3. What are some practical steps individuals can take to improve their retirement savings, even if they are starting late?

Even if you are starting late, there are several steps you can take to improve your retirement savings:

- Increase Savings Rate: Gradually increase your savings rate, even if it’s just by 1% or 2% per year.

- Take Advantage of Employer Matching: Maximize your employer’s 401(k) matching contributions.

- Reduce Debt: Pay down high-interest debt to free up more cash flow for savings.

- Delay Retirement: Working for a few additional years can significantly boost your retirement savings.

- Consolidate Retirement Accounts: Consolidating multiple retirement accounts can simplify management and potentially reduce fees.

- Seek Professional Advice: Consult with a financial advisor for personalized guidance.

- Adjust Lifestyle: Reducing discretionary spending can allow for more to be saved.

- Consider a Roth IRA or Roth 401(k): These plans offer tax-free withdrawals in retirement.

4. How does inflation affect retirement savings, and what can be done to mitigate its impact?

Inflation erodes the purchasing power of savings, meaning that the same amount of money will buy fewer goods and services over time. To mitigate the impact of inflation:

- Invest in Growth Assets: Stocks and other growth assets have historically outpaced inflation over the long term.

- Consider Inflation-Protected Securities: Treasury Inflation-Protected Securities (TIPS) are designed to protect investors from inflation.

- Adjust Withdrawal Rates: Be mindful of withdrawal rates in retirement and adjust them as needed to account for inflation.

- Factor Inflation into Retirement Projections: When estimating retirement expenses, be sure to factor in potential inflation rates.

- Consider Real Estate: Real estate investments can provide a hedge against inflation.

5. What role do Social Security benefits play in retirement, and are they sufficient for a comfortable retirement?

Social Security benefits provide a crucial safety net for many retirees, but they are generally not sufficient to maintain a comfortable retirement lifestyle on their own. Social Security is designed to replace only a portion of pre-retirement income, and the replacement rate varies depending on earnings history.

For many retirees, Social Security benefits will cover essential expenses such as housing, food, and healthcare. However, additional savings and income sources are typically needed to maintain a desired lifestyle in retirement.

It’s important to understand how Social Security benefits are calculated and to plan accordingly. You can estimate your future Social Security benefits by using the Social Security Administration’s online calculator. Also, understand that the future of Social Security is uncertain, and that it may be subject to changes that affect future benefits. Planning assumes that Social Security will be available, but acknowledges the need for additional sources of income.

The $1.46 million is a goal to strive for that is considered comfortable, but comfortable can be achieved at other levels depending on lifestyle choices and debt management. The key to any successful retirement is to plan and seek professional guidance.