Jim Cramer’s recent warning regarding the 10-year Treasury yield proved drastically off-target, overshooting his prediction by a staggering 380%, undermining his credibility among market observers.

CNBC’s Jim Cramer, known for his market pronouncements on “Mad Money,” significantly missed the mark with his forecast on the 10-year Treasury yield. In October, Cramer cautioned viewers about an impending surge in the 10-year yield, advising them to brace for a climb to 5%. However, instead of rising, the yield plummeted, recently hovering around 3.9%, revealing a massive miscalculation. This deviation of approximately 380% raises questions about the accuracy and reliability of his market analysis.

Cramer’s erroneous prediction underscores the inherent challenges in forecasting financial markets, which are subject to myriad and often unpredictable factors. The misjudgment also reignites the debate surrounding the influence and accountability of financial commentators. This situation highlights the risks investors face when relying solely on media personalities for financial advice, as emphasized by experts and financial analysts.

The Erroneous Forecast

During an October broadcast, Jim Cramer emphatically stated his expectation for the 10-year Treasury yield to reach 5%. He warned viewers that rising rates would negatively impact various sectors, particularly housing and technology. However, contrary to his forecast, the 10-year yield embarked on a downward trajectory, confounding his prediction. The yield never approached the 5% threshold; instead, it has consistently fallen, currently sitting around 3.9%.

This massive discrepancy between Cramer’s forecast and the actual market performance raises serious concerns about the methodology and accuracy of his analysis. Financial analysts have been quick to point out that such a significant error can have detrimental consequences for investors who base their decisions on such advice.

Market Reaction and Investor Sentiment

Following Cramer’s inaccurate forecast, many investors expressed disappointment and skepticism regarding his market analysis. The financial community has highlighted the necessity of conducting independent research rather than relying solely on media personalities. This incident has fueled discussions about the role of financial commentators in shaping market sentiment and the responsibilities they bear in providing accurate information.

Experts emphasize that market forecasts should be viewed as merely one component of a comprehensive investment strategy and not as definitive guidelines. They stress the importance of diversification and careful risk management in navigating the complexities of the financial markets.

Impact on Cramer’s Credibility

The miscalculated forecast has understandably impacted Cramer’s credibility within the financial community. Critics argue that his pronouncements often lack the depth and rigor necessary for precise market predictions. This incident is not an isolated case; Cramer has faced criticism in the past for other inaccurate predictions and investment recommendations.

While Cramer remains a prominent figure in financial media, the recent forecasting error has prompted many to reassess his reliability. Financial analysts suggest that investors should approach his commentary with caution and consider a wide range of sources before making investment decisions.

Broader Implications for Financial Forecasting

Cramer’s misjudgment underscores the inherent difficulties in financial forecasting. The global economy is influenced by numerous factors, including geopolitical events, economic indicators, and unforeseen crises. These factors make it nearly impossible to predict market movements with absolute certainty.

Financial professionals acknowledge that even the most sophisticated models and analytical techniques can be subject to error. As a result, they emphasize the importance of adaptive investment strategies that can be adjusted in response to changing market conditions. The Cramer incident serves as a reminder of the limitations of forecasting and the necessity of maintaining a pragmatic approach to financial planning.

Expert Analysis and Commentary

Financial experts have weighed in on Cramer’s inaccurate forecast, providing additional insights into the factors that may have contributed to his misjudgment. Some analysts suggest that Cramer may have overemphasized certain economic indicators while overlooking others. Others point to the unpredictable nature of global events that can quickly alter market dynamics.

One financial analyst noted, “While it is impossible to predict the future with certainty, it is crucial for financial commentators to base their analysis on thorough research and a comprehensive understanding of market fundamentals.”

Another expert added, “Investors should view media commentary as just one piece of the puzzle and always conduct their own due diligence before making any investment decisions.”

Alternative Perspectives and Counterarguments

Despite the widespread criticism, some argue that Cramer’s role is primarily to entertain and stimulate discussion rather than provide definitive financial advice. They suggest that his commentary should be viewed as a form of market entertainment rather than a source of reliable investment guidance.

However, this perspective is not universally accepted. Many argue that financial commentators have a responsibility to provide accurate and responsible information, particularly given the potential impact of their statements on investors’ financial well-being.

Lessons for Investors

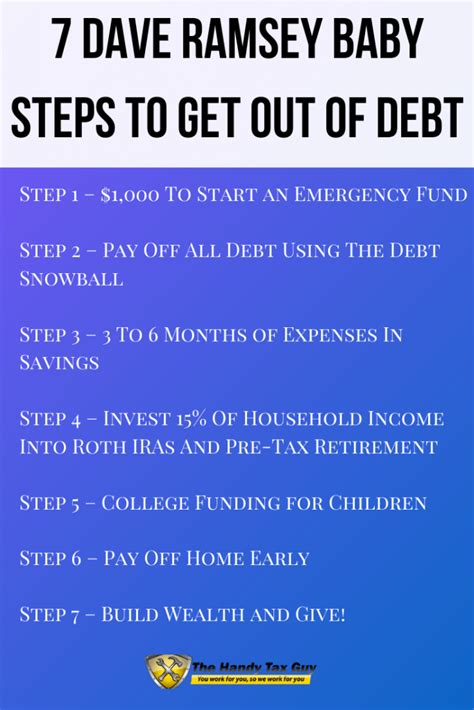

The Cramer forecasting error provides valuable lessons for investors of all levels of experience. The most important takeaway is the need for independent research and critical thinking. Investors should not blindly follow the advice of any single individual or source, but rather gather information from a variety of sources and make informed decisions based on their own analysis.

Other key lessons include:

- Diversification: Spreading investments across different asset classes can help mitigate risk and protect against market volatility.

- Risk Management: Understanding one’s own risk tolerance and setting appropriate limits is essential for responsible investing.

- Long-Term Perspective: Focusing on long-term goals rather than short-term fluctuations can help avoid emotional decision-making.

- Continuous Learning: Staying informed about market trends and economic developments is crucial for making sound investment decisions.

Comparison with Other Forecasts

To provide a broader context, it is useful to compare Cramer’s forecast with those of other financial analysts and institutions. A survey of leading economic forecasts revealed a wide range of predictions for the 10-year Treasury yield in October. While some analysts anticipated a modest increase, none predicted a surge to 5%.

This comparison highlights the degree to which Cramer’s forecast deviated from the consensus view. It also underscores the importance of considering a range of perspectives when evaluating market predictions.

The Role of Financial Media

The incident involving Cramer raises important questions about the role of financial media in shaping investor behavior. Financial media outlets have a powerful influence on market sentiment and can significantly impact investment decisions.

As a result, it is crucial for financial journalists and commentators to adhere to high standards of accuracy and responsibility. They should avoid sensationalism and focus on providing balanced and objective information.

Future Implications

The long-term implications of Cramer’s inaccurate forecast remain to be seen. While the incident may damage his credibility in the short term, it is unlikely to diminish his prominence in financial media entirely.

However, the incident may prompt investors to be more cautious about relying solely on his advice. It may also encourage financial media outlets to adopt more rigorous standards for their commentators.

Conclusion

Jim Cramer’s miscalculated forecast regarding the 10-year Treasury yield serves as a cautionary tale for investors and financial media professionals alike. It underscores the inherent difficulties in financial forecasting and the importance of independent research and critical thinking.

While market predictions can be useful tools for informing investment decisions, they should not be treated as definitive guidelines. Investors should always diversify their portfolios, manage their risk prudently, and maintain a long-term perspective. The Cramer incident serves as a reminder of the limitations of forecasting and the necessity of maintaining a pragmatic approach to financial planning.

Additional Context and Background

Jim Cramer’s career spans several decades, during which he has established himself as a prominent figure in financial media. Before becoming a television personality, Cramer co-founded a hedge fund, Cramer Berkowitz, which achieved notable success in the 1990s. He later transitioned to writing and broadcasting, eventually launching “Mad Money” on CNBC.

Throughout his career, Cramer has developed a reputation for his energetic and often theatrical style of presentation. He is known for his bold predictions and outspoken opinions, which have both attracted a large following and drawn criticism from some corners of the financial community.

Cramer’s influence on the market is undeniable. His recommendations can sometimes lead to short-term price movements in individual stocks. However, the long-term impact of his commentary is less clear.

The Dynamics of Treasury Yields

Understanding the dynamics of Treasury yields is essential for comprehending the significance of Cramer’s forecasting error. Treasury yields reflect the market’s expectations for future interest rates and inflation. They also serve as a benchmark for other interest rates, such as mortgage rates and corporate bond yields.

The 10-year Treasury yield is particularly important because it is widely used as a proxy for the overall health of the economy. A rising yield typically indicates that investors expect stronger economic growth and higher inflation, while a falling yield suggests the opposite.

Numerous factors can influence Treasury yields, including Federal Reserve policy, economic data releases, geopolitical events, and investor sentiment. Predicting yield movements is notoriously difficult, even for experienced financial professionals.

The Importance of Independent Analysis

The Cramer forecasting error underscores the importance of independent analysis in financial decision-making. Investors should not rely solely on the opinions of media personalities, but rather conduct their own research and due diligence.

Independent analysis involves gathering information from a variety of sources, evaluating the credibility of those sources, and forming one’s own conclusions. It also involves understanding one’s own risk tolerance and investment goals.

By conducting independent analysis, investors can make more informed decisions and reduce their reliance on potentially flawed advice.

The Role of Regulation

The incident involving Cramer raises questions about the role of regulation in protecting investors from misleading financial advice. While financial media outlets are subject to certain regulations, these regulations are often limited in scope.

Some argue that financial commentators should be held to a higher standard of accountability, particularly given the potential impact of their statements on investors’ financial well-being. Others argue that stricter regulations could stifle free speech and hinder the flow of information.

The debate over regulation in financial media is likely to continue as the industry evolves.

Future Market Outlook

The future outlook for the 10-year Treasury yield remains uncertain. While some analysts expect yields to rise gradually as the economy continues to recover, others predict that yields will remain low for an extended period.

The Federal Reserve’s policy decisions will be a key factor in determining the direction of Treasury yields. If the Fed begins to raise interest rates more aggressively than expected, yields could rise sharply. However, if the economy weakens or inflation remains low, yields could remain subdued.

Investors should closely monitor economic data and Fed policy announcements to stay informed about the potential direction of Treasury yields.

The Psychology of Investing

The Cramer forecasting error also highlights the psychology of investing. Investors are often influenced by emotions such as fear and greed, which can lead to irrational decision-making.

Media commentary can exacerbate these emotions, particularly during periods of market volatility. Investors should be aware of their own emotional biases and take steps to mitigate their influence.

Developing a disciplined investment strategy and sticking to it can help investors avoid making impulsive decisions based on fear or greed.

Alternative Investment Strategies

In light of the uncertainties surrounding the market, investors may want to consider alternative investment strategies. These strategies may include diversifying into asset classes such as real estate, commodities, or private equity.

Alternative investment strategies can help reduce portfolio volatility and potentially enhance returns. However, they also come with their own risks and complexities.

Investors should carefully research any alternative investment strategy before committing capital.

The Importance of Financial Literacy

The Cramer forecasting error underscores the importance of financial literacy. Many investors lack a basic understanding of financial concepts, which makes them vulnerable to misleading advice.

Improving financial literacy requires a concerted effort from individuals, schools, and the government. Financial education programs can help investors develop the skills and knowledge they need to make informed decisions.

The Evolving Media Landscape

The media landscape is constantly evolving, with new platforms and channels emerging all the time. This makes it more challenging than ever for investors to discern reliable information from misinformation.

Investors should be critical of the sources they consult and seek out information from reputable and objective sources. They should also be wary of social media and online forums, where misinformation can spread rapidly.

Long-Term Financial Planning

Ultimately, successful investing is about more than just making short-term profits. It is about developing a long-term financial plan that aligns with one’s goals and values.

A comprehensive financial plan should include goals for retirement, education, and other major life events. It should also include strategies for saving, investing, and managing debt.

By developing a long-term financial plan, investors can increase their chances of achieving their financial goals and securing their financial future.

FAQ on Jim Cramer’s Forecast Error

1. What was Jim Cramer’s inaccurate forecast about?

Jim Cramer predicted in October that the 10-year Treasury yield would rise to 5%. Contrary to his prediction, the yield has since fallen to around 3.9%.

2. How much did Cramer’s forecast miss the actual mark?

Cramer’s forecast missed the actual yield by approximately 380%.

3. What has been the impact on Cramer’s credibility?

The inaccurate forecast has damaged Cramer’s credibility within the financial community, prompting many to question his reliability and analytical approach.

4. What lessons can investors learn from this incident?

Investors should prioritize independent research, diversify their portfolios, manage risk prudently, and maintain a long-term perspective rather than relying solely on media personalities.

5. What factors influence the 10-year Treasury yield?

Numerous factors influence the 10-year Treasury yield, including Federal Reserve policy, economic data releases, geopolitical events, and investor sentiment.