A couple who meticulously followed Dave Ramsey’s financial advice found themselves with $46,000 in debt after experiencing unexpected financial setbacks and questioning the rigidity of the plan in their specific circumstances.

Following Dave Ramsey’s renowned “Baby Steps” program is often touted as a surefire path to debt freedom, but for one couple, the journey took an unexpected and disheartening turn, resulting in a $46,000 debt burden despite their initial commitment. According to a recent report, the couple, who remain unnamed in the original article to protect their privacy, diligently followed Ramsey’s plan, which emphasizes aggressive debt reduction and a strict budgeting approach. However, unforeseen circumstances and a reevaluation of the plan’s applicability to their unique financial situation led to a significant accumulation of debt.

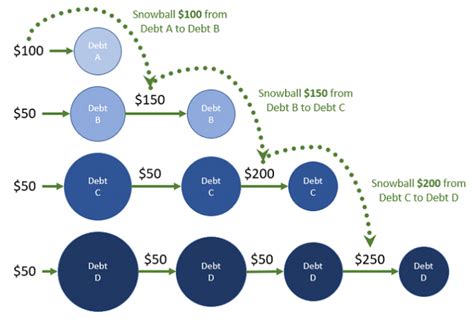

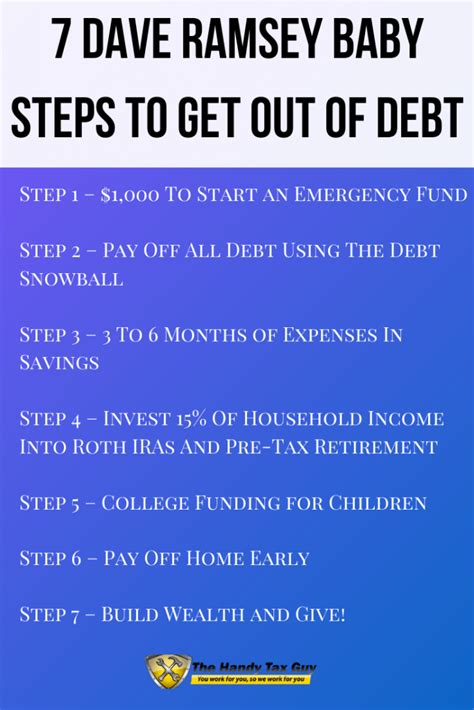

The couple’s journey began with high hopes and a determination to achieve financial independence. They embraced the principles of the “Baby Steps,” which include saving a $1,000 starter emergency fund, paying off all debt (except the house) using the debt snowball method (paying off debts from smallest to largest regardless of interest rate), saving 3-6 months of expenses in a fully funded emergency fund, investing 15% of household income in retirement, saving for children’s college fund, paying off the home early, and building wealth.

Initially, the plan seemed to be working. They diligently tracked their expenses, cut unnecessary spending, and directed every spare dollar toward their debts. However, as time went on, they encountered unforeseen challenges that tested the limits of the Ramsey plan. Unexpected medical bills, car repairs, and a period of unemployment significantly impacted their financial stability.

The “turn” in their journey occurred when they began questioning the rigidity of the debt snowball method in the face of high-interest debt. While the Ramsey plan prioritizes psychological wins by tackling smaller debts first, regardless of interest rates, the couple realized that they were paying significantly more in interest over time by neglecting larger debts with higher interest rates. This realization led them to deviate from the plan and adopt a more customized approach to debt repayment.

Despite their efforts to adapt the plan, the unforeseen expenses and the accrued interest on their debts proved to be overwhelming. The couple ultimately found themselves with a debt of $46,000, a stark contrast to their initial goal of debt freedom. Their experience highlights the importance of flexibility and adaptability in financial planning and the need to tailor strategies to individual circumstances.

This case study raises questions about the universal applicability of the Dave Ramsey plan. While the plan has helped countless individuals achieve financial success, it may not be suitable for everyone, particularly those facing significant financial challenges or those with complex financial situations. Financial experts often emphasize the importance of considering factors such as income stability, debt composition, and risk tolerance when developing a personalized financial plan.

The couple’s story serves as a cautionary tale, reminding individuals to carefully evaluate their financial situation, consider all available options, and seek professional advice when necessary. While the Dave Ramsey plan can be a valuable tool for debt reduction, it is essential to approach it with a critical eye and adapt it to one’s specific needs and circumstances.

Detailed Breakdown:

The couple’s experience underscores several critical aspects of personal finance and the potential pitfalls of adhering too rigidly to any single financial plan without considering individual circumstances.

-

The Allure and Limitations of the “Baby Steps”: Dave Ramsey’s “Baby Steps” are designed to provide a clear, step-by-step approach to financial freedom. The initial steps, such as building a small emergency fund and aggressively paying off debt, are particularly appealing to those feeling overwhelmed by their financial situation. The “debt snowball” method, where individuals focus on paying off the smallest debt first, provides quick wins and a psychological boost, which can be highly motivating. However, the downside of this approach is that it may not be the most efficient way to reduce debt from a purely mathematical standpoint.

-

Impact of Unexpected Expenses: Life is unpredictable, and unforeseen expenses can derail even the most carefully laid financial plans. Medical bills, car repairs, job loss, and home repairs are just a few examples of unexpected events that can significantly impact a household’s finances. Without a sufficient emergency fund, these expenses can quickly lead to debt accumulation. In the couple’s case, unexpected medical bills and car repairs played a significant role in their debt spiral.

-

The Importance of Interest Rates: The “debt snowball” method prioritizes psychological wins over minimizing interest paid. While this can be effective for some, it can also be costly. If the couple had focused on paying off debts with the highest interest rates first (the “debt avalanche” method), they may have saved a significant amount of money in the long run. The difference between the interest rates on various debts can be substantial, and neglecting high-interest debt can prolong the debt repayment process and increase the overall cost of borrowing.

-

The Need for a Personalized Approach: Every individual’s financial situation is unique, and there is no one-size-fits-all solution to debt reduction. Factors such as income, expenses, debt composition, risk tolerance, and financial goals all play a role in determining the best course of action. The couple’s experience highlights the importance of tailoring financial plans to individual circumstances and being willing to adapt as needed. Sticking rigidly to a plan that does not account for unforeseen events or changing financial priorities can be detrimental.

-

The Role of Financial Advice: Seeking professional financial advice can be invaluable, especially for those with complex financial situations or those struggling to manage their debt. A financial advisor can help individuals assess their financial situation, develop a personalized financial plan, and provide guidance on debt reduction strategies, investment options, and retirement planning. While Dave Ramsey offers financial advice through his books, radio show, and online resources, it is essential to recognize that this advice is general in nature and may not be appropriate for everyone.

The Ramsey Plan: A Closer Look

Dave Ramsey’s financial advice has resonated with millions seeking financial freedom, particularly those struggling with debt. His “Baby Steps” provide a clear, actionable framework for achieving financial stability. However, it is essential to understand the nuances of the plan and its potential limitations.

-

Baby Step 1: $1,000 Starter Emergency Fund: This initial step is designed to provide a small safety net to cover unexpected expenses. While $1,000 may not be sufficient to cover all emergencies, it can help prevent individuals from resorting to credit cards or payday loans when faced with unexpected costs.

-

Baby Step 2: Pay Off All Debt (Except the House) Using the Debt Snowball: As mentioned earlier, the “debt snowball” method involves paying off debts from smallest to largest, regardless of interest rate. This approach prioritizes psychological wins and can be motivating for those who are easily discouraged. However, it may not be the most efficient way to reduce debt from a purely mathematical standpoint.

-

Baby Step 3: Save 3-6 Months of Expenses in a Fully Funded Emergency Fund: This step is crucial for building financial security and protecting against unexpected job loss or other financial setbacks. Having a fully funded emergency fund can provide peace of mind and prevent individuals from accumulating debt during times of hardship.

-

Baby Step 4: Invest 15% of Household Income in Retirement: Investing for retirement is essential for long-term financial security. Ramsey recommends investing 15% of household income in retirement accounts such as 401(k)s and Roth IRAs.

-

Baby Step 5: Save for Children’s College Fund: Saving for college can be a significant expense, and starting early can make a big difference. Ramsey recommends using tax-advantaged accounts such as 529 plans to save for college.

-

Baby Step 6: Pay Off the Home Early: Paying off the mortgage early can free up cash flow and reduce overall interest costs. However, it is important to consider the opportunity cost of paying off the mortgage early, as the money could potentially be invested elsewhere and generate a higher return.

-

Baby Step 7: Build Wealth and Give: This final step is about building wealth and using it to make a positive impact on the world. Ramsey encourages individuals to be generous and give back to their communities.

Alternative Debt Reduction Strategies:

While the “debt snowball” method is popular, there are other debt reduction strategies that may be more efficient for some individuals.

-

Debt Avalanche: The “debt avalanche” method involves paying off debts with the highest interest rates first, regardless of the loan balance. This approach minimizes the total amount of interest paid over time and can be more efficient than the “debt snowball” method.

-

Debt Consolidation: Debt consolidation involves taking out a new loan to pay off multiple existing debts. This can simplify debt repayment and potentially lower the overall interest rate. However, it is important to shop around for the best rates and terms and to avoid taking on more debt than you can afford.

-

Balance Transfer: A balance transfer involves transferring the balance of a high-interest credit card to a new credit card with a lower interest rate. This can save you money on interest charges and help you pay off your debt faster. However, it is important to be aware of any balance transfer fees and to make sure you can pay off the balance before the introductory rate expires.

-

Negotiating with Creditors: In some cases, it may be possible to negotiate with creditors to lower your interest rates or monthly payments. This can be a viable option for those who are struggling to make their payments.

The Broader Context: Personal Finance and Behavioral Economics

The couple’s experience also touches upon the intersection of personal finance and behavioral economics. Behavioral economics explores how psychological factors influence financial decision-making. For instance, the “debt snowball” method’s success often hinges on the psychological boost of early wins, which can outweigh the purely mathematical advantage of the “debt avalanche” method. This highlights how emotional factors play a significant role in how people manage their finances.

Furthermore, the concept of “loss aversion” – the tendency to feel the pain of a loss more strongly than the pleasure of an equivalent gain – can influence debt repayment strategies. Some individuals may be more motivated to avoid the perceived loss of not paying off a small debt quickly, even if it means paying more interest in the long run.

Understanding these behavioral biases can help individuals make more informed financial decisions. It’s crucial to be aware of how emotions and psychological factors can influence spending habits, saving behavior, and debt repayment strategies. By recognizing these biases, individuals can take steps to mitigate their impact and make more rational financial choices.

Financial Resilience: Building a Strong Foundation

The key takeaway from the couple’s story isn’t necessarily a condemnation of the Dave Ramsey plan, but rather a reminder of the importance of financial resilience. Financial resilience refers to the ability to withstand financial shocks and bounce back from setbacks. Building financial resilience involves several key components:

-

Adequate Emergency Savings: Having a robust emergency fund is crucial for weathering unexpected financial storms. Financial experts generally recommend saving 3-6 months’ worth of living expenses in a readily accessible account. This cushion can provide a safety net in case of job loss, medical emergencies, or other unforeseen events.

-

Diversified Income Streams: Relying on a single source of income can be risky. Exploring opportunities to diversify income streams, such as starting a side hustle or investing in passive income generating assets, can provide a buffer against job loss or income reduction.

-

Comprehensive Insurance Coverage: Adequate insurance coverage, including health insurance, auto insurance, and homeowners or renters insurance, can protect against significant financial losses due to accidents, illnesses, or property damage.

-

Financial Literacy and Education: Understanding basic financial principles, such as budgeting, saving, investing, and debt management, is essential for making informed financial decisions. Continuously seeking financial education and staying informed about economic trends can help individuals navigate the complexities of personal finance.

-

Contingency Planning: Developing a contingency plan for potential financial setbacks can help individuals prepare for unexpected events and minimize their impact. This plan should include strategies for reducing expenses, increasing income, and accessing emergency funds.

Conclusion:

The couple’s experience serves as a valuable lesson in the complexities of personal finance. While the Dave Ramsey plan can be a helpful starting point for many, it is crucial to approach it with a critical eye and adapt it to individual circumstances. Unexpected expenses, high-interest debt, and a lack of flexibility can derail even the most well-intentioned financial plans.

Ultimately, achieving financial freedom requires a personalized approach, a commitment to financial literacy, and a willingness to adapt to changing circumstances. Building financial resilience and seeking professional advice when necessary can help individuals navigate the challenges of personal finance and achieve their financial goals. The couple’s story highlights the importance of understanding the underlying principles of personal finance rather than blindly following a prescribed plan. Financial success is not just about eliminating debt; it is about creating a sustainable financial foundation that can withstand the inevitable storms of life. The lesson is not that the Ramsey plan is inherently flawed, but that any financial plan must be flexible and adaptable to individual needs and unforeseen circumstances. It is a journey, not a destination, and requires constant evaluation and adjustment.

Frequently Asked Questions (FAQ):

-

What is the Dave Ramsey plan and its “Baby Steps”?

- The Dave Ramsey plan is a financial program based on seven “Baby Steps” designed to help individuals get out of debt and build wealth. The steps include: 1) Saving $1,000 for a starter emergency fund, 2) Paying off all debt (except the house) using the debt snowball method, 3) Saving 3-6 months of expenses in a fully funded emergency fund, 4) Investing 15% of household income in retirement, 5) Saving for children’s college fund, 6) Paying off the home early, and 7) Building wealth and giving.

-

What is the “debt snowball” method and how does it differ from the “debt avalanche” method?

- The “debt snowball” method involves paying off debts from smallest to largest, regardless of interest rate. This approach prioritizes psychological wins by providing quick successes. The “debt avalanche” method, on the other hand, focuses on paying off debts with the highest interest rates first, which minimizes the total amount of interest paid over time.

-

Why did the couple in the article end up with $46,000 in debt despite following the Dave Ramsey plan?

- The couple encountered unexpected financial setbacks, such as medical bills and car repairs, which strained their budget. They also began to question the rigidity of the debt snowball method, particularly regarding high-interest debt, and deviated from the plan. These factors contributed to their debt accumulation.

-

Is the Dave Ramsey plan suitable for everyone?

- While the Dave Ramsey plan has helped many people, it may not be suitable for everyone. Individuals with complex financial situations, significant financial challenges, or those who prefer a more mathematically efficient approach to debt repayment may find the plan less effective. A personalized financial plan is often recommended.

-

What are some alternative debt reduction strategies besides the debt snowball method?

- Alternative debt reduction strategies include the debt avalanche method (paying off debts with the highest interest rates first), debt consolidation (taking out a new loan to pay off multiple debts), balance transfers (transferring high-interest credit card balances to lower-interest cards), and negotiating with creditors to lower interest rates or monthly payments.