Living off dividends at 62 is attainable with strategic investment in high-yield stocks, according to Insider Monkey’s analysis of dividend yields, financial stability, and growth potential. The report identifies six companies poised to provide a comfortable retirement income stream: Enterprise Products Partners L.P. (EPD), MPLX LP (MPLX), British American Tobacco p.l.c. (BTI), Verizon Communications Inc. (VZ), ONEOK, Inc. (OKE), and Pembina Pipeline Corporation (PBA). These stocks offer a blend of attractive dividend yields and relative safety in a turbulent market, making them potentially suitable for retirees seeking passive income.

The goal of early retirement, particularly living off dividends by age 62, is increasingly popular, yet achieving this requires careful financial planning and strategic investment choices. Insider Monkey’s analysis, based on a comprehensive review of dividend yields, financial stability metrics, analyst recommendations, and growth potential, suggests that a portfolio built around these six dividend stocks could offer a viable pathway to financial independence in retirement. The selected companies represent diverse sectors, including energy infrastructure, telecommunications, and consumer staples, providing a degree of diversification that can help mitigate risk.

Enterprise Products Partners L.P. (EPD):

Enterprise Products Partners L.P. (EPD) stands out as a key player in the midstream energy sector, boasting an impressive dividend yield that makes it an attractive option for income-seeking investors. As one of the largest publicly traded partnerships, Enterprise Products Partners operates an extensive network of pipelines, processing plants, and storage facilities that are crucial for the transportation and processing of natural gas, crude oil, and petrochemicals.

The company’s financial strength is underpinned by its diversified asset base and long-term, fee-based contracts, which provide a stable and predictable revenue stream. This stability is particularly appealing to retirees who prioritize consistent income over high-growth potential. Enterprise Products Partners has a track record of increasing its dividend payouts consistently over the years, demonstrating its commitment to returning value to shareholders. This consistent dividend growth, coupled with the company’s robust financial performance, makes EPD a cornerstone for a dividend-focused retirement portfolio. The partnership structure, while having specific tax implications, often provides higher yields than traditional corporations, further enhancing its appeal to retirees.

MPLX LP (MPLX):

MPLX LP (MPLX) is another significant player in the midstream energy sector, formed by Marathon Petroleum Corporation to own, operate, develop, and acquire midstream energy infrastructure assets. MPLX’s operations are primarily focused on gathering, processing, and transporting natural gas and crude oil, as well as providing storage and fractionation services. The company’s strategic assets are located in key shale production regions, positioning it to benefit from the continued growth in U.S. energy production.

MPLX’s financial profile is characterized by its strong cash flow generation and disciplined capital allocation. The company has consistently demonstrated its ability to generate sustainable earnings and distribute a significant portion of its cash flow to unitholders through dividends. Like Enterprise Products Partners, MPLX operates as a master limited partnership (MLP), which offers tax advantages and typically results in higher dividend yields compared to traditional corporate structures. MPLX’s commitment to maintaining a strong balance sheet and investing in growth projects enhances its long-term sustainability as a dividend-paying entity. The company’s operational efficiency and strategic positioning make it a compelling choice for retirees seeking reliable income from the energy sector.

British American Tobacco p.l.c. (BTI):

British American Tobacco p.l.c. (BTI) is a global leader in the tobacco industry, manufacturing and selling a wide range of tobacco and nicotine products. Despite the health concerns and regulatory challenges facing the industry, British American Tobacco has maintained a strong market position and continues to generate substantial profits. The company’s diverse portfolio of brands, including well-known names like Dunhill, Kent, and Lucky Strike, provides a solid foundation for its revenue stream.

British American Tobacco’s dividend yield is particularly attractive, reflecting the company’s commitment to returning value to shareholders despite the inherent risks associated with the tobacco industry. The company’s ability to navigate regulatory complexities and adapt to changing consumer preferences is crucial for its long-term sustainability. While the tobacco industry is facing increasing pressure from health advocates and regulators, British American Tobacco is investing in new product categories, such as vaping and heated tobacco products, to diversify its revenue streams and mitigate the impact of declining cigarette sales. The company’s global presence and brand recognition give it a competitive advantage in the market, while its high dividend yield makes it an appealing option for income-focused investors.

Verizon Communications Inc. (VZ):

Verizon Communications Inc. (VZ) is a leading telecommunications company, providing a wide range of communication services, including wireless, broadband, and video services. Verizon’s extensive network infrastructure and large customer base make it a dominant player in the U.S. telecommunications market. The company’s consistent revenue stream and strong cash flow generation underpin its ability to pay a reliable dividend to shareholders.

Verizon’s dividend yield, while not as high as some of the other stocks on this list, is still attractive, especially considering the company’s stability and long-term growth potential. Verizon is investing heavily in 5G technology, which is expected to drive future growth in its wireless business. The company’s commitment to innovation and its focus on providing high-quality services position it to maintain its competitive edge in the telecommunications industry. Verizon’s strong balance sheet and disciplined capital allocation enhance its financial stability, making it a reliable income-generating asset for retirees. The company’s essential services, such as wireless communication and broadband internet, are relatively resilient to economic downturns, providing a degree of stability to its revenue stream.

ONEOK, Inc. (OKE):

ONEOK, Inc. (OKE) is a leading midstream service provider and owns one of the nation’s premier natural gas liquids (NGL) systems, connecting NGL supply in the Rocky Mountain, Mid-Continent and Permian regions with key market centers. ONEOK plays a crucial role in the energy value chain, providing essential services that support the production and transportation of natural gas and NGLs. The company’s extensive infrastructure network and strategic asset locations contribute to its stable revenue stream and strong financial performance.

ONEOK’s dividend yield is particularly attractive to income-seeking investors, reflecting the company’s commitment to returning value to shareholders. The company’s financial strength is underpinned by its long-term contracts and its diversified customer base. ONEOK’s strategic investments in expanding its infrastructure network position it to benefit from the continued growth in U.S. energy production. The company’s focus on operational efficiency and its commitment to maintaining a strong balance sheet enhance its long-term sustainability as a dividend-paying entity. ONEOK’s critical role in the energy value chain makes it a compelling choice for retirees seeking reliable income from the energy sector.

Pembina Pipeline Corporation (PBA):

Pembina Pipeline Corporation (PBA) is a Canadian-based company that provides transportation and midstream services to the energy industry. Pembina’s extensive network of pipelines and processing facilities spans across Western Canada, transporting crude oil, natural gas, and natural gas liquids. The company’s diversified asset base and its long-term contracts provide a stable and predictable revenue stream.

Pembina’s dividend yield is attractive, making it a popular choice among income-seeking investors. The company’s financial strength is underpinned by its diversified business model and its strategic investments in expanding its infrastructure network. Pembina’s commitment to sustainable growth and its focus on environmental stewardship enhance its long-term prospects. The company’s critical role in the Canadian energy industry makes it a reliable income-generating asset for retirees. Pembina’s stable cash flows and its commitment to maintaining a strong balance sheet provide a solid foundation for its dividend payments.

Building a Dividend Portfolio for Retirement:

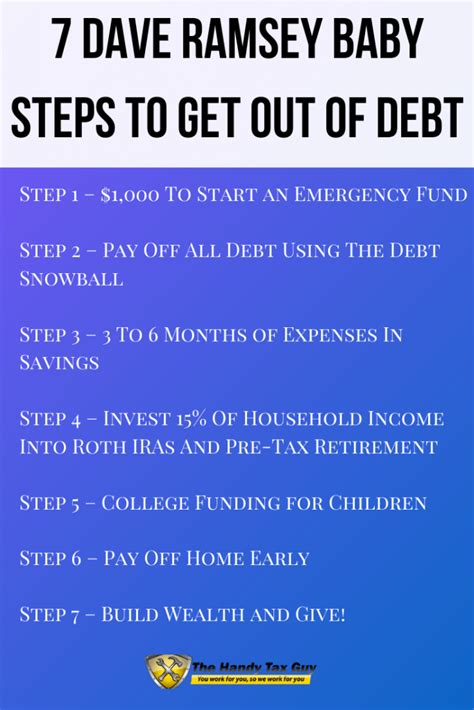

Creating a dividend-focused retirement portfolio requires careful consideration of several factors, including risk tolerance, time horizon, and income needs. While the six stocks mentioned above offer attractive dividend yields and relative stability, it is essential to diversify your portfolio across different sectors and asset classes to mitigate risk.

Diversification: Diversifying your portfolio across different sectors and asset classes can help reduce the impact of any single investment on your overall returns. Consider adding stocks from other sectors, such as healthcare, consumer staples, and utilities, to your dividend portfolio.

Risk Tolerance: Assess your risk tolerance and adjust your portfolio accordingly. If you are risk-averse, you may want to focus on companies with lower dividend yields but higher credit ratings. If you are comfortable with more risk, you may consider investing in companies with higher dividend yields but also higher volatility.

Time Horizon: Consider your time horizon and adjust your portfolio accordingly. If you are planning to retire soon, you may want to focus on companies with stable dividend payouts and low volatility. If you have a longer time horizon, you may be able to invest in companies with higher growth potential but also higher risk.

Income Needs: Determine your income needs and adjust your portfolio accordingly. Calculate how much income you need to generate from your dividend portfolio to cover your living expenses in retirement. Then, select stocks that offer a dividend yield that meets your income needs.

Dividend Reinvestment:

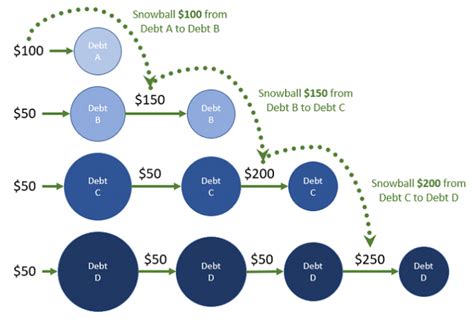

Consider reinvesting your dividends to further enhance your returns. Dividend reinvestment allows you to purchase additional shares of the same stock, which can lead to compounding growth over time. This strategy can be particularly effective in the early years of retirement, as it allows you to build a larger portfolio that can generate even more income in the future.

Tax Considerations:

Be aware of the tax implications of dividend investing. Dividends are generally taxed as ordinary income, although some dividends may qualify for lower tax rates. Consult with a tax advisor to understand the tax implications of your dividend portfolio and to develop a tax-efficient investment strategy.

Due Diligence:

Before investing in any dividend stock, conduct thorough research to assess the company’s financial health, dividend history, and growth prospects. Review the company’s financial statements, read analyst reports, and stay up-to-date on industry trends. This due diligence process can help you make informed investment decisions and avoid potential pitfalls.

The Broader Market Context:

It’s crucial to remember that even the most promising dividend stocks are subject to market volatility and economic fluctuations. A well-rounded retirement strategy should include not only dividend-paying stocks but also other assets like bonds, real estate, and potentially even alternative investments, depending on individual risk tolerance and financial goals. The Federal Reserve’s interest rate policies, inflation trends, and overall economic growth can all impact the performance of dividend stocks. Therefore, continuous monitoring and periodic adjustments to the portfolio are essential to ensure it remains aligned with the retiree’s needs and objectives.

The appeal of dividend investing lies in its potential to generate passive income, providing a cushion against market downturns and supplementing other retirement income sources like Social Security or pensions. However, relying solely on dividends also carries risks. Companies can cut or suspend dividends if they face financial difficulties, which can significantly impact the income stream. Therefore, diversification is not just about spreading investments across different sectors but also about ensuring that retirement income is not overly reliant on a single source.

Alternative Investment Strategies:

While dividend stocks can form a solid foundation for retirement income, exploring alternative investment strategies can further enhance financial security. Real estate, for example, can provide rental income and potential capital appreciation. Bonds offer a more conservative option, providing a fixed income stream with lower volatility than stocks. Annuities can provide a guaranteed income stream for life, offering peace of mind for retirees concerned about outliving their savings. The optimal investment strategy will vary depending on individual circumstances and financial goals.

Financial Planning is Key:

Ultimately, successful retirement planning requires a comprehensive approach that encompasses not only investment decisions but also budgeting, expense management, and healthcare planning. Working with a qualified financial advisor can provide valuable guidance in developing a personalized retirement plan that addresses individual needs and goals. A financial advisor can help assess risk tolerance, determine income needs, and create a diversified portfolio that aligns with those objectives. They can also provide ongoing support and advice, helping retirees navigate the complexities of retirement planning and make informed decisions about their finances.

Conclusion:

The pursuit of financial independence through dividend investing is a worthwhile goal, but it requires careful planning, diligent research, and a realistic understanding of the risks involved. While the six dividend stocks identified in Insider Monkey’s report may offer attractive income opportunities, they should be viewed as part of a broader retirement strategy that includes diversification, risk management, and ongoing monitoring. By taking a holistic approach to retirement planning and seeking professional guidance when needed, individuals can increase their chances of achieving a comfortable and financially secure retirement.

Frequently Asked Questions (FAQ):

1. What are the primary benefits of living off dividends in retirement?

Living off dividends provides a passive income stream, offering financial independence and flexibility. Dividends can supplement other retirement income sources, such as Social Security or pensions, and provide a cushion against market volatility. Additionally, dividend-paying stocks often represent established, financially stable companies, potentially offering a degree of safety compared to growth stocks. The beauty is in the passive nature, requiring less active management than other income-generating strategies.

2. What are the key risks associated with relying solely on dividend income in retirement?

The primary risk is dividend cuts or suspensions. Companies facing financial difficulties may reduce or eliminate dividend payments, significantly impacting the retiree’s income stream. Market volatility can also affect stock prices, potentially reducing the value of the dividend portfolio. Furthermore, inflation can erode the purchasing power of fixed dividend payments over time. Over-reliance on a few stocks presents concentration risk and unexpected tax liabilities on dividend income can affect net earnings.

3. How much capital is typically needed to generate a sufficient income stream from dividends for retirement?

The amount of capital needed varies depending on individual income needs, dividend yields, and investment strategies. A common rule of thumb is the “4% rule,” which suggests withdrawing 4% of the portfolio’s value each year. However, this rule may need to be adjusted based on individual circumstances and market conditions. As a hypothetical example, to generate $50,000 per year in dividend income with an average dividend yield of 4%, a portfolio of $1.25 million would be required. It’s crucial to calculate individual income needs and adjust the portfolio size accordingly.

4. What factors should be considered when selecting dividend stocks for a retirement portfolio?

When selecting dividend stocks, consider the company’s financial stability, dividend history, payout ratio, and growth prospects. Look for companies with a track record of consistently paying and increasing dividends, a low payout ratio (indicating the dividend is sustainable), and a strong balance sheet. Analyze the company’s competitive position, industry trends, and management team. Diversification across different sectors and asset classes is also essential to mitigate risk. Consider the impact of taxes in order to determine after-tax earnings.

5. How can retirees manage the impact of inflation on their dividend income stream?

Retirees can manage the impact of inflation by investing in companies with a history of increasing their dividends over time. These companies are more likely to be able to maintain the purchasing power of their dividends as prices rise. Additionally, investing in a diversified portfolio that includes inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), can help hedge against inflation. Periodic portfolio reviews and adjustments are also essential to ensure the portfolio remains aligned with inflation goals. The strategy of regularly reinvesting a portion of the dividends can increase the number of shares owned over time, potentially increasing future dividend income.