A 62-year-old man is living comfortably off dividends earned from a portfolio of six carefully selected stocks, showcasing a potential path to financial independence through strategic dividend investing. His success highlights the power of consistent, long-term investment in dividend-paying companies, enabling him to enjoy a “blessed” life free from traditional employment.

Living the Dividend Dream: How a 62-Year-Old Achieved Financial Freedom

For many, retirement represents the culmination of years of hard work and diligent saving. However, the path to a secure and fulfilling retirement isn’t always straightforward. One 62-year-old individual has seemingly cracked the code, achieving financial independence through a strategic investment approach focused on dividend-paying stocks. By carefully selecting six companies known for their consistent dividend payouts, he’s built a portfolio that generates enough income to cover his living expenses, allowing him to live a life he describes as “blessed.” This story serves as an inspiring example of how dividend investing, when approached with knowledge and discipline, can provide a viable route to financial freedom.

The man’s journey underscores the potential for individuals to take control of their financial futures through informed investment decisions. While he remains anonymous in the initial report, his experience provides valuable lessons for those seeking to replicate his success. The core of his strategy lies in identifying and investing in companies with a proven track record of paying and, ideally, increasing their dividends over time. This approach allows him to benefit not only from potential capital appreciation but also from a steady stream of income that can be used to cover daily expenses, pursue hobbies, or simply enjoy a more relaxed lifestyle.

The allure of dividend investing lies in its simplicity and relative predictability. Unlike growth stocks, which rely heavily on speculation and market sentiment, dividend stocks offer a tangible return on investment in the form of regular cash payments. These payments can provide a cushion during market downturns and offer a sense of security that is particularly appealing to retirees or those approaching retirement.

However, it’s crucial to recognize that dividend investing is not without its risks. Companies can cut or suspend their dividends if they experience financial difficulties, which can significantly impact an investor’s income stream. Therefore, thorough research and due diligence are essential before investing in any dividend-paying stock.

The Power of Dividend Investing: A Closer Look

Dividend investing is a strategy focused on acquiring shares of companies that regularly distribute a portion of their earnings to shareholders in the form of dividends. These dividends are typically paid out quarterly, although some companies may opt for monthly or annual payments. The amount of the dividend is usually expressed as a dollar amount per share, and the dividend yield represents the annual dividend payment as a percentage of the stock’s current market price.

For example, a stock trading at $100 per share that pays an annual dividend of $5 per share would have a dividend yield of 5%. This means that for every $100 invested in the stock, the investor would receive $5 in dividends each year, assuming the dividend remains constant.

The appeal of dividend investing stems from several factors:

- Passive Income: Dividends provide a regular stream of income that can be used to cover living expenses or reinvested to further grow the portfolio. This passive income can be particularly valuable during retirement, when individuals may no longer have a regular salary.

- Potential for Capital Appreciation: While dividend stocks are often seen as more stable than growth stocks, they can still appreciate in value over time. This means that investors can potentially benefit from both dividend income and capital gains.

- Inflation Hedge: Some companies increase their dividends over time, which can help to protect investors from the effects of inflation. As prices rise, the dividend income can also increase, helping to maintain purchasing power.

- Reduced Volatility: Dividend stocks tend to be less volatile than growth stocks, which can make them a more attractive option for risk-averse investors. The steady stream of dividend income can provide a cushion during market downturns, helping to reduce overall portfolio volatility.

Key Considerations for Dividend Investors

While dividend investing offers several advantages, it’s important to approach it with a clear understanding of the risks and challenges involved. Here are some key considerations for dividend investors:

- Dividend Sustainability: Not all dividend-paying companies are created equal. Some companies may be paying out a large portion of their earnings in dividends, which could make the dividend unsustainable in the long run. It’s important to analyze a company’s financials to ensure that it has the capacity to continue paying its dividend, even during challenging economic times.

- Dividend Growth: Look for companies that have a history of increasing their dividends over time. This indicates that the company is financially stable and committed to rewarding its shareholders. Dividend growth can also help to protect investors from the effects of inflation.

- Industry Analysis: Different industries have different dividend characteristics. For example, utilities and consumer staples companies tend to be more reliable dividend payers than technology or energy companies. It’s important to understand the characteristics of the industry in which a company operates before investing in its dividend stock.

- Diversification: As with any investment strategy, diversification is key. Don’t put all your eggs in one basket by investing in a single dividend stock. Spread your investments across multiple companies and industries to reduce risk.

- Tax Implications: Dividends are typically taxed as ordinary income, which means that they are subject to the same tax rates as wages and salaries. However, qualified dividends are taxed at a lower rate. It’s important to understand the tax implications of dividend investing before making any investment decisions.

- Valuation: Just because a stock has a high dividend yield doesn’t mean it’s a good investment. It’s important to consider the company’s overall valuation before investing in its stock. A high dividend yield could be a sign that the stock is overvalued or that the market expects the company to cut its dividend in the future.

- Due Diligence: Conduct thorough research on any company before investing in its dividend stock. Read the company’s financial statements, listen to its earnings calls, and stay up-to-date on industry news. This will help you make informed investment decisions and avoid potential pitfalls.

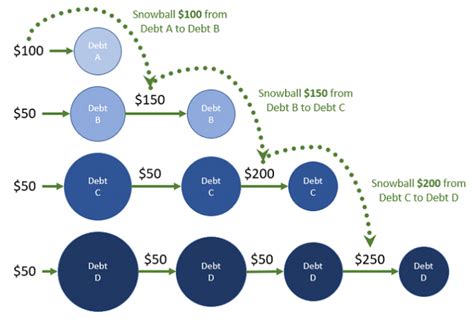

- Reinvestment: Consider reinvesting your dividends to further grow your portfolio. Dividend reinvestment plans (DRIPs) allow you to automatically reinvest your dividends back into the company’s stock, which can help to accelerate your wealth accumulation over time. Many brokers offer DRIPs at no cost, making it a convenient and cost-effective way to reinvest your dividends.

- Professional Advice: Consult with a financial advisor to determine if dividend investing is the right strategy for you. A financial advisor can help you assess your risk tolerance, investment goals, and time horizon, and recommend a portfolio of dividend stocks that is appropriate for your individual circumstances.

Lessons from a Dividend Investor’s “Blessed” Life

While the specific stocks held by the 62-year-old investor remain undisclosed in the original report, the story offers several valuable lessons for aspiring dividend investors:

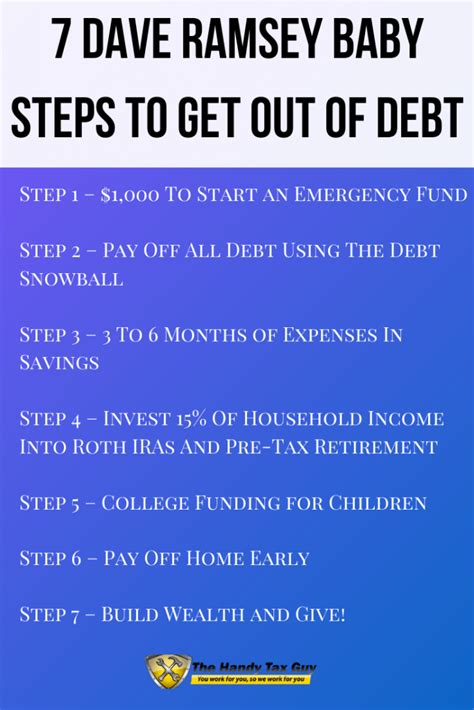

- Start Early: The power of compounding works best when given time. The earlier you start investing in dividend stocks, the more time your dividends have to reinvest and generate further returns.

- Be Patient: Dividend investing is a long-term strategy. It takes time to build a portfolio that generates enough income to cover your living expenses. Don’t expect to get rich quick with dividend stocks.

- Stay Disciplined: Stick to your investment plan, even during market downturns. Don’t panic and sell your stocks when the market is falling. Instead, consider using market dips as an opportunity to buy more shares at lower prices.

- Focus on Quality: Invest in companies with strong fundamentals, a history of paying and increasing dividends, and a sustainable business model. Avoid chasing high dividend yields without doing your due diligence.

- Reinvest Dividends: As mentioned earlier, reinvesting your dividends can significantly boost your returns over time. Take advantage of DRIPs to automatically reinvest your dividends back into your favorite dividend stocks.

- Be Tax-Efficient: Consider holding your dividend stocks in tax-advantaged accounts, such as 401(k)s or IRAs, to minimize your tax liability.

- Regularly Review Your Portfolio: Review your portfolio periodically to ensure that your investments are still aligned with your goals and risk tolerance. Rebalance your portfolio as needed to maintain your desired asset allocation.

The Importance of Financial Literacy

The story of the 62-year-old living off dividends underscores the importance of financial literacy. Understanding basic investment concepts, such as dividends, compounding, and diversification, is essential for making informed financial decisions and achieving financial independence.

Unfortunately, financial literacy remains a challenge for many people. According to a recent study by the FINRA Investor Education Foundation, only 34% of Americans can correctly answer basic questions about financial concepts. This lack of financial literacy can lead to poor financial decisions, such as taking on too much debt, not saving enough for retirement, or investing in inappropriate investments.

To improve financial literacy, individuals can take advantage of a variety of resources, such as:

- Online Courses: Many websites and organizations offer free or low-cost online courses on personal finance and investing.

- Books and Articles: There are countless books and articles available on personal finance and investing.

- Financial Advisors: Financial advisors can provide personalized guidance and advice on managing your finances.

- Community Workshops: Many community organizations offer workshops and seminars on personal finance topics.

By taking the time to educate yourself about personal finance, you can empower yourself to make informed decisions and achieve your financial goals.

The Future of Dividend Investing

Dividend investing has been a popular strategy for decades, and it’s likely to remain so in the future. However, the landscape of dividend investing is constantly evolving. Here are some trends that are shaping the future of dividend investing:

- Low Interest Rates: Low interest rates have made dividend stocks more attractive relative to bonds and other fixed-income investments. As interest rates remain low, demand for dividend stocks is likely to remain strong.

- Aging Population: As the population ages, more people are looking for ways to generate income in retirement. Dividend stocks can provide a reliable stream of income that can help to supplement Social Security and other retirement savings.

- Technological Innovation: Technological innovation is disrupting many industries, and dividend investing is no exception. New tools and platforms are making it easier for investors to research and invest in dividend stocks.

- ESG Investing: Environmental, social, and governance (ESG) investing is becoming increasingly popular. Investors are looking for companies that are not only financially successful but also socially responsible. Companies with strong ESG practices are often seen as more sustainable in the long run, which can make them attractive dividend investments.

- Inflation: With inflation on the rise, investors are looking for ways to protect their purchasing power. Dividend stocks that grow their payouts can help to offset the effects of inflation and maintain real returns.

Conclusion: A Path to Financial Independence

The story of the 62-year-old living off dividends serves as a powerful reminder that financial independence is achievable through careful planning, disciplined investing, and a commitment to long-term goals. While the specific stocks that fueled his success remain unnamed, the underlying principles of dividend investing – focusing on quality companies with a history of consistent payouts, reinvesting dividends, and staying patient – are applicable to anyone seeking to build a sustainable income stream. By understanding the nuances of dividend investing and developing a sound financial strategy, individuals can potentially replicate this success and create their own “blessed” life, free from the constraints of traditional employment. However, it’s crucial to remember that investing involves risk, and there’s no guarantee of success. Thorough research, due diligence, and professional guidance are essential for navigating the complexities of the stock market and achieving your financial goals. Frequently Asked Questions (FAQ)

-

What exactly are dividends?

- Dividends are distributions of a company’s earnings to its shareholders. They are typically paid out in cash, but can also be paid in the form of stock. “Companies can cut or suspend their dividends if they experience financial difficulties, which can significantly impact an investor’s income stream.” The amount of the dividend is usually expressed as a dollar amount per share. “The dividend yield represents the annual dividend payment as a percentage of the stock’s current market price.” For example, a stock trading at $100 per share that pays an annual dividend of $5 per share would have a dividend yield of 5%.

-

What are the advantages of dividend investing?

- Dividend investing offers several advantages, including passive income, potential for capital appreciation, an inflation hedge, and reduced volatility. “Dividends provide a regular stream of income that can be used to cover living expenses or reinvested to further grow the portfolio. This passive income can be particularly valuable during retirement, when individuals may no longer have a regular salary.” Also, “dividend stocks tend to be less volatile than growth stocks, which can make them a more attractive option for risk-averse investors. The steady stream of dividend income can provide a cushion during market downturns, helping to reduce overall portfolio volatility.”

-

What are the risks of dividend investing?

- While attractive, dividend investing also comes with risks. Dividend sustainability is a key concern. Not all dividend-paying companies are created equal. “Some companies may be paying out a large portion of their earnings in dividends, which could make the dividend unsustainable in the long run. It’s important to analyze a company’s financials to ensure that it has the capacity to continue paying its dividend, even during challenging economic times.” Another risk relates to valuation; a high dividend yield might be a sign that the stock is overvalued or that the market expects the company to cut its dividend.

-

How can I choose the right dividend stocks?

- Choosing the right dividend stocks requires careful research and analysis. Key factors to consider include dividend sustainability, dividend growth, industry analysis, and valuation. Look for companies with strong fundamentals, a history of paying and increasing dividends, and a sustainable business model. “Conduct thorough research on any company before investing in its dividend stock. Read the company’s financial statements, listen to its earnings calls, and stay up-to-date on industry news. This will help you make informed investment decisions and avoid potential pitfalls.”

-

Is dividend investing right for me?

- The suitability of dividend investing depends on your individual circumstances, including your risk tolerance, investment goals, and time horizon. “Consult with a financial advisor to determine if dividend investing is the right strategy for you. A financial advisor can help you assess your risk tolerance, investment goals, and time horizon, and recommend a portfolio of dividend stocks that is appropriate for your individual circumstances.” Consider factors like age, income needs, and financial literacy before committing to this strategy. Dividend investing is a long-term strategy and requires patience and discipline.