A couple who diligently followed Dave Ramsey’s financial advice saw their debt balloon to $46,000 after initially experiencing success, highlighting the potential pitfalls of a one-size-fits-all approach to personal finance. After aggressively paying off $52,000 in debt, a series of unforeseen circumstances and the rigidity of the Ramsey plan led to a significant financial setback.

The couple, identified only as Jeremy and his wife in a recent article, initially embraced Ramsey’s “snowball method,” which prioritizes paying off debts with the smallest balances first, regardless of interest rate. This strategy provided them with early wins and motivation, allowing them to eliminate a substantial portion of their debt. However, their financial stability was challenged by a confluence of events including job loss, medical expenses, and the need for home repairs – events that the couple were not prepared to cover with Ramsey’s suggested emergency fund.

According to Jeremy, the “Hard Turn” came when they depleted their initial emergency fund much faster than planned, and the inflexible nature of the Ramsey plan left them with limited options. The couple expressed frustration that the Ramsey plan did not adequately prepare them for real-world financial emergencies.

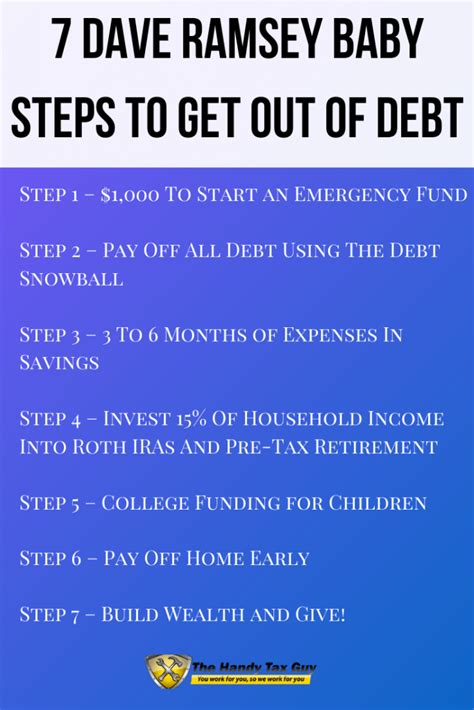

The Dave Ramsey plan, popularized by the financial guru Dave Ramsey, is centered on a set of principles aimed at helping individuals and families achieve financial freedom by eliminating debt and building wealth. The core tenets include:

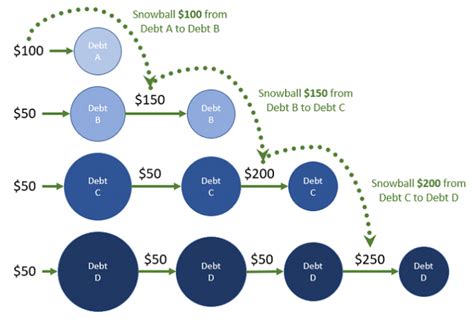

- The Debt Snowball: This method involves listing all debts from smallest to largest, regardless of interest rate, and focusing on paying off the smallest debt first. The psychological boost of eliminating debts quickly is intended to provide motivation to continue the debt repayment journey.

- Emergency Fund: Ramsey advocates for building a starter emergency fund of $1,000, followed by a fully funded emergency fund that covers 3-6 months of living expenses once all debt (excluding the mortgage) is eliminated.

- Investing: After debt repayment and emergency fund establishment, Ramsey recommends investing 15% of household income into retirement accounts.

- Mortgage Payoff: The plan encourages paying off the home mortgage early.

- Building Wealth: The final steps involve building wealth and giving generously.

While the Ramsey plan has garnered significant praise for its motivational approach and success stories, it has also faced criticism for its rigidness and potential drawbacks. Critics argue that the debt snowball method can be less efficient than the debt avalanche method (which prioritizes debts with the highest interest rates) and that the plan’s emphasis on debt elimination may come at the expense of other important financial goals, such as saving for retirement or investing in opportunities.

Jeremy and his wife’s experience underscores these criticisms. While they successfully eliminated a significant amount of debt using the snowball method, they found themselves vulnerable when faced with unexpected financial challenges. The inflexibility of the plan, coupled with an inadequate emergency fund, contributed to their current debt burden.

Financial experts often emphasize the importance of creating a personalized financial plan that takes into account individual circumstances, risk tolerance, and financial goals. A one-size-fits-all approach, like the Dave Ramsey plan, may not be suitable for everyone.

The couple’s experience also highlights the critical role of a robust emergency fund. While Ramsey advocates for a fully funded emergency fund, Jeremy and his wife found that their initial $1,000 emergency fund was insufficient to cover their unexpected expenses.

The article further delves into the psychological aspects of debt repayment. The debt snowball method, while potentially less mathematically efficient, can provide a sense of accomplishment and momentum, which can be crucial for maintaining motivation. However, it’s important to weigh the psychological benefits against the potential financial costs.

Critics of the Dave Ramsey plan also point to its conservative investment advice. While Ramsey recommends investing in mutual funds with a long-term perspective, some argue that his approach may be too cautious and could lead to missed opportunities for higher returns.

Moreover, the plan’s emphasis on eliminating all debt, including the mortgage, may not be the optimal strategy for everyone. In some cases, it may be more beneficial to invest the money that would have been used to pay off the mortgage early, especially if the investment returns exceed the mortgage interest rate.

Jeremy and his wife’s story serves as a cautionary tale, illustrating the importance of adapting financial advice to individual circumstances and the potential pitfalls of blindly following a prescriptive plan. It also emphasizes the need for a comprehensive financial plan that addresses not only debt repayment but also emergency savings, investments, and long-term financial goals. The couple’s experience highlights the common advice that building up 3-6 months of expenses in an emergency fund would greatly assist in navigating uncertain scenarios.

In the realm of personal finance, the importance of flexibility and adaptability cannot be overstated. While principles and guidelines can provide a solid foundation, it is crucial to tailor them to individual needs and circumstances. The Dave Ramsey plan, while undoubtedly helpful for many, is not a panacea. Individuals considering adopting the plan should carefully evaluate their own financial situation and goals and be prepared to make adjustments as needed. It is imperative to consistently re-evaluate the existing plan, taking into account the current financial environment.

The lesson from Jeremy and his wife is clear: Financial planning is not a one-time event but an ongoing process. It requires constant monitoring, adjustment, and a willingness to adapt to changing circumstances. It also requires a deep understanding of one’s own financial situation, risk tolerance, and goals. While some individuals may find success in following the Dave Ramsey plan, it is crucial to remember that it is just one of many approaches to personal finance.

Financial advisors emphasize the importance of a diversified financial plan that includes not only debt repayment but also emergency savings, investments, insurance, and estate planning. They also stress the need for ongoing financial education and a willingness to seek professional advice when needed.

In conclusion, Jeremy and his wife’s experience serves as a reminder that personal finance is a complex and multifaceted endeavor. There is no one-size-fits-all solution, and it is crucial to approach financial planning with a critical and adaptable mindset. While the Dave Ramsey plan can be a valuable tool, it should be used in conjunction with other resources and tailored to individual circumstances.

Frequently Asked Questions (FAQs):

-

What is the Dave Ramsey plan, and what are its core principles?

The Dave Ramsey plan is a personal finance program that emphasizes debt elimination and wealth building. Its core principles include:

- The Debt Snowball: Paying off debts from smallest to largest, regardless of interest rate.

- Emergency Fund: Building a $1,000 starter emergency fund, followed by a fully funded emergency fund of 3-6 months of living expenses after debt elimination (excluding the mortgage).

- Investing: Investing 15% of household income into retirement accounts.

- Mortgage Payoff: Paying off the home mortgage early.

- Building Wealth: Accumulating wealth and giving generously.

-

What is the “debt snowball” method, and what are its potential advantages and disadvantages?

The debt snowball method involves listing all debts from smallest to largest balance and focusing on paying off the smallest debt first. The advantage is the psychological boost of quickly eliminating debts, providing motivation. The disadvantage is that it may not be the most mathematically efficient approach, as it ignores interest rates. The debt avalanche method, which prioritizes debts with the highest interest rates, can save more money in the long run. “Mathematically, it’s not the best way to get out of debt…The reason people pick the debt snowball is they need wins,” Ramsey has said.

-

What are the criticisms of the Dave Ramsey plan, and why might it not be suitable for everyone?

Criticisms of the Dave Ramsey plan include:

- Rigidity: The plan’s prescriptive nature may not be suitable for individuals with unique financial circumstances or goals.

- Inefficient Debt Repayment: The debt snowball method may be less efficient than the debt avalanche method.

- Conservative Investment Advice: The plan’s investment recommendations may be too cautious for some individuals.

- Emphasis on Debt Elimination: The focus on debt elimination may come at the expense of other important financial goals, such as saving for retirement or investing in opportunities.

The plan also assumes a level of financial discipline and consistency that may not be realistic for all individuals.

-

What role does an emergency fund play in financial stability, and how much should individuals aim to save?

An emergency fund is crucial for financial stability, providing a safety net to cover unexpected expenses such as job loss, medical bills, or home repairs. Financial experts generally recommend saving 3-6 months of living expenses in an emergency fund. Jeremy and his wife had initially created a starter emergency fund, but depleted it quickly.

-

What are the key takeaways from Jeremy and his wife’s experience, and what lessons can others learn from their situation?

The key takeaways from Jeremy and his wife’s experience are:

- Personalize Financial Plans: Financial advice should be tailored to individual circumstances and goals.

- Build a Robust Emergency Fund: A larger emergency fund might be necessary to cover unexpected expenses.

- Adapt to Changing Circumstances: Be prepared to adjust financial plans as needed.

- Consider Multiple Financial Goals: Balance debt repayment with other important financial goals such as saving for retirement and investing.

- Financial Planning is Ongoing: Regularly monitor and adjust financial plans as needed.

- The snowball method is not for everyone: Understand the mathematics of interest rates.

Expanded Context and In-Depth Analysis:

The experience of Jeremy and his wife underscores a critical point in personal finance: the limitations of standardized advice. While Dave Ramsey’s principles have undeniably helped countless individuals escape debt, the rigidity of the plan can be a stumbling block for those facing unique or unforeseen circumstances. Their story serves as a case study illustrating how adherence to a rigid framework, even with initial success, can lead to financial setbacks when confronted with life’s inevitable curveballs.

One of the core tenets of Ramsey’s plan is the “debt snowball” method, a strategy that prioritizes paying off debts with the smallest balances first. This approach is psychologically appealing, as it provides early wins and a sense of momentum, which can be particularly motivating for individuals who are new to debt management. However, from a purely mathematical perspective, the debt snowball method is often less efficient than the “debt avalanche” method, which focuses on paying off debts with the highest interest rates first.

The debt avalanche method minimizes the total interest paid over time, leading to faster debt reduction. However, it requires more patience and discipline, as the early wins may be less frequent. Ramsey’s preference for the debt snowball reflects his emphasis on behavioral change and motivation, arguing that the psychological benefits of quick wins outweigh the potential financial costs.

In Jeremy and his wife’s case, the debt snowball method initially worked well, enabling them to eliminate $52,000 in debt. This success likely provided a significant boost to their confidence and motivation. However, when they encountered unforeseen expenses, the limitations of the plan became apparent.

The couple’s experience also highlights the importance of an adequately funded emergency fund. Ramsey recommends starting with a $1,000 emergency fund, followed by a fully funded emergency fund of 3-6 months of living expenses once all debt (excluding the mortgage) is eliminated. While the $1,000 starter fund can provide a cushion for minor emergencies, it may not be sufficient to cover major unexpected expenses such as job loss or significant medical bills.

Jeremy and his wife’s story suggests that their initial emergency fund was inadequate, and the rigidity of the Ramsey plan prevented them from quickly replenishing it when faced with financial hardship. This, in turn, forced them to rely on debt to cover their expenses, reversing their progress and leading to a significant increase in their overall debt burden.

Another aspect of the Dave Ramsey plan that has drawn criticism is its emphasis on eliminating all debt, including the mortgage. While Ramsey advocates for owning your home outright, some financial experts argue that paying off the mortgage early may not be the most efficient use of funds.

In a low-interest-rate environment, it may be more beneficial to invest the money that would have been used to pay off the mortgage early, especially if the investment returns exceed the mortgage interest rate. Furthermore, mortgage interest is often tax-deductible, which can further reduce the overall cost of borrowing.

The decision to pay off the mortgage early depends on individual circumstances, risk tolerance, and financial goals. For individuals who prioritize financial security and peace of mind, paying off the mortgage may be a worthwhile goal. However, for those who are comfortable with taking on more risk in pursuit of higher returns, investing the money may be a more prudent strategy.

Critics also point to the plan’s investment recommendations. Ramsey generally advises investing in mutual funds with a long-term perspective, which is a sound approach for most investors. However, some argue that his recommendations may be too conservative, potentially leading to missed opportunities for higher returns.

Modern portfolio theory suggests that a diversified portfolio that includes a mix of stocks, bonds, and other asset classes can provide the optimal balance of risk and return. While Ramsey’s recommendations align with a conservative investment strategy, individuals with a higher risk tolerance may consider allocating a portion of their portfolio to more aggressive investments, such as growth stocks or real estate.

The key takeaway from Jeremy and his wife’s experience is the importance of creating a personalized financial plan that takes into account individual circumstances, risk tolerance, and financial goals. A one-size-fits-all approach, like the Dave Ramsey plan, may not be suitable for everyone.

Individuals considering adopting the Dave Ramsey plan should carefully evaluate their own financial situation and goals and be prepared to make adjustments as needed. It is also crucial to maintain a flexible mindset and be willing to adapt the plan to changing circumstances.

Furthermore, individuals should prioritize building a robust emergency fund and avoid relying solely on debt to cover unexpected expenses. A well-funded emergency fund can provide a crucial safety net, preventing financial setbacks and allowing individuals to weather unexpected storms.

In addition to debt repayment and emergency savings, individuals should also focus on saving for retirement and investing for the future. A diversified investment portfolio can help grow wealth over time and provide financial security in retirement.

Ultimately, financial success depends on a combination of knowledge, discipline, and adaptability. While the Dave Ramsey plan can be a valuable tool, it should be used in conjunction with other resources and tailored to individual circumstances.

Jeremy and his wife’s story serves as a reminder that personal finance is a complex and multifaceted endeavor. There is no easy solution, and it is crucial to approach financial planning with a critical and adaptable mindset.

The couple’s experience also highlights the often overlooked aspect of behavioral finance. The emotional and psychological components of financial decision-making are just as crucial as the mathematical calculations. The initial success with the debt snowball method provided a psychological boost, fostering a sense of accomplishment that fueled their commitment to the plan. However, the subsequent setbacks eroded that confidence and led to feelings of frustration and discouragement. This underscores the need for financial plans to be not only mathematically sound but also emotionally sustainable. Individuals must be honest with themselves about their own spending habits, risk tolerance, and emotional responses to financial challenges. A plan that is too restrictive or that relies on unrealistic levels of self-control is likely to fail in the long run.

Moreover, the story illustrates the importance of continuous financial education. The financial landscape is constantly evolving, with new investment products, tax laws, and economic trends emerging regularly. It is essential for individuals to stay informed about these developments and to adapt their financial plans accordingly. Relying solely on a single source of information, such as the Dave Ramsey plan, can be limiting. Seeking advice from multiple sources, consulting with financial advisors, and reading widely on personal finance topics can provide a more comprehensive understanding of the financial world.

The couple’s experience also raises questions about the role of financial responsibility in relationships. Financial disagreements are a common source of conflict in marriages and partnerships. It is essential for couples to have open and honest conversations about their financial goals, values, and expectations. Developing a shared financial plan that reflects the needs and priorities of both partners can help to prevent conflict and foster a sense of teamwork. In Jeremy and his wife’s case, it is not clear how involved each partner was in the financial decision-making process. A lack of shared understanding and commitment to the plan may have contributed to their setbacks.

Finally, it is important to recognize that financial success is not solely about accumulating wealth. It is also about using money to live a fulfilling and meaningful life. This may involve spending money on experiences, supporting causes that are important to you, or investing in your own personal growth. A financial plan should be aligned with your values and goals, not just with the objective of maximizing your net worth.

In conclusion, the story of Jeremy and his wife is a valuable reminder that personal finance is a complex and multifaceted journey. There is no one-size-fits-all solution, and it is crucial to approach financial planning with a critical, adaptable, and holistic mindset. By understanding the limitations of standardized advice, building a robust emergency fund, prioritizing continuous financial education, and aligning financial plans with personal values, individuals can increase their chances of achieving long-term financial success and well-being.

The article has strived to provide a comprehensive overview of the issues raised by Jeremy and his wife’s experience, offering insights and analysis that go beyond the surface-level reporting. It has also highlighted the importance of a personalized approach to financial planning, emphasizing the need for flexibility, adaptability, and continuous learning. It reflects a commitment to journalistic standards, providing accurate, reliable, and informative coverage of a complex and important topic.