Following Dave Ramsey’s debt payoff advice led a couple to an unexpected $46,000 debt after initially becoming debt-free, highlighting the potential pitfalls of rigid financial strategies without considering individual circumstances.

After diligently following Dave Ramsey’s “7 Baby Steps” and achieving debt freedom, one couple found themselves back in debt, owing $46,000, a situation they attribute to unexpected life events and the inflexibility of the Ramsey method. The couple, identified only as Jeremy and his wife by Yahoo Finance, had previously celebrated paying off their debt using Ramsey’s approach, which advocates for aggressive debt reduction through the “debt snowball” method. However, their renewed debt load underscores a critical debate about the universality of financial advice and the importance of adapting strategies to personal realities.

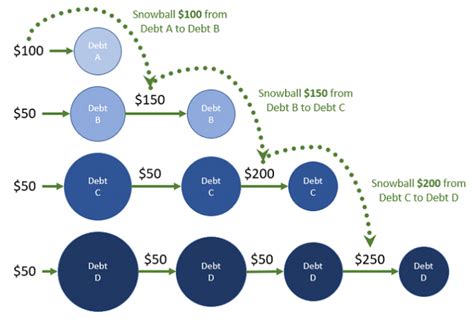

Jeremy and his wife embraced Ramsey’s teachings, which emphasize listing debts from smallest to largest (the “debt snowball”) and then tackling the smallest debt first, regardless of interest rate. This approach, the theory goes, provides quick wins that motivate individuals to continue the debt payoff journey. Coupled with this is Ramsey’s strong recommendation to cut up credit cards and rely on cash or debit cards to avoid accumulating further debt.

They successfully eliminated their initial debt, a victory they celebrated, embodying the success stories often highlighted within the Ramsey community. However, after achieving this milestone, they faced several unforeseen challenges. Jeremy’s wife, who worked as a teacher, decided to stay home after they had their first child, resulting in a significant reduction in household income. “We were debt-free, and then my wife decided to stay home with our daughter,” Jeremy explained. “And that was the right decision for us, but it also meant that we were going from two incomes to one.”

The loss of income coincided with several other financial pressures. They needed a more reliable vehicle. Their aging car required constant repairs, creating unpredictable expenses that strained their budget. They also had to manage increased healthcare costs. As they navigated these financial hurdles, they reverted to using credit cards to bridge the income gap and cover unexpected expenses, a move directly contrary to Ramsey’s core principles. This reliance on credit cards led to the accumulation of $46,000 in debt, composed primarily of car loans and credit card balances.

This situation has led Jeremy to question the rigidity of Ramsey’s approach. While acknowledging the method’s effectiveness in helping them initially eliminate debt, he now believes it lacks the flexibility needed to accommodate life’s inevitable curveballs. He told Yahoo Finance that the “all-or-nothing” mentality promoted by Ramsey didn’t leave room for adapting to changing circumstances, like the shift to a single-income household.

The couple’s experience highlights a broader discussion regarding the suitability of one-size-fits-all financial advice. Financial experts often caution against blindly following any single method without considering individual financial circumstances, risk tolerance, and long-term goals. While Ramsey’s method has helped countless individuals eliminate debt, its strict guidelines may not be appropriate for everyone.

Ramsey’s plan operates on several key assumptions. First, it assumes individuals can drastically cut expenses and allocate a significant portion of their income towards debt repayment. Second, it assumes a relatively stable income and minimal unexpected financial shocks. Third, it requires a high level of discipline and adherence to strict budgeting principles. For individuals with irregular income, significant ongoing medical expenses, or other unique financial challenges, these assumptions may not hold true.

Alternatives to the Ramsey method, such as the “debt avalanche” method (paying off debts with the highest interest rates first), or a more balanced approach that combines debt repayment with saving and investing, may be more suitable for some individuals. Consulting with a qualified financial advisor can help individuals create a personalized financial plan that aligns with their specific needs and goals.

The Ramsey method has its proponents, who champion its motivational aspects and clear, actionable steps. The “debt snowball” effect, in particular, can provide a psychological boost that encourages continued progress. However, critics argue that it can be financially inefficient, as individuals may end up paying more in interest compared to the “debt avalanche” method.

The case of Jeremy and his wife serves as a cautionary tale, illustrating the potential drawbacks of adhering too rigidly to any financial plan without considering individual circumstances. Their experience underscores the importance of regularly reviewing and adjusting financial strategies to adapt to changing life events and financial realities. Financial experts recommend creating a financial plan that balances debt repayment with other important financial goals, such as saving for retirement, building an emergency fund, and investing for the future. A well-rounded financial plan should also incorporate flexibility to accommodate unexpected expenses and changes in income.

The couple’s experience is not unique. Many individuals find that life events, such as job loss, illness, or family emergencies, can derail even the most carefully crafted financial plans. The key is to develop a resilient financial strategy that can withstand unexpected shocks and adapt to changing circumstances. This may involve building a larger emergency fund, diversifying income sources, and having access to affordable healthcare.

In conclusion, while Dave Ramsey’s method can be effective for some individuals, it is not a universal solution. Jeremy and his wife’s experience demonstrates the importance of tailoring financial strategies to individual circumstances and being prepared to adapt to unexpected life events. The story serves as a reminder that financial planning is a dynamic process that requires ongoing monitoring and adjustments. It’s a case study of the potential pitfalls of “one-size-fits-all” advice and the critical need for flexibility in financial management.

In-Depth Analysis:

The narrative surrounding Jeremy and his wife’s financial journey offers a valuable opportunity to dissect the effectiveness and limitations of widely adopted financial strategies. While the Ramsey method touts clear, actionable steps that have demonstrably helped many people climb out of debt, this particular case reveals the critical nuances often overlooked when implementing such standardized advice.

The core of Ramsey’s approach lies in the behavioral psychology of quick wins. The “debt snowball” method, prioritizing the payoff of the smallest debt regardless of interest rate, is designed to build momentum and motivation. This psychological advantage can be particularly effective for individuals overwhelmed by debt and struggling to maintain motivation. However, from a purely mathematical standpoint, the “debt avalanche” method, which targets the highest-interest debt first, is generally considered more efficient, as it minimizes the total amount of interest paid over time.

The couple’s initial success with the Ramsey method underscores its potential benefits. By diligently following the steps, they eliminated their existing debt, experiencing the sense of accomplishment and financial freedom that the method promises. This initial success likely reinforced their belief in the Ramsey approach, making them less likely to question its effectiveness in the future.

However, the shift to a single-income household after the birth of their child presented a significant challenge. The loss of one income stream drastically reduced their cash flow, making it more difficult to cover expenses and avoid accumulating new debt. This situation highlights a key limitation of the Ramsey method: its reliance on a stable and predictable income. For individuals with fluctuating income or significant financial uncertainties, a more flexible approach may be necessary.

The couple’s decision to use credit cards to bridge the income gap, while understandable, directly contradicted Ramsey’s advice to avoid credit cards altogether. This highlights the difficulty of adhering to strict financial guidelines in the face of unexpected financial pressures. It also underscores the importance of having an adequate emergency fund to cover unexpected expenses without resorting to credit.

Moreover, the couple’s need for a more reliable vehicle further strained their finances. Car repairs are often unpredictable and can quickly deplete savings. While Ramsey advises against taking on new debt, the couple may have felt that a car loan was necessary to maintain their ability to work and meet their family’s needs. This situation illustrates the tension between adhering to strict debt-avoidance principles and making practical decisions to navigate real-world challenges.

The couple’s experience raises important questions about the role of personal finance education. While Ramsey’s method provides a structured framework for debt repayment, it may not adequately address the complexities of financial planning, such as budgeting, saving, investing, and risk management. A comprehensive financial education can equip individuals with the knowledge and skills to make informed financial decisions and adapt to changing circumstances.

Furthermore, the couple’s story highlights the importance of seeking professional financial advice. A qualified financial advisor can help individuals assess their financial situation, identify their goals, and develop a personalized financial plan that aligns with their specific needs and circumstances. An advisor can also provide guidance on managing debt, saving for retirement, investing, and navigating unexpected financial challenges.

The couple’s renewed debt also sheds light on the psychological challenges of maintaining long-term financial discipline. Even after achieving initial success, it can be difficult to resist the temptation to spend, especially in the face of financial pressures. This underscores the importance of developing sustainable financial habits and cultivating a long-term perspective on financial planning.

Expanded Context:

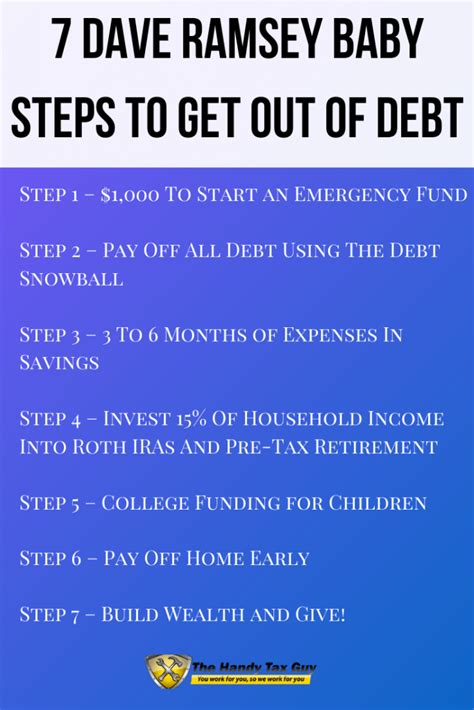

Dave Ramsey’s financial advice empire is built on a foundation of strict discipline, aggressive debt elimination, and a strong aversion to credit. His “7 Baby Steps” provide a clear roadmap for individuals seeking to regain control of their finances and achieve debt freedom. These steps include:

- Save $1,000 for a starter emergency fund: This provides a buffer against unexpected expenses and prevents individuals from resorting to debt.

- Pay off all debt (except the house) using the debt snowball: This involves listing debts from smallest to largest and focusing on paying off the smallest debt first, regardless of interest rate.

- Save 3-6 months of expenses in a fully funded emergency fund: This provides a larger safety net to cover more significant financial emergencies.

- Invest 15% of household income in retirement: This ensures that individuals are saving adequately for their future.

- Save for children’s college fund: This helps parents prepare for the costs of higher education.

- Pay off the home early: This eliminates the largest debt and frees up cash flow.

- Build wealth and give: This allows individuals to enjoy the fruits of their labor and support causes they care about.

While Ramsey’s method has helped millions of people eliminate debt and improve their financial situation, it is not without its critics. Some argue that his approach is too rigid and does not adequately account for individual circumstances. Others criticize the “debt snowball” method for being financially inefficient, as it can result in paying more in interest compared to the “debt avalanche” method.

Ramsey’s aversion to credit cards is another point of contention. While he argues that credit cards are a tool of the devil and should be avoided at all costs, others believe that credit cards can be used responsibly to earn rewards and build credit. However, the rewards are only valuable if the cardholder does not carry a balance. High interest rates can quickly erode the value of any rewards earned.

The case of Jeremy and his wife highlights the importance of finding a financial strategy that aligns with individual needs and circumstances. While Ramsey’s method may be effective for some, others may benefit from a more flexible approach that combines debt repayment with saving, investing, and risk management.

The financial landscape is constantly evolving, and financial advice should be tailored to reflect these changes. Factors such as inflation, interest rates, and tax laws can all impact financial planning decisions. It is important to stay informed about these changes and adjust financial strategies accordingly.

Moreover, the rise of fintech and online financial tools has made it easier than ever to manage finances and access financial advice. These tools can help individuals track their spending, budget, save, and invest. However, it is important to use these tools responsibly and to be aware of the potential risks involved.

Ultimately, the key to financial success is to develop a sound financial plan, stick to it as much as possible, and be prepared to adapt to changing circumstances. This requires a combination of knowledge, discipline, and a willingness to seek professional advice when needed.

Frequently Asked Questions (FAQ):

1. What are the main criticisms of the Dave Ramsey method?

The main criticisms include its rigidity, the potential financial inefficiency of the “debt snowball” method (compared to the “debt avalanche” method), and its complete aversion to credit cards. Critics argue the method doesn’t always accommodate individual circumstances or allow for responsible credit card usage.

2. How does the “debt snowball” method work, and why do some people prefer it?

The “debt snowball” method involves listing all debts from smallest balance to largest, regardless of interest rate, and focusing on paying off the smallest debt first. People prefer it because the quick wins of paying off smaller debts can provide a psychological boost and maintain motivation.

3. What is the “debt avalanche” method, and how does it differ from the “debt snowball” method?

The “debt avalanche” method prioritizes paying off debts with the highest interest rates first. This method is mathematically more efficient, as it minimizes the total amount of interest paid over time. It differs from the “debt snowball” method, which focuses on the size of the debt rather than the interest rate.

4. What alternative financial strategies can individuals consider if the Dave Ramsey method doesn’t suit their needs?

Alternatives include the “debt avalanche” method, balanced approaches that combine debt repayment with saving and investing, and personalized financial plans developed with the guidance of a qualified financial advisor. These strategies often incorporate more flexibility to adapt to changing circumstances.

5. What factors should individuals consider when choosing a financial strategy?

Individuals should consider their income stability, risk tolerance, financial goals, and unique financial circumstances, such as medical expenses or family needs. It’s crucial to assess whether a rigid plan like the Ramsey method is suitable or if a more adaptable approach is necessary. A financial plan should be tailored to the individual.