A woman who prepaid a year’s rent for her mother is seeking advice on how to encourage her millionaire sister to contribute to their mother’s ongoing care, highlighting the complexities of family financial responsibilities.

A woman, identified only as the original poster (OP) on a popular online forum, turned to the internet for advice after pre-paying a year’s worth of rent for her mother. The central issue stems from the OP’s sister, a millionaire, not contributing financially to their mother’s care, despite the OP’s efforts. The OP, who clearly felt a sense of responsibility and perhaps some resentment, sought guidance on how to equitably distribute the financial burden. The situation underscores the often-complicated dynamics of family finances, sibling responsibilities, and the challenges of elder care.

The original poster explained that she covered a year’s worth of rent for her mother’s apartment. Following this significant contribution, she expressed her desire for her sister, who she described as a millionaire, to step up and assist with their mother’s ongoing needs. The crux of the matter revolves around the perceived imbalance in financial contribution and the OP’s attempt to find a fair solution to support their mother effectively.

According to the post, the OP took the initiative to ensure their mother’s housing was secure for a year. However, this act seems to have created an expectation that the millionaire sister should now contribute in other ways. The OP’s plea for advice indicates a level of frustration and a desire for a more equitable distribution of responsibilities, given the sister’s substantial financial resources.

The details provided in the online post did not specify the mother’s exact needs beyond housing. However, the implication is that the mother requires ongoing financial support for living expenses, healthcare, or other necessities. The OP’s question focuses primarily on how to approach her sister to solicit financial assistance, suggesting that direct communication or previous attempts may not have yielded the desired results.

This scenario highlights a common dilemma faced by many families: how to fairly divide the responsibilities of caring for aging parents, especially when there are significant disparities in the financial capabilities of the siblings involved. It touches on issues of fairness, obligation, and the emotional complexities of family relationships intertwined with financial considerations.

The response from the online community, while not detailed in the original article, likely offered a range of suggestions, from direct communication strategies to involving a neutral third party, such as a family mediator or financial advisor. The goal would be to facilitate a constructive conversation between the sisters and establish a sustainable plan for their mother’s care.

The situation presented raises broader questions about societal expectations regarding filial responsibility, the role of wealth in family obligations, and the importance of open and honest communication within families about financial matters. It serves as a case study in the challenges of navigating elder care within the context of varying financial circumstances and sibling dynamics. The question of how to get her sister to help reflects a deep-seated concern about fairness and the long-term sustainability of their mother’s care plan.

The problem is multifaceted. It involves not only the financial aspect but also emotional and relational dynamics. The sister’s reluctance to contribute could stem from various factors, including differing perspectives on parental responsibility, previous family conflicts, or a lack of awareness of the mother’s needs. Addressing these underlying issues is crucial to finding a resolution that works for everyone involved.

The online forum responses may have suggested exploring options such as creating a formal care agreement or establishing a trust to manage the mother’s finances. These strategies can provide clarity, accountability, and a structured framework for ensuring the mother’s needs are met in a fair and transparent manner. Legal and financial professionals can also provide guidance on the best course of action, tailored to the family’s specific circumstances.

The narrative underscores a common struggle experienced by many individuals who find themselves as primary caregivers or financial contributors to their aging parents’ well-being. The complexities of family dynamics, coupled with the emotional toll of elder care, can make it challenging to navigate these situations effectively. Seeking external support, whether through online communities, professional advisors, or family therapy, can provide valuable insights and strategies for managing these challenges.

This scenario also highlights the importance of proactive financial planning for aging parents. While it may not always be possible to anticipate every need or circumstance, having a plan in place can help alleviate some of the financial burden on family members and ensure that the parents’ wishes are respected. This may involve long-term care insurance, retirement savings, and estate planning.

In the specific case of the OP, the focus remains on how to effectively communicate with her sister and encourage her to contribute financially to their mother’s care. This requires a delicate balance of empathy, assertiveness, and a willingness to find common ground. The goal is to create a collaborative approach that prioritizes the mother’s well-being while respecting the individual circumstances of each sibling.

The underlying issue is the perceived unfairness in the distribution of financial responsibility. The OP has already made a significant contribution by pre-paying the rent, and she believes that her sister, with her substantial wealth, should shoulder a proportionate share of the remaining expenses. This sentiment is understandable, given the disparity in their financial situations.

The challenge lies in how to approach the sister without creating further conflict or resentment. Direct confrontation may not be the most effective strategy, as it could lead to defensiveness and resistance. Instead, a more collaborative and empathetic approach may be more productive.

One possible approach is to initiate a conversation with the sister that focuses on the mother’s needs and the desire to work together to ensure her well-being. The OP could express her appreciation for any past contributions the sister has made, while also highlighting the ongoing financial requirements and the desire to find a sustainable solution.

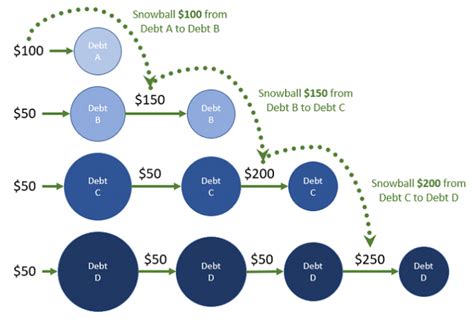

It may also be helpful to present a clear and detailed breakdown of the mother’s expenses, so that the sister has a clear understanding of the financial commitment involved. This could include rent, utilities, food, healthcare, and any other essential costs. By providing concrete information, the OP can demonstrate the legitimacy of her request and make it easier for the sister to understand the need for her assistance.

Another strategy is to suggest a trial period, during which the sister contributes a specific amount each month. This allows her to gradually increase her involvement and assess her comfort level with the financial commitment. It also provides an opportunity to evaluate the effectiveness of the arrangement and make adjustments as needed.

In addition to financial contributions, the OP could also explore other ways for the sister to be involved in their mother’s care. This could include spending time with her, assisting with errands, or providing emotional support. By broadening the scope of involvement, the OP can create a more holistic approach to caregiving and reduce the burden on herself.

Ultimately, the success of this approach depends on the willingness of both sisters to communicate openly and honestly, and to prioritize their mother’s well-being above all else. It requires a commitment to finding a solution that is fair, sustainable, and respectful of each other’s individual circumstances.

The article further highlights a universal concern: the rising costs associated with elder care. As the population ages, more families are facing the challenge of providing adequate care for their aging parents. This often involves significant financial burdens, as well as emotional and logistical challenges.

Long-term care costs can be substantial, encompassing expenses such as assisted living facilities, nursing homes, in-home care, and medical treatments. These costs can quickly deplete a family’s savings and create financial strain, particularly for those with limited resources.

In addition to the financial costs, elder care also requires a significant time commitment. Caregivers often spend countless hours providing support, managing medical appointments, and coordinating services. This can take a toll on their own physical and mental health, as well as their careers and personal lives.

Given the challenges associated with elder care, it is essential for families to plan ahead and explore all available resources. This includes long-term care insurance, government programs, and community-based services. It also involves open communication and collaboration among family members to ensure that the responsibilities are shared equitably.

In the case of the OP and her sister, the situation underscores the importance of addressing these issues proactively. By having a candid conversation about their mother’s needs and their respective financial capabilities, they can develop a plan that ensures her well-being and alleviates the burden on any one individual.

The OP’s decision to seek advice online reflects a growing trend of individuals turning to online communities for support and guidance on personal finance and family matters. These forums provide a platform for sharing experiences, seeking advice, and connecting with others who have faced similar challenges.

While online advice can be valuable, it is important to approach it with caution and to verify the accuracy of any information received. It is also essential to consult with qualified professionals, such as financial advisors, attorneys, and healthcare providers, to obtain personalized guidance tailored to your specific circumstances.

In conclusion, the story of the OP and her millionaire sister highlights the complexities of family finances and the challenges of elder care. It underscores the importance of open communication, equitable distribution of responsibilities, and proactive planning to ensure the well-being of aging parents. By addressing these issues head-on and seeking support from trusted sources, families can navigate these challenges more effectively and maintain harmonious relationships.

In-Depth Analysis and Expanded Context:

The scenario presented by the online poster resonates deeply because it touches upon several fundamental aspects of human relationships and societal expectations. It’s not merely a financial problem; it’s a complex interplay of filial piety, sibling rivalry, financial disparity, and the emotional weight of caring for aging parents.

Filial Piety and Societal Expectations: Many cultures place a high value on filial piety – the duty of children to respect, honor, and care for their parents. This expectation can create immense pressure, especially when financial resources are limited or unevenly distributed among siblings. The OP likely feels a strong sense of obligation to her mother, which is compounded by the fact that her sister, with her millionaire status, appears to be shirking her responsibilities. This perceived imbalance is at the heart of the OP’s frustration. Societal norms often reinforce this expectation, leading to feelings of guilt and resentment when one feels overburdened.

Sibling Dynamics and Competition: Sibling relationships are often complex, marked by a mix of love, loyalty, and competition. These dynamics can be further complicated by financial disparities. The OP may harbor feelings of resentment towards her sister’s wealth, especially if she perceives that her sister is not using her resources to help their mother. Past experiences and unresolved conflicts between the siblings can also influence their willingness to cooperate and contribute. The sister’s potential reluctance might stem from long-held beliefs about family roles, past disagreements, or a simple lack of awareness of the situation’s urgency.

Financial Disparity and Fairness: The vast difference in financial resources between the sisters is a key factor in this situation. While the OP has taken on the responsibility of paying her mother’s rent, she feels it is unfair that her millionaire sister is not contributing. The concept of fairness is subjective and can be interpreted differently by each individual. The OP may believe that the sister should contribute proportionally to her wealth, while the sister may have her own reasons for not doing so. These reasons could range from personal financial goals to differing views on how best to support their mother.

Emotional Toll of Elder Care: Caring for aging parents can be emotionally and physically demanding. Caregivers often experience stress, burnout, and feelings of isolation. The OP’s decision to pre-pay the rent demonstrates her commitment to her mother’s well-being, but it also comes at a cost. She may be sacrificing her own financial security or personal goals to provide for her mother. The emotional burden of being the primary caregiver can exacerbate feelings of resentment towards siblings who are not contributing equally.

Communication Breakdown and Lack of Transparency: A lack of open and honest communication can further complicate the situation. The OP may be hesitant to confront her sister directly, fearing conflict or rejection. The sister may be unaware of the extent of the mother’s needs or the OP’s financial strain. Without clear communication, misunderstandings and assumptions can easily arise, leading to further resentment and division. The article subtly points to a potential communication breakdown, as the OP is seeking external advice rather than directly resolving the issue with her sister.

Potential Solutions and Strategies: Several strategies can be employed to address this situation and foster a more equitable and collaborative approach to elder care. These include:

*Direct Communication: The OP should initiate a candid conversation with her sister, expressing her concerns and outlining the mother's financial needs. This conversation should be approached with empathy and a willingness to understand the sister's perspective.

*Financial Transparency: The OP should provide her sister with a detailed breakdown of the mother's expenses, including rent, utilities, healthcare costs, and other essential needs. This transparency can help the sister understand the financial commitment involved and make a more informed decision about her contribution.

*Mediation and Facilitation: If direct communication proves difficult, a neutral third party, such as a family mediator or financial advisor, can facilitate a constructive conversation and help the sisters reach a mutually agreeable solution.

*Formal Care Agreement: A formal care agreement can outline the responsibilities of each sibling and establish a clear framework for financial contributions. This agreement can provide accountability and prevent misunderstandings in the future.

*Legal and Financial Planning: Consulting with an attorney or financial advisor can help the family explore options such as establishing a trust or creating a long-term care plan. These strategies can ensure that the mother's needs are met in a sustainable and equitable manner.

*Exploring Government and Community Resources: The family should investigate available government programs and community resources that can provide financial assistance or support services for the mother. This can help alleviate some of the financial burden on the siblings.Impact of Wealth on Family Dynamics: The presence of significant wealth, as in the case of the millionaire sister, often introduces unique dynamics into family relationships. While wealth can provide security and opportunity, it can also create distance and resentment. The sister may feel entitled to her wealth and resistant to sharing it with others, even family members. Alternatively, she may have valid reasons for not wanting to contribute, such as concerns about enabling dependency or a desire to preserve her financial security. Regardless of her reasons, the disparity in wealth creates a power imbalance that can complicate the dynamics of elder care.

Ethical Considerations: The situation also raises ethical questions about the responsibilities of wealthy individuals to support their families and communities. While there is no legal obligation for the sister to contribute to her mother’s care, there may be a moral or ethical obligation, depending on her values and beliefs. The concept of “moral responsibility” is complex and can vary depending on cultural norms and individual perspectives. However, many people believe that those who have the means to help others have a moral duty to do so.

Long-Term Implications: The way in which this situation is resolved will have long-term implications for the sisters’ relationship and the family as a whole. If the issue is not addressed constructively, it could lead to lasting resentment and estrangement. Conversely, if the sisters can work together to find a fair and sustainable solution, it could strengthen their bond and create a more supportive and harmonious family environment.

5 Frequently Asked Questions (FAQ):

-

What is the primary issue in this news article?

- The primary issue is a woman (“OP”) seeking advice on how to get her millionaire sister to financially contribute to their mother’s care after the OP prepaid a year’s rent. This highlights the challenges of fair financial distribution within families, particularly when siblings have vastly different financial capacities.

-

Why did the original poster (OP) seek advice online rather than resolving the issue directly with her sister?

- The article doesn’t explicitly state the reason, but it implies a potential communication breakdown or a fear of direct confrontation. The OP may have sought external advice due to past conflicts, uncertainty about how to approach her sister, or a desire for impartial perspectives on the situation.

-

What are some potential reasons why the millionaire sister might be reluctant to contribute financially to her mother’s care?

- Potential reasons could include differing perspectives on parental responsibility, previous family conflicts, concerns about enabling dependency, personal financial goals, a lack of awareness of the extent of the mother’s needs, or simply differing opinions on the best way to support their mother.

-

What strategies were suggested to resolve the financial imbalance between the sisters regarding their mother’s care?

- Strategies include initiating open and honest communication, providing financial transparency (a detailed breakdown of the mother’s expenses), considering mediation with a neutral third party, establishing a formal care agreement, and exploring legal and financial planning options like trusts.

-

Beyond financial contributions, what other ways could the millionaire sister become involved in her mother’s care?

- The sister could offer emotional support, spend time with their mother, assist with errands, manage appointments, or provide respite care to alleviate the burden on the OP. This more holistic approach to caregiving can foster stronger family bonds and contribute to the mother’s overall well-being.