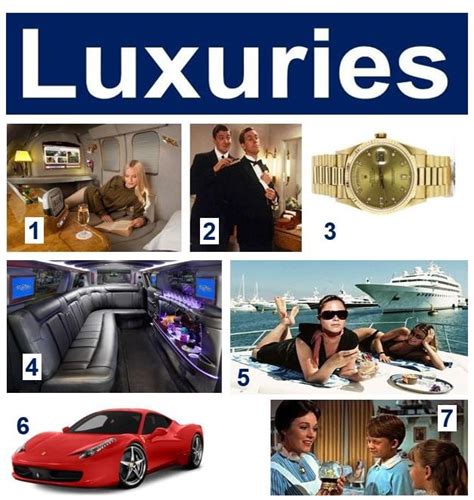

Rising inflation and economic anxieties are forcing Americans to re-evaluate what constitutes a necessity, with a growing number deeming everyday items like groceries, dining out, and even streaming services as increasingly unaffordable luxuries. A recent survey reveals 28 common expenses that people now consider “too expensive,” highlighting the significant strain on household budgets as costs continue to climb.

The Shifting Landscape of Affordability

The perception of what is affordable has dramatically shifted in recent years, driven by persistent inflation and a sense of economic unease. Everyday items once taken for granted are now viewed as luxuries by a significant portion of the population. This trend reflects a broader concern about the cost of living and the ability to maintain a comfortable standard of living. The survey, which polled a representative sample of Americans, underscores the widespread impact of rising prices on household finances.

The 28 Perceived Luxuries

The survey identified a diverse range of items and services that respondents now consider “too expensive.” These include:

- Groceries: Soaring food prices have made it difficult for many families to afford basic necessities. The cost of staples like milk, eggs, and bread has increased substantially, putting a strain on household budgets.

- Eating Out: Restaurant meals, once a common indulgence, are now viewed as a luxury by many. The rising cost of food and labor has led to higher menu prices, making dining out less accessible.

- Streaming Services: With a plethora of streaming platforms available, the cost of subscribing to multiple services can quickly add up. Many consumers are now cutting back on their streaming subscriptions to save money.

- Name-Brand Clothing: The price difference between name-brand and generic clothing has widened, making it difficult for budget-conscious consumers to justify the expense of designer labels.

- Vacations: Travel costs have surged in recent years, making vacations an unaffordable luxury for many families. The cost of flights, accommodations, and activities has increased significantly.

- Concerts/Sporting Events: Tickets to concerts and sporting events have become increasingly expensive, putting them out of reach for many fans. The high cost of tickets, concessions, and parking makes these events a significant expense.

- New Cars: The price of new vehicles has skyrocketed in recent years, making it difficult for many consumers to afford a new car. Rising interest rates and supply chain issues have contributed to the increase in car prices.

- Home Repairs: The cost of home repairs has increased significantly, making it difficult for homeowners to maintain their properties. The rising cost of materials and labor has made even minor repairs a significant expense.

- Childcare: Childcare costs have long been a burden for many families, but the problem has worsened in recent years. The rising cost of childcare services has forced many parents to make difficult choices about their careers.

- Pet Care: The cost of pet food, veterinary care, and other pet-related expenses has increased significantly, making pet ownership a luxury for some.

- Gym Memberships: With the rise of at-home fitness options, gym memberships are increasingly viewed as an unnecessary expense.

- Manicures/Pedicures: Personal grooming services are often among the first expenses to be cut when budgets are tight.

- Professional Haircuts/Styling: Similar to manicures and pedicures, regular trips to the hair salon can be a significant expense.

- Coffee Shop Drinks: The daily habit of buying coffee from a coffee shop can add up to a significant expense over time.

- Takeout Coffee: Like coffee shop drinks, opting for takeout coffee on a regular basis contributes to the financial strain.

- Premium Gas: The price of premium gasoline is often significantly higher than regular gasoline, making it a luxury for many drivers.

- Ride-Sharing Services: The cost of using ride-sharing services like Uber and Lyft can be high, especially during peak hours.

- Cable TV: With the rise of streaming services, cable TV is increasingly viewed as an outdated and expensive option.

- Subscription Boxes: While subscription boxes can be a fun treat, the cost of subscribing to multiple boxes can quickly add up.

- Designer Handbags: Designer handbags are a luxury item that is often out of reach for budget-conscious consumers.

- High-End Makeup: The price of high-end makeup products can be significantly higher than drugstore brands.

- Expensive Wine/Alcohol: Opting for expensive wine or alcohol can add to a substantial expense.

- House Cleaning Services: Utilizing house cleaning services is considered a luxury expense that many are opting out of during financial difficulties.

- Lawn Care Services: Much like house cleaning services, lawn care is a non-essential expense.

- Dry Cleaning: Dry cleaning is an optional, and expensive, maintenance task.

- Car Washes: Many are opting to wash their own cars as opposed to paying for the service.

- Movie Tickets: With options to stream movies at home, theaters are seen as more of a luxury experience.

- Books: As library cards are free, some are opting to borrow as opposed to buying.

Contributing Factors: Inflation and Economic Anxiety

The rising cost of living is a major driver of this trend. Inflation has eroded purchasing power, making it more difficult for families to afford basic necessities. The Consumer Price Index (CPI), a key measure of inflation, has shown significant increases in recent years, reflecting the rising cost of goods and services across the board. The Federal Reserve’s efforts to combat inflation by raising interest rates have also contributed to the problem by increasing borrowing costs for consumers and businesses.

Economic anxiety is another important factor. Concerns about job security, healthcare costs, and retirement savings are weighing on people’s minds, making them more cautious about their spending habits. Many Americans are worried about the possibility of a recession and are taking steps to prepare for a potential economic downturn. This includes cutting back on discretionary spending and prioritizing essential expenses.

The Impact on Consumer Behavior

The shift in affordability perceptions is having a significant impact on consumer behavior. People are becoming more price-conscious and are actively seeking out ways to save money. This includes:

- Cutting back on non-essential expenses: Consumers are reducing their spending on discretionary items like entertainment, dining out, and personal care services.

- Switching to cheaper alternatives: People are opting for generic brands over name-brand products and are shopping at discount stores to save money.

- Delaying or postponing purchases: Consumers are delaying or postponing major purchases like new cars, home repairs, and vacations.

- Seeking out deals and discounts: People are actively searching for coupons, discounts, and sales to maximize their purchasing power.

- DIY Solutions: More and more individuals are taking on tasks themselves, like home and car repairs, grooming, and home services.

“People are definitely feeling the pinch,” says financial advisor Sarah Johnson. “They’re having to make tough choices about what they can afford, and many are realizing that things they used to take for granted are now luxuries.”

Long-Term Implications

The trend of re-evaluating affordability could have long-term implications for the economy. If consumers continue to cut back on spending, it could lead to slower economic growth. Businesses that rely on discretionary spending may struggle to survive, and unemployment could rise.

However, there could also be some positive effects. The shift towards frugality could encourage people to save more money and become more financially responsible. It could also lead to greater innovation and efficiency as businesses look for ways to reduce costs and offer more affordable products and services.

Government and Industry Responses

Governments and businesses are responding to the affordability crisis in a variety of ways. Governments are providing financial assistance to low-income families through programs like food stamps and unemployment benefits. They are also implementing policies to address the root causes of inflation, such as supply chain disruptions and energy price volatility.

Businesses are offering discounts, promotions, and loyalty programs to attract price-conscious consumers. They are also investing in technology and automation to reduce costs and improve efficiency. Some companies are even experimenting with new business models, such as subscription services and shared ownership programs, to make their products and services more accessible.

A Broader Perspective

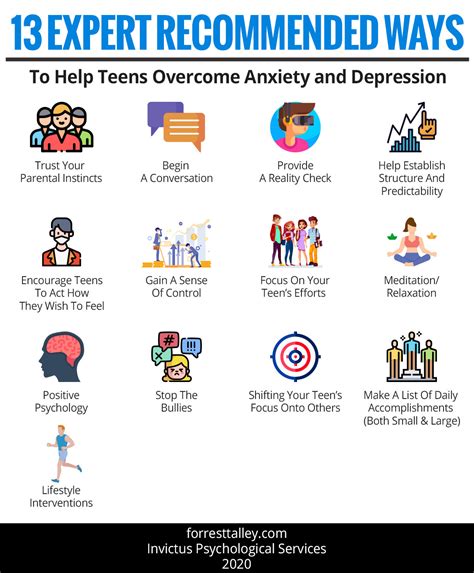

The issue of affordability is not just an economic one; it also has social and psychological dimensions. The inability to afford basic necessities can lead to stress, anxiety, and feelings of inadequacy. It can also exacerbate existing inequalities and create social divisions.

Addressing the affordability crisis requires a multi-faceted approach that takes into account the economic, social, and psychological factors at play. This includes policies to promote economic growth, reduce inequality, and provide support for vulnerable populations. It also requires a shift in mindset towards greater frugality and financial responsibility.

Expert Opinions and Analysis

Economists and financial experts offer varying perspectives on the current affordability crisis. Some argue that it is a temporary phenomenon driven by supply chain disruptions and other short-term factors. They predict that inflation will eventually subside and that the economy will return to normal.

Others believe that the affordability crisis is a more fundamental problem rooted in long-term trends like globalization, technological change, and income inequality. They argue that these trends are likely to persist and that policymakers need to take more aggressive action to address them.

Regardless of their specific views, most experts agree that the affordability crisis is a serious issue that needs to be addressed. They also agree that there is no easy solution and that it will require a combination of policies and individual actions to overcome.

Personal Strategies for Coping with Rising Costs

In the face of rising costs, individuals can take several steps to manage their finances and maintain their standard of living. These include:

- Creating a budget: A budget helps track income and expenses, allowing individuals to identify areas where they can cut back.

- Prioritizing essential expenses: Focus on paying for necessities like housing, food, and transportation before discretionary items.

- Finding cheaper alternatives: Look for generic brands, discount stores, and free or low-cost entertainment options.

- Negotiating bills: Contact service providers to negotiate lower rates or payment plans.

- Increasing income: Explore opportunities to earn extra money through part-time jobs, freelancing, or selling unwanted items.

- Seeking financial advice: Consult with a financial advisor to develop a personalized plan for managing finances and achieving financial goals.

By taking proactive steps to manage their finances, individuals can mitigate the impact of rising costs and maintain a sense of financial security.

Conclusion: Adapting to a New Economic Reality

The rising cost of living is forcing Americans to adapt to a new economic reality. What was once considered affordable is now increasingly viewed as a luxury. This trend is having a significant impact on consumer behavior and could have long-term implications for the economy. Addressing the affordability crisis requires a multi-faceted approach that takes into account the economic, social, and psychological factors at play. By implementing sound policies, promoting financial responsibility, and adapting personal spending habits, individuals and society as a whole can navigate this challenging economic environment. As the economic landscape continues to evolve, adaptability and informed financial decision-making will be crucial for maintaining a stable and comfortable quality of life. The re-evaluation of essential versus luxury items highlights a fundamental shift in the economic priorities of American households, reflecting a broader struggle to maintain financial stability in an era of persistent inflation and economic uncertainty. “It’s about adapting,” Johnson notes. “Finding ways to still enjoy life, but within a more constrained budget.”

Frequently Asked Questions (FAQ)

-

What are the main drivers behind the increasing perception of everyday items as luxuries?

The primary drivers are rising inflation and economic anxiety. Inflation erodes purchasing power, making it harder to afford basic necessities. Economic anxiety, fueled by concerns about job security and potential recessions, leads people to cut back on discretionary spending and prioritize essential expenses. The increase in the Consumer Price Index (CPI) reflects the rising costs across various sectors, contributing to the re-evaluation of affordability.

-

Which items are most commonly considered “too expensive” by Americans according to the survey?

According to the survey, the items most commonly considered “too expensive” include groceries, eating out, streaming services, name-brand clothing, vacations, concerts/sporting events, new cars, and home repairs. These items reflect both essential needs and discretionary spending, indicating a widespread impact of rising prices on household budgets.

-

How are consumers changing their behavior in response to rising costs?

Consumers are adapting by cutting back on non-essential expenses, switching to cheaper alternatives (e.g., generic brands), delaying or postponing major purchases, actively seeking out deals and discounts, and using DIY solutions to maintain their budget. They are becoming more price-conscious and financially responsible in their spending habits.

-

What can individuals do to cope with rising costs and maintain their standard of living?

Individuals can create a budget to track income and expenses, prioritize essential expenses, find cheaper alternatives for goods and services, negotiate bills with service providers, increase income through part-time jobs or freelancing, and seek financial advice from professionals. Proactive financial management is key to mitigating the impact of rising costs.

-

What are some potential long-term implications of this trend on the economy and society?

Potential long-term implications include slower economic growth if consumer spending continues to decline, challenges for businesses relying on discretionary spending, and increased unemployment. On the positive side, it could encourage greater savings and financial responsibility. Socially, it could exacerbate inequalities and lead to increased stress and anxiety among those struggling to afford basic necessities. Government and industry responses, such as financial assistance programs and cost-reduction strategies, will play a crucial role in addressing these challenges.