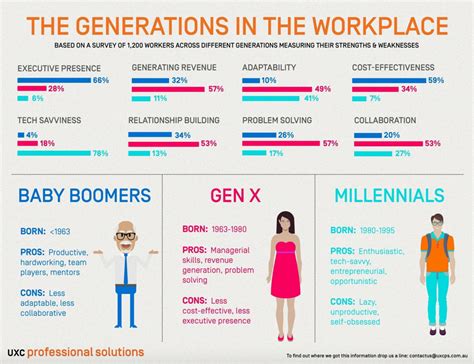

Many older women believe Millennials and Gen Z are making critical life errors by prioritizing short-term gratification over long-term security, neglecting the importance of homeownership, and undervaluing face-to-face communication, according to recent insights shared with Yahoo Lifestyle.

Older generations are observing that younger adults are perhaps not laying the necessary groundwork for a secure and fulfilling future. Their insights are based on decades of experience, and they offer potential lessons for Millennials and Gen Z, even if some advice clashes with the current cultural climate.

The Allure of Immediate Gratification

One of the most prominent concerns raised is the tendency towards instant gratification. Many older women believe that the younger generations prioritize immediate pleasures, such as frequent travel, dining out, and acquiring the latest gadgets, at the expense of long-term financial stability.

“I see so many young people spending their money on experiences rather than investing in their future,” one woman stated. “While travel and fun are important, they shouldn’t come at the cost of saving for a home or retirement.”

This perspective aligns with a traditional view of financial planning, emphasizing the importance of delayed gratification and strategic investment. However, it also acknowledges the shift in priorities observed in younger generations, who often value experiences and personal growth over material possessions. This shift can be partially attributed to economic factors such as student loan debt and rising housing costs, which make traditional markers of success seem less attainable.

The Homeownership Debate

Homeownership is another area where older women expressed strong opinions. They see owning a home as a fundamental step towards building wealth and security. “Owning a home is not just about having a place to live; it’s an investment in your future,” one woman emphasized. “It’s a tangible asset that can provide financial stability and a sense of belonging.”

However, the path to homeownership is significantly more challenging for Millennials and Gen Z than it was for previous generations. Skyrocketing property prices, stagnant wages, and stringent lending criteria make it difficult for young adults to enter the housing market. This has led some to question the traditional emphasis on homeownership, arguing that renting provides greater flexibility and financial freedom.

Despite these challenges, many older women maintain that the long-term benefits of homeownership outweigh the initial difficulties. They point to the potential for appreciation in property value, the tax advantages of owning a home, and the sense of security that comes with having a permanent residence.

The Art of Face-to-Face Communication

In an increasingly digital world, the importance of face-to-face communication is often overlooked. Older women worry that younger generations are losing the ability to connect with others on a personal level, relying instead on digital interactions.

“I see young people constantly glued to their phones, even when they’re with friends,” one woman observed. “They’re missing out on the nuances of human interaction, the nonverbal cues that are essential for building strong relationships.”

This concern extends beyond personal relationships to professional settings. Many older women believe that strong communication skills are essential for success in the workplace, and that the ability to communicate effectively in person is a valuable asset.

However, Millennials and Gen Z grew up in a digital age and are often more comfortable communicating online than in person. They have developed a unique set of communication skills that are well-suited to the digital world, such as the ability to communicate concisely and effectively in writing. Also, platforms like Zoom and Teams have made virtual face-to-face interactions common and normal.

Financial Prudence and Planning

Beyond the big-ticket items like homes, older women often stressed the importance of careful budgeting and financial planning early in life. “Start saving early, even if it’s just a small amount,” one woman advised. “The power of compounding interest is amazing, and the sooner you start, the better off you’ll be.”

This advice reflects a long-term perspective on financial security, emphasizing the importance of making small, consistent investments over time. While this may seem daunting to young adults facing immediate financial pressures, it can make a significant difference in the long run. It also underscores that investing in retirement can’t be ignored or indefinitely postponed.

Career Choices and Work-Life Balance

The discussion also touched on career choices and the pursuit of work-life balance. Older women often encouraged younger generations to prioritize job security and long-term career prospects over immediate gratification or trendy job titles.

“Choose a career that is in demand and that offers opportunities for growth,” one woman suggested. “Don’t be afraid to start at the bottom and work your way up. Hard work and dedication will pay off in the long run.”

However, younger generations are often more interested in finding work that is meaningful and fulfilling, even if it doesn’t offer the same level of financial security. They are also more likely to prioritize work-life balance, seeking jobs that allow them to pursue their passions and spend time with loved ones.

Navigating Debt

The burden of debt, particularly student loan debt, was a recurring theme in the conversations. Older women expressed concern about the impact of debt on young adults’ financial well-being. “Avoid taking on unnecessary debt,” one woman cautioned. “It can hold you back from achieving your goals and put a strain on your relationships.”

Student loan debt has become a major issue for Millennials and Gen Z, with many young adults struggling to repay their loans while also trying to build their careers and start families. This debt can make it difficult to save for a down payment on a home, invest in retirement, or even afford basic necessities.

The Value of Mentorship

Several older women emphasized the importance of seeking mentorship from experienced professionals. “Find someone who has been where you want to go and learn from their mistakes,” one woman advised. “A good mentor can provide valuable guidance and support.”

Mentorship can be particularly helpful for young adults navigating the complexities of the modern workplace. A mentor can offer insights into industry trends, provide advice on career development, and help young professionals build their networks.

Adaptability and Resilience

While offering advice, older women also acknowledged the unique challenges faced by Millennials and Gen Z. They emphasized the importance of adaptability and resilience in a rapidly changing world. “Be prepared to adapt to new technologies and new ways of working,” one woman advised. “The world is constantly changing, and you need to be able to keep up.”

Adaptability and resilience are essential qualities for success in the 21st century. The ability to learn new skills, embrace change, and bounce back from setbacks is crucial for navigating the challenges of a rapidly evolving economy.

Striking a Balance

Ultimately, the advice offered by older women boils down to striking a balance between short-term enjoyment and long-term planning. While it’s important to enjoy life and pursue your passions, it’s also essential to make smart financial decisions and invest in your future.

This balance may look different for each individual, depending on their personal circumstances and priorities. However, by considering the insights of older generations and adapting their advice to fit their own needs, Millennials and Gen Z can increase their chances of building a secure and fulfilling future.

Nuances and Counterarguments

While the older generation’s advice carries the weight of experience, it’s also crucial to acknowledge the counterarguments and the economic realities faced by younger adults.

-

Economic Pressures: Millennials and Gen Z have entered the workforce during periods of economic instability, including the Great Recession and the COVID-19 pandemic. This has led to job losses, wage stagnation, and increased financial insecurity.

-

Student Loan Debt: The rising cost of education has saddled many young adults with significant student loan debt, making it difficult to save for the future.

-

Housing Affordability: Skyrocketing property prices in many cities have made homeownership unattainable for many young adults.

-

Shifting Priorities: Millennials and Gen Z often prioritize experiences and personal growth over material possessions, which may explain their willingness to spend money on travel and entertainment.

These factors highlight the complexities of the financial landscape facing younger generations and suggest that a one-size-fits-all approach to financial planning may not be appropriate.

The Broader Context

The concerns raised by older women reflect a broader debate about generational differences and the changing nature of success. While traditional markers of success, such as homeownership and financial security, remain important, younger generations are also placing greater emphasis on personal fulfillment, social impact, and work-life balance.

This shift in priorities is not necessarily a bad thing. It reflects a growing recognition that success is not just about accumulating wealth and possessions, but also about living a meaningful and fulfilling life. However, it’s important to ensure that this pursuit of personal fulfillment does not come at the expense of long-term financial security.

A Dialogue Across Generations

The perspectives shared by older women provide valuable insights into the challenges and opportunities facing younger generations. By engaging in open and honest conversations across generations, we can learn from each other and work together to build a better future for all. These conversations should not be one-sided. Older generations can also learn from the innovative and entrepreneurial spirit of younger adults, their adaptability to new technologies, and their commitment to social justice.

Conclusion

The concerns raised by older women about the life choices of Millennials and Gen Z underscore the need for thoughtful financial planning, the importance of developing strong communication skills, and the value of seeking mentorship. While younger generations face unique challenges, they also have the potential to create a more innovative, equitable, and fulfilling future. By learning from the experiences of older generations and adapting their advice to fit their own needs, Millennials and Gen Z can increase their chances of achieving success and happiness in all areas of their lives. It’s about striking a balance between immediate satisfaction and long-term security while acknowledging that what worked in the past might need adjusting for the present and future realities.

Frequently Asked Questions (FAQ)

Q1: What are the main concerns older women have about Millennials and Gen Z’s life choices?

A1: Older women primarily worry that Millennials and Gen Z prioritize short-term gratification over long-term financial security, often neglecting the importance of homeownership and undervaluing face-to-face communication skills in favor of digital interactions. They also express concerns about high levels of debt, particularly student loan debt, and its potential impact on future financial stability.

Q2: Why do older women emphasize the importance of homeownership so strongly?

A2: Older women view homeownership as a fundamental step toward building wealth and financial security. They see it not just as a place to live but as an investment in the future, offering potential appreciation in value, tax advantages, and a sense of stability. They believe it’s a tangible asset that contributes to long-term financial well-being, even though they acknowledge the challenges younger generations face in entering the housing market.

Q3: How does the older generation view the younger generation’s reliance on digital communication?

A3: While acknowledging the prevalence of digital communication, older women express concerns that Millennials and Gen Z may be losing the ability to connect with others on a personal level. They believe that relying heavily on digital interactions can diminish crucial nonverbal communication skills necessary for building strong relationships and succeeding in professional settings. They feel face-to-face interactions are essential for conveying emotions and understanding nuances in communication that might be missed in digital formats.

Q4: What advice do older women give regarding financial planning and career choices?

A4: Older women advise young adults to start saving early, even small amounts, to benefit from the power of compounding interest. They suggest prioritizing job security and long-term career prospects over trendier job titles or immediate gratification. They also emphasize the importance of careful budgeting, avoiding unnecessary debt, and seeking mentorship from experienced professionals to gain valuable guidance and support in career development.

Q5: Are there counterarguments or alternative perspectives to the older generation’s advice?

A5: Yes, there are several counterarguments. Millennials and Gen Z face unique economic challenges, including entering the workforce during periods of instability, grappling with significant student loan debt, and facing high housing costs. These factors can make traditional financial goals, like homeownership, seem unattainable. Additionally, younger generations often prioritize experiences, personal growth, and work-life balance, which may influence their spending and career choices differently than older generations. They also have different and innovative ways of communicating and managing their professional and personal lives.