A woman who called into “The Ramsey Show” seeking debt advice received a shock when her parents unexpectedly offered to pay off her remaining $200,000 in student loan debt, leaving both her and host Dave Ramsey stunned.

A caller identified as “Sarah” dialed into the popular financial advice show seeking guidance on managing her substantial student loan burden. She explained that she had already diligently paid off $80,000 of her loans and was seeking strategies to tackle the remaining $200,000. What followed was a moment that Ramsey described as one of the most memorable in his show’s history.

As Sarah detailed her situation, her parents, who were listening in, decided to intervene. They revealed their intention to pay off her remaining debt, a gesture that left Sarah speechless and Ramsey visibly impressed. “Well, that’s one of the greatest moments we’ve had on the air in 30 years,” Ramsey exclaimed, emphasizing the extraordinary nature of the situation.

The unexpected act of generosity sparked a wide range of reactions, highlighting the complex emotions surrounding student loan debt and the varying approaches families take to address it.

Sarah, a diligent debt payer, had already made significant strides in reducing her student loan balance. Her proactive approach to financial management impressed Ramsey, who often emphasizes the importance of hard work and financial discipline.

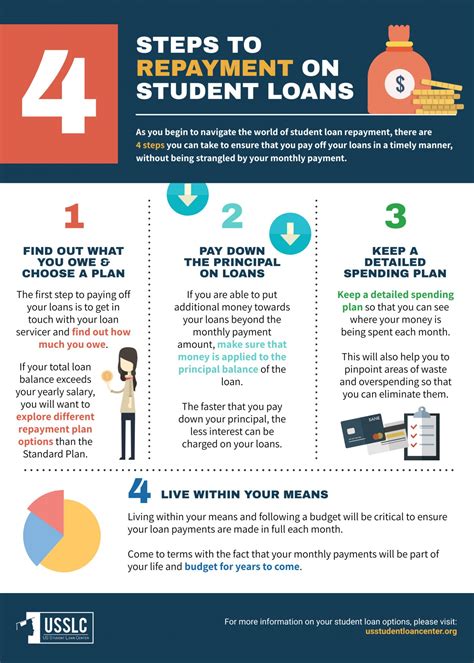

“I’ve paid off $80,000, and I have $200,000 left,” Sarah told Ramsey. She was seeking advice on how to accelerate her repayment plan and become debt-free sooner. Ramsey, known for his no-nonsense approach to personal finance, typically advises callers to aggressively pay down debt using the “debt snowball” method, where smaller debts are tackled first to build momentum.

However, before Ramsey could offer his usual advice, Sarah’s parents stepped in with their surprising offer. The decision, made spontaneously while listening to their daughter’s call, underscored the deep concern many parents have for their children’s financial well-being.

Ramsey’s reaction to the unexpected turn of events was one of genuine amazement. He praised the parents’ generosity and highlighted the rarity of such a situation. “That doesn’t happen every day,” he remarked, acknowledging the profound impact the gift would have on Sarah’s life.

The incident has ignited a debate about the role of parents in helping their children manage student loan debt. While some applaud the parents’ generosity and their desire to alleviate their daughter’s financial burden, others argue that such interventions can perpetuate a cycle of dependency and undermine the importance of individual financial responsibility.

The story also highlights the broader issue of student loan debt in the United States, which has become a significant economic burden for millions of Americans. The rising cost of higher education and the increasing reliance on loans have created a crisis that affects individuals, families, and the economy as a whole.

Many young adults are graduating with substantial debt, which can delay major life milestones such as buying a home, starting a family, and saving for retirement. The burden of student loans can also impact career choices, as graduates may feel compelled to pursue high-paying jobs to repay their debt, even if those jobs are not aligned with their passions or interests.

The Ramsey episode serves as a reminder of the challenges faced by those struggling with student loan debt and the importance of finding effective strategies for managing and repaying it. While Sarah’s situation is unique, her story resonates with many who are seeking financial freedom and a path to a debt-free future.

Understanding the Dynamics of the Situation

The scenario presented on “The Ramsey Show” unveils a complex interplay of financial responsibility, parental support, and the emotional weight of student loan debt. To fully grasp the significance of this event, it’s crucial to examine the perspectives of each party involved: Sarah, her parents, and Dave Ramsey himself.

Sarah’s Perspective: Diligence Meets Serendipity

Sarah’s initial call to the show demonstrated her commitment to financial responsibility. Having already paid off $80,000 of her student loans, she displayed a proactive approach to managing her debt. Her willingness to seek advice from a financial expert like Dave Ramsey underscores her desire to accelerate her debt repayment and achieve financial freedom.

For Sarah, the unexpected offer from her parents must have been a mix of immense relief and perhaps a touch of conflicted emotions. While undoubtedly grateful for their generosity, she may have also experienced a sense of internal conflict, as she had been diligently working towards repaying the debt herself.

The sudden elimination of her $200,000 debt provides Sarah with a significant head start in her financial life. It frees up a substantial portion of her income, allowing her to pursue other financial goals, such as saving for a down payment on a home, investing for retirement, or starting a business.

The Parents’ Perspective: Love, Concern, and Financial Capacity

Sarah’s parents’ decision to pay off her student loans was driven by a combination of love, concern for their daughter’s financial well-being, and the financial capacity to make such a significant gift. Their spontaneous offer, made while listening to the show, suggests a deep emotional connection to their daughter’s struggles and a desire to alleviate her burden.

For parents who have the means, helping their children with student loan debt can be seen as an investment in their future. By removing the financial obstacle of student loans, parents can enable their children to pursue their dreams and achieve their full potential.

However, such a decision also raises questions about the potential for enabling dependency and undermining the importance of individual financial responsibility. Some argue that parents should encourage their children to take ownership of their debt and develop the skills necessary to manage their finances independently.

Dave Ramsey’s Perspective: A Moment of Awe and a Reminder of the Bigger Picture

Dave Ramsey’s reaction to the situation was one of genuine amazement and admiration. He recognized the extraordinary nature of the parents’ generosity and the profound impact it would have on Sarah’s life. His exclamation, “Well, that’s one of the greatest moments we’ve had on the air in 30 years,” underscores the rarity and significance of the event.

While Ramsey typically advocates for individual financial responsibility and the “debt snowball” method, he also acknowledges the role of parental support in helping young adults achieve financial success. He often encourages parents to provide guidance and support to their children, while also allowing them to learn from their own mistakes and develop their own financial skills.

The Ramsey episode also served as a reminder of the broader issue of student loan debt in the United States. Ramsey has been a vocal critic of the student loan system, arguing that it saddles young adults with unsustainable debt and hinders their ability to achieve financial freedom. He advocates for reforms to the system, including measures to control the rising cost of higher education and provide more affordable options for students.

The Broader Context: The Student Loan Crisis in America

The story of Sarah and her parents highlights the pervasive issue of student loan debt in the United States. With the cost of higher education continuing to rise, more and more students are relying on loans to finance their education. As a result, student loan debt has become a significant economic burden for millions of Americans.

According to recent data, outstanding student loan debt in the United States exceeds $1.7 trillion, making it the second-largest category of household debt after mortgages. More than 45 million Americans have student loan debt, with an average balance of over $37,000.

The burden of student loan debt can have a significant impact on individuals’ financial well-being. It can delay major life milestones such as buying a home, starting a family, and saving for retirement. It can also impact career choices, as graduates may feel compelled to pursue high-paying jobs to repay their debt, even if those jobs are not aligned with their passions or interests.

The student loan crisis also has broader economic implications. It can reduce consumer spending, slow economic growth, and exacerbate income inequality. The crisis has prompted calls for reforms to the student loan system, including measures to make college more affordable, provide debt relief to borrowers, and hold institutions accountable for student outcomes.

Analyzing the Ethical Considerations

The act of Sarah’s parents paying off her student loan raises several ethical considerations. While seemingly a generous and loving act, it’s essential to examine the potential implications and unintended consequences.

Potential for Enabling Dependency: One concern is that such acts of financial assistance can inadvertently foster dependency. By removing the responsibility of repaying the loan, Sarah may miss out on valuable life lessons about financial management, budgeting, and the importance of fulfilling obligations. Critics might argue that while well-intentioned, this action could hinder her long-term financial growth and independence.

Fairness to Others: Another ethical question revolves around fairness. Many individuals diligently repay their student loans, often making sacrifices to do so. Sarah’s situation highlights a disparity, as she benefits from a privilege not available to everyone. This can lead to feelings of resentment or a perception of unfairness among those struggling with their own debt.

Impact on Family Dynamics: While the parents’ gesture appears selfless, it’s crucial to consider the potential impact on family dynamics. Such a significant financial contribution could create imbalances in the relationship, leading to feelings of obligation or a shift in power dynamics. It’s important for families to have open and honest communication about such matters to avoid any unintended negative consequences.

Alternative Approaches: Instead of an outright payment, alternative approaches could have been considered. For example, the parents could have provided financial guidance, assisted with budgeting, or offered support in finding higher-paying employment. These methods would empower Sarah to take control of her debt while still providing assistance.

The Importance of Financial Literacy: Regardless of the circumstances, this situation underscores the importance of financial literacy. Equipping young adults with the knowledge and skills to manage their finances effectively is crucial for their long-term success. This includes understanding budgeting, debt management, investing, and saving.

Navigating Generational Wealth Transfers: As wealth is increasingly transferred between generations, it’s essential to approach these transactions with careful planning and consideration. Open communication, financial education, and a focus on empowerment can help ensure that such transfers benefit both parties involved without creating unintended negative consequences.

Exploring the Psychological Impact

Beyond the financial implications, the act of having one’s student loan paid off can have a profound psychological impact.

Relief and Reduced Stress: The most immediate and obvious impact is a sense of immense relief. Student loan debt can be a significant source of stress, anxiety, and even depression. Eliminating this burden can free up mental and emotional resources, allowing individuals to focus on other aspects of their lives.

Increased Confidence and Empowerment: Being debt-free can lead to increased confidence and a sense of empowerment. Individuals may feel more in control of their finances and more optimistic about their future. This can translate into greater risk-taking, such as starting a business or pursuing a career change.

Potential for Guilt or Shame: On the other hand, some individuals may experience feelings of guilt or shame, especially if they perceive themselves as having not earned the financial assistance. This can be particularly true for those who have a strong sense of independence and a desire to achieve success through their own efforts.

Shift in Identity: Student loan debt can become intertwined with one’s identity. Repaying the debt can be seen as a marker of success, responsibility, and adulthood. Having the debt paid off by someone else can disrupt this narrative and lead to a sense of identity confusion.

The Importance of Gratitude and Perspective: It’s important for individuals in this situation to cultivate gratitude and maintain a healthy perspective. Recognizing the generosity of the gift while also acknowledging their own efforts and contributions can help mitigate any negative psychological effects.

Long-Term Financial Planning

Regardless of how one’s student loan debt is resolved, it’s essential to develop a long-term financial plan. This includes setting financial goals, creating a budget, investing wisely, and planning for retirement.

Setting Financial Goals: Financial goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Examples include saving for a down payment on a home, paying off credit card debt, or building an emergency fund.

Creating a Budget: A budget is a plan for how to spend and save money. It should track income and expenses and allocate funds to different categories, such as housing, transportation, food, and entertainment.

Investing Wisely: Investing is a way to grow wealth over time. It involves putting money into assets, such as stocks, bonds, and real estate, with the expectation that they will increase in value.

Planning for Retirement: Retirement planning is the process of saving and investing for retirement. It involves estimating how much money will be needed in retirement and developing a plan to accumulate those funds.

The Role of Financial Advisors

Financial advisors can provide valuable guidance and support in developing and implementing a financial plan. They can help individuals assess their financial situation, set financial goals, and make informed decisions about investing and saving.

Choosing a Financial Advisor: When choosing a financial advisor, it’s important to consider their qualifications, experience, and fees. It’s also important to find an advisor who is trustworthy and who has your best interests at heart.

Frequently Asked Questions (FAQ)

-

What was the original amount of student loan debt Sarah had accumulated?

Sarah originally accumulated $280,000 in student loan debt. She had already paid off $80,000 before her parents offered to pay the remaining $200,000.

-

What was Dave Ramsey’s initial reaction to the parents’ offer?

Dave Ramsey was visibly impressed and exclaimed, “Well, that’s one of the greatest moments we’ve had on the air in 30 years,” emphasizing the extraordinary nature of the situation.

-

What debt repayment method does Dave Ramsey typically advocate for?

Ramsey typically advises callers to aggressively pay down debt using the “debt snowball” method, where smaller debts are tackled first to build momentum.

-

What is the total amount of outstanding student loan debt in the United States?

According to recent data, outstanding student loan debt in the United States exceeds $1.7 trillion.

-

What are some potential negative psychological effects of having student loan debt paid off by someone else?

Some individuals may experience feelings of guilt, shame, or a shift in identity, especially if they perceive themselves as having not earned the financial assistance. It’s important for individuals in this situation to cultivate gratitude and maintain a healthy perspective.