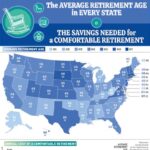

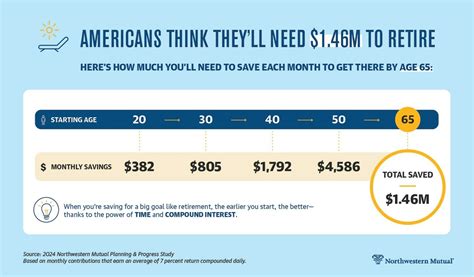

Most Americans are nowhere near prepared for a comfortable retirement, with a new analysis suggesting individuals should aim to save $1.47 million by age 67 to achieve that goal. However, a staggering 97% of Americans are currently projected to fall short of this target, raising concerns about the future financial security of a large segment of the population.

A recent report by Principal Financial Well-Being Index, cited in Yahoo Finance, highlights the widening gap between retirement aspirations and reality. While individual circumstances vary, the $1.47 million benchmark serves as a general guideline for those seeking financial independence and a comfortable lifestyle in their post-work years. This figure accounts for factors such as healthcare costs, inflation, and potential long-term care expenses, which are often underestimated.

The report further emphasizes the impact of inflation, which has significantly eroded purchasing power and made it more challenging for individuals to save adequately. Rising costs of living, combined with stagnant wages for many, have created a perfect storm that hinders retirement savings efforts. The average retirement savings across all age groups lags far behind the recommended target, with many Americans relying heavily on Social Security and employer-sponsored retirement plans, which may not be sufficient to cover all expenses.

Several factors contribute to this widespread retirement savings shortfall. These include a lack of financial literacy, insufficient access to employer-sponsored retirement plans, competing financial priorities (such as debt repayment and housing costs), and a tendency to underestimate the length and cost of retirement. The current economic climate, characterized by volatility and uncertainty, also plays a significant role in discouraging long-term savings.

The implications of this retirement savings crisis are far-reaching. As more Americans enter retirement without adequate savings, they may be forced to rely on government assistance, reduce their living standards, or continue working beyond their desired retirement age. This can create significant social and economic challenges, placing a strain on public resources and potentially impacting future generations.

Addressing this issue requires a multi-faceted approach involving individual responsibility, employer support, and government policies aimed at promoting retirement savings. Enhancing financial literacy, expanding access to retirement savings plans, and incentivizing long-term savings are crucial steps toward ensuring a more secure retirement for all Americans.

The $1.47 Million Retirement Target: A Deeper Dive

The $1.47 million target, while ambitious, is based on several key assumptions and calculations designed to provide a comfortable retirement. Financial advisors typically recommend that retirees aim to replace approximately 80% of their pre-retirement income to maintain their standard of living. This percentage accounts for the fact that retirees typically have lower expenses related to work (e.g., commuting, clothing) and may benefit from lower tax rates.

To achieve this income replacement goal, retirees need to accumulate sufficient savings to generate a sustainable stream of income throughout their retirement years. The amount of savings required depends on several factors, including the individual’s desired retirement income, life expectancy, and investment returns. The $1.47 million target assumes a reasonable rate of return on investments and a retirement period of approximately 25-30 years.

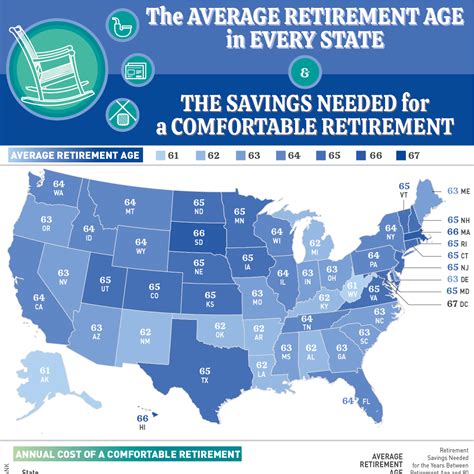

However, it’s important to note that this figure is just a guideline, and individual circumstances may vary significantly. Factors such as healthcare costs, lifestyle preferences, and geographic location can significantly impact the amount of savings needed for a comfortable retirement. Individuals living in high-cost areas, for example, may require significantly more savings than those living in areas with lower living expenses.

Furthermore, the $1.47 million target does not account for potential unexpected expenses, such as long-term care needs or major medical emergencies. These expenses can quickly deplete retirement savings, leaving individuals vulnerable to financial hardship. It’s therefore crucial to plan for these contingencies and consider purchasing long-term care insurance or other forms of protection.

Why Are So Many Americans Falling Short?

The fact that 97% of Americans are projected to fall short of the $1.47 million retirement target is a cause for serious concern. Several factors contribute to this widespread savings shortfall, including:

-

Lack of Financial Literacy: Many Americans lack the knowledge and skills needed to make informed financial decisions. They may not understand the importance of saving for retirement, how to invest their money wisely, or how to manage their debt effectively. This lack of financial literacy can lead to poor financial choices and inadequate retirement savings.

-

Insufficient Access to Retirement Savings Plans: Not all Americans have access to employer-sponsored retirement plans, such as 401(k)s or pensions. These plans offer significant advantages, such as tax-deferred savings and employer matching contributions. Individuals who lack access to these plans may find it more challenging to save for retirement on their own. According to the Social Security Administration, only about half of private-sector workers participate in an employer-sponsored retirement plan.

-

Competing Financial Priorities: Many Americans face competing financial priorities, such as debt repayment, housing costs, and education expenses. These expenses can make it difficult to save for retirement, especially for those with limited incomes. Student loan debt, in particular, has become a major obstacle to retirement savings for many young adults.

-

Underestimating the Length and Cost of Retirement: Many Americans underestimate the length and cost of retirement. They may not realize how long they will live in retirement or how much money they will need to cover their expenses. As a result, they may not save enough money to last throughout their retirement years. Life expectancies are increasing, meaning that people are living longer in retirement, which requires more savings.

-

Inflation: Inflation erodes the purchasing power of savings, making it more challenging to accumulate enough money for retirement. The recent surge in inflation has further exacerbated this problem, as prices for goods and services have risen sharply. This means that individuals need to save even more money to maintain their standard of living in retirement.

-

Economic Uncertainty: Economic uncertainty can discourage long-term savings. When the economy is volatile or uncertain, individuals may be hesitant to invest their money, fearing that they will lose their savings. This can lead to a cycle of under-saving, which makes it even more difficult to achieve a comfortable retirement.

-

Procrastination: Putting off saving for retirement is a common mistake. Many people believe they have plenty of time to save and delay starting until later in life. However, the earlier you start saving, the more time your money has to grow through compounding. Delaying saving can significantly reduce the amount of money you accumulate by retirement.

The Role of Social Security

Social Security plays a crucial role in providing retirement income for millions of Americans. However, it’s important to recognize that Social Security is not designed to be the sole source of retirement income. The average Social Security benefit is relatively modest, and it may not be sufficient to cover all of a retiree’s expenses.

According to the Social Security Administration, the average monthly Social Security retirement benefit in 2023 was approximately $1,827. This amount may not be enough to maintain a comfortable standard of living, especially in high-cost areas. Furthermore, the future of Social Security is uncertain, as the system is projected to face funding shortfalls in the coming years. This could lead to benefit reductions or other changes that could impact retirees’ income.

Therefore, it’s crucial to supplement Social Security with other sources of retirement income, such as savings, investments, and employer-sponsored retirement plans. Relying solely on Social Security can leave retirees vulnerable to financial hardship.

Strategies for Improving Retirement Savings

Despite the challenges, there are several strategies that individuals can use to improve their retirement savings:

-

Start Saving Early: The earlier you start saving, the more time your money has to grow through compounding. Even small contributions can make a big difference over time. Consider automating your savings by setting up regular contributions to a retirement account.

-

Take Advantage of Employer-Sponsored Retirement Plans: If your employer offers a 401(k) or other retirement plan, take advantage of it. These plans offer tax-deferred savings and often include employer matching contributions. Contribute enough to your employer’s plan to receive the full matching contribution. This is essentially free money that can significantly boost your retirement savings.

-

Increase Your Savings Rate: Gradually increase your savings rate over time. Even a small increase can make a big difference in the long run. Consider increasing your contribution rate whenever you get a raise or bonus.

-

Reduce Debt: High levels of debt can make it difficult to save for retirement. Focus on reducing your debt as quickly as possible. Consider consolidating your debt or using a debt snowball method to pay off your debts more efficiently.

-

Create a Budget: Creating a budget can help you track your income and expenses and identify areas where you can save money. Use a budgeting app or spreadsheet to track your spending and make adjustments as needed.

-

Invest Wisely: Invest your money in a diversified portfolio of stocks, bonds, and other assets. Consider consulting with a financial advisor to develop an investment strategy that is appropriate for your risk tolerance and time horizon.

-

Consider Working Longer: Working longer can help you increase your retirement savings and delay drawing on your savings. Even working a few extra years can make a significant difference in your financial security.

-

Delay Social Security Benefits: If possible, delay claiming Social Security benefits until age 70. This will result in a higher monthly benefit amount. The longer you wait to claim, the higher your benefit will be.

-

Seek Financial Advice: Consider seeking advice from a qualified financial advisor. A financial advisor can help you develop a retirement plan that is tailored to your individual needs and circumstances.

Government and Employer Initiatives

Addressing the retirement savings crisis requires a collective effort involving individuals, employers, and the government. Several initiatives are underway to promote retirement savings and improve financial security.

-

The SECURE Act: The SECURE Act, passed in 2019, made several changes to retirement laws designed to make it easier for individuals to save for retirement. The act increased the age at which individuals must begin taking required minimum distributions from retirement accounts and made it easier for small businesses to offer retirement plans.

-

The SECURE Act 2.0: Building on the SECURE Act, SECURE Act 2.0 includes provisions such as auto-enrollment in employer-sponsored retirement plans, expanded access to emergency savings accounts, and increased catch-up contributions for older workers.

-

State-Sponsored Retirement Plans: Several states have established state-sponsored retirement plans for workers who do not have access to employer-sponsored plans. These plans typically offer low-cost investment options and are designed to be easy to use.

-

Employer Matching Contributions: Many employers offer matching contributions to their employees’ retirement accounts. These contributions can significantly boost retirement savings and provide a powerful incentive for employees to participate in retirement plans.

-

Financial Literacy Programs: Many organizations offer financial literacy programs designed to help individuals improve their financial knowledge and skills. These programs can cover topics such as budgeting, debt management, and retirement planning.

The Importance of Planning and Preparation

Ultimately, achieving a comfortable retirement requires careful planning and preparation. It’s essential to start saving early, invest wisely, and make informed financial decisions. By taking proactive steps to improve their retirement savings, individuals can increase their chances of achieving financial security in their post-work years. The consequences of failing to adequately prepare for retirement can be severe, leading to financial hardship and a reduced quality of life. Therefore, it’s crucial to prioritize retirement savings and take the necessary steps to ensure a secure future.

The statistic that 97% of Americans are not on track to meet the $1.47 million target should serve as a wake-up call. It underscores the urgency of addressing the retirement savings crisis and highlights the need for individuals, employers, and the government to work together to promote retirement savings and improve financial security for all Americans.

Frequently Asked Questions (FAQ)

-

How was the $1.47 million retirement target calculated?

The $1.47 million figure is a general guideline based on the assumption that retirees need to replace approximately 80% of their pre-retirement income to maintain their standard of living. It accounts for factors such as healthcare costs, inflation, and potential long-term care expenses, assuming a reasonable rate of return on investments and a retirement period of approximately 25-30 years. However, individual circumstances may vary significantly, and factors such as lifestyle, location, and unexpected expenses can impact the amount of savings needed.

-

What can I do if I’m behind on my retirement savings?

If you’re behind on your retirement savings, there are several steps you can take to catch up. These include increasing your savings rate, reducing debt, taking advantage of employer-sponsored retirement plans, and seeking financial advice. Consider working longer or delaying Social Security benefits to increase your retirement income. Even small changes can make a big difference over time.

-

Is Social Security enough to live on in retirement?

Social Security is not designed to be the sole source of retirement income. The average Social Security benefit is relatively modest, and it may not be sufficient to cover all of a retiree’s expenses, especially in high-cost areas. It’s crucial to supplement Social Security with other sources of retirement income, such as savings, investments, and employer-sponsored retirement plans.

-

What is the SECURE Act and how does it impact retirement savings?

The SECURE Act, passed in 2019, and SECURE Act 2.0 are laws designed to make it easier for individuals to save for retirement. The acts include provisions such as auto-enrollment in employer-sponsored retirement plans, expanded access to emergency savings accounts, and increased catch-up contributions for older workers. These changes are intended to encourage more people to save for retirement and improve their financial security.

-

How important is financial literacy in preparing for retirement?

Financial literacy is crucial in preparing for retirement. Many Americans lack the knowledge and skills needed to make informed financial decisions. Understanding the importance of saving for retirement, how to invest your money wisely, and how to manage your debt effectively can lead to better financial choices and adequate retirement savings. Financial literacy programs can help individuals improve their financial knowledge and skills.