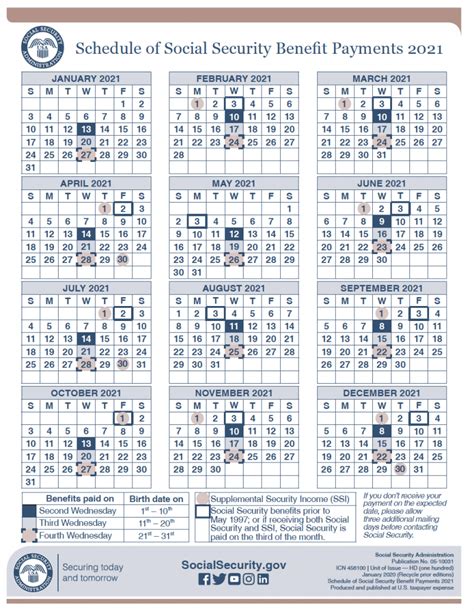

Social Security beneficiaries will receive their June payments according to a schedule determined by their birthdate, with payments distributed on the second, third, and fourth Wednesdays of the month. This schedule applies to recipients of Social Security retirement, disability, and survivor benefits.

Social Security payments for June are being disbursed based on the established schedule determined by the beneficiaries’ birthdates. This routine distribution affects millions of Americans who rely on these benefits for retirement income, disability support, or survivor assistance. The Social Security Administration (SSA) has continued its standard procedure, ensuring consistent and predictable payment delivery for eligible individuals. Understanding this schedule is crucial for beneficiaries to manage their finances effectively and plan accordingly.

The payment schedule is structured as follows:

-

Those with birthdays between the 1st and 10th of the month: Payments are issued on the second Wednesday of the month, which was June 12th.

-

Those with birthdays between the 11th and 20th of the month: Payments are issued on the third Wednesday of the month, which was June 19th.

-

Those with birthdays between the 21st and 31st of the month: Payments are issued on the fourth Wednesday of the month, which will be June 26th.

This systematic approach helps the Social Security Administration manage the vast number of payments it processes each month, ensuring that beneficiaries receive their funds in a timely and organized manner. The predictability of this schedule is essential for beneficiaries, many of whom depend on these payments to cover essential living expenses.

The Social Security Act, enacted in 1935, established the Social Security program as a crucial component of the American social safety net. This program provides a range of benefits, including retirement, disability, and survivor benefits, to eligible individuals and their families. The Social Security Administration, responsible for administering the program, oversees the collection of Social Security taxes, the management of trust funds, and the distribution of benefits to millions of Americans each month.

The importance of Social Security cannot be overstated. For many retirees, Social Security benefits represent a significant portion of their retirement income, helping them to maintain a reasonable standard of living in their later years. For individuals with disabilities, Social Security Disability Insurance (SSDI) provides vital financial support, enabling them to cover medical expenses, housing costs, and other essential needs. Survivor benefits offer crucial assistance to families who have lost a wage earner, helping them to cope with the financial challenges that can arise in such circumstances.

The Social Security program is funded primarily through payroll taxes. Workers and employers each pay a percentage of their earnings into the Social Security system, and these funds are used to pay benefits to current recipients. The Social Security Administration also manages trust funds, which hold surplus Social Security taxes collected in previous years. These trust funds are invested in U.S. government securities, and the interest earned on these investments helps to support the Social Security program.

However, the Social Security program faces significant long-term challenges. As the population ages and birth rates decline, the number of workers paying into the system relative to the number of beneficiaries receiving benefits is decreasing. This demographic shift puts pressure on the Social Security trust funds, and projections indicate that the trust funds could be depleted in the coming years if no action is taken to address the program’s financial challenges.

Policymakers have proposed a variety of solutions to shore up the Social Security system, including raising the retirement age, increasing Social Security taxes, reducing benefits, and changing the way benefits are calculated. Each of these proposals has its own set of advantages and disadvantages, and there is no consensus on the best way forward. Finding a sustainable solution to the Social Security challenges will require careful consideration of the trade-offs involved and a willingness to compromise.

Understanding the Social Security payment schedule and the factors that influence it is essential for beneficiaries to manage their finances effectively. By staying informed about the program’s rules and regulations, beneficiaries can ensure that they receive the benefits to which they are entitled and make informed decisions about their retirement planning.

Payment Details and Eligibility:

The timing of Social Security payments hinges primarily on the recipient’s birthdate. As previously stated, those born between the 1st and 10th receive their payments on the second Wednesday of the month, those born between the 11th and 20th receive payments on the third Wednesday, and those born between the 21st and 31st receive payments on the fourth Wednesday. This structured approach helps the SSA manage the high volume of monthly transactions efficiently.

However, it’s crucial to note that certain beneficiaries may receive payments on different days. For example, those who receive both Social Security and Supplemental Security Income (SSI) usually receive their Social Security payment on the third of the month. If the third falls on a weekend or holiday, the payment is typically issued on the preceding business day. This ensures that beneficiaries receive their funds without undue delay.

Furthermore, individuals who began receiving Social Security benefits before May 1997 also have a different payment schedule. These beneficiaries generally receive their payments on the third of the month, regardless of their birthdate. This exception reflects historical payment practices and is maintained for those who have been receiving benefits for an extended period.

Eligibility for Social Security retirement benefits is based on a worker’s earnings history. Individuals must accumulate a sufficient number of work credits to qualify for benefits. The number of credits required depends on the year of birth, but generally, 40 credits are needed to be fully insured. Workers earn credits by paying Social Security taxes on their earnings, and they can accumulate a maximum of four credits per year.

The amount of Social Security retirement benefits a worker receives depends on their average indexed monthly earnings (AIME) over their 35 highest-earning years. The SSA uses a formula to calculate the primary insurance amount (PIA), which is the basic benefit amount a worker is entitled to receive at their full retirement age. The full retirement age is currently 67 for those born in 1960 or later, but it was lower for those born earlier.

Workers can choose to retire as early as age 62, but their benefits will be reduced if they retire before their full retirement age. The reduction in benefits is permanent, and it reflects the fact that individuals who retire early will receive benefits for a longer period. Conversely, workers can delay retirement beyond their full retirement age, and their benefits will be increased. The increase in benefits is also permanent, and it provides an incentive for workers to continue working longer.

Social Security disability benefits are available to individuals who are unable to work due to a medical condition that is expected to last at least 12 months or result in death. To qualify for disability benefits, individuals must have a sufficient work history and meet the SSA’s definition of disability. The SSA evaluates disability claims based on a variety of factors, including medical evidence, work history, and vocational factors.

Survivor benefits are paid to the surviving spouse and dependent children of a deceased worker who had a sufficient work history. The amount of survivor benefits depends on the deceased worker’s earnings record and the relationship of the survivor to the deceased worker. Survivor benefits can provide crucial financial support to families who have lost a wage earner.

Changes and Updates to Social Security:

The Social Security program is constantly evolving to reflect changes in the economy and society. The SSA regularly updates its rules and regulations to ensure that the program remains effective and sustainable. Some of the recent changes and updates to Social Security include:

-

Cost-of-Living Adjustments (COLAs): Social Security benefits are adjusted annually to reflect changes in the cost of living. The COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), and it is designed to protect beneficiaries from the effects of inflation. The COLA for 2024 was 3.2%, which resulted in an increase in monthly Social Security benefits for millions of Americans. The COLA for 2023 was a substantial 8.7%, reflecting a period of high inflation. These adjustments are vital for maintaining the purchasing power of Social Security benefits.

-

Earnings Limit: Social Security beneficiaries who are under full retirement age and continue to work may have their benefits reduced if their earnings exceed a certain limit. The earnings limit for 2024 is \$22,320. For every \$2 earned above the limit, Social Security benefits are reduced by \$1. In the year an individual reaches full retirement age, the earnings limit is higher, and the reduction in benefits is less. Once an individual reaches full retirement age, there is no earnings limit, and they can earn as much as they want without affecting their Social Security benefits.

-

Taxation of Benefits: Social Security benefits may be subject to federal income tax, depending on the beneficiary’s income level. Up to 50% of Social Security benefits may be taxable for individuals with incomes between \$25,000 and \$34,000, and up to 85% of Social Security benefits may be taxable for individuals with incomes above \$34,000. The taxation of Social Security benefits can be a complex issue, and beneficiaries should consult with a tax professional to determine how it affects their individual circumstances.

-

Online Services: The SSA offers a wide range of online services to help beneficiaries manage their Social Security accounts. Beneficiaries can use the SSA’s website to apply for benefits, check their benefit statements, update their address, and access other important information. The SSA’s online services are a convenient and efficient way for beneficiaries to stay informed and manage their Social Security benefits.

“Understanding the payment schedule and the factors that influence it is essential for beneficiaries to manage their finances effectively,” said a representative from the Social Security Administration. “By staying informed about the program’s rules and regulations, beneficiaries can ensure that they receive the benefits to which they are entitled and make informed decisions about their retirement planning.”

Future of Social Security:

The long-term financial challenges facing the Social Security program remain a significant concern. As the population ages and birth rates decline, the number of workers paying into the system relative to the number of beneficiaries receiving benefits is decreasing. This demographic shift puts pressure on the Social Security trust funds, and projections indicate that the trust funds could be depleted in the coming years if no action is taken to address the program’s financial challenges.

The Social Security Administration publishes an annual report that provides detailed projections of the program’s financial status. The most recent report indicates that the Social Security trust funds could be depleted by the mid-2030s if Congress does not act to reform the program. If the trust funds are depleted, Social Security benefits would have to be reduced, potentially significantly.

Policymakers have proposed a variety of solutions to shore up the Social Security system, including raising the retirement age, increasing Social Security taxes, reducing benefits, and changing the way benefits are calculated. Each of these proposals has its own set of advantages and disadvantages, and there is no consensus on the best way forward. Finding a sustainable solution to the Social Security challenges will require careful consideration of the trade-offs involved and a willingness to compromise.

Some of the specific proposals that have been put forward include:

-

Raising the Retirement Age: Increasing the full retirement age would reduce the number of years that individuals receive Social Security benefits, which would help to reduce the program’s costs. However, raising the retirement age could also have negative consequences for workers who are unable to work longer due to health problems or other factors.

-

Increasing Social Security Taxes: Increasing Social Security taxes would provide more revenue to the program, which would help to shore up the trust funds. However, increasing Social Security taxes could also have negative consequences for workers and businesses, as it would reduce their disposable income and increase their labor costs.

-

Reducing Benefits: Reducing Social Security benefits would also help to reduce the program’s costs. However, reducing benefits could have negative consequences for beneficiaries, particularly those who rely on Social Security as their primary source of income.

-

Changing the Way Benefits are Calculated: There are a variety of ways to change the way Social Security benefits are calculated. For example, policymakers could change the formula used to calculate the primary insurance amount (PIA), or they could change the way cost-of-living adjustments (COLAs) are calculated. Each of these changes would have different effects on different groups of beneficiaries.

The debate over the future of Social Security is likely to continue for many years to come. Finding a sustainable solution to the program’s financial challenges will require careful consideration of the trade-offs involved and a willingness to compromise.

Supplemental Security Income (SSI) and its Coordination with Social Security:

It’s important to distinguish Social Security benefits from Supplemental Security Income (SSI). While both programs are administered by the Social Security Administration, they serve different purposes and have different eligibility requirements. Social Security benefits, as discussed, are based on a worker’s earnings history and are available to retired workers, individuals with disabilities, and survivors of deceased workers. SSI, on the other hand, is a needs-based program that provides financial assistance to aged, blind, and disabled individuals who have limited income and resources.

SSI recipients often receive their payments on the first of the month. However, if the first falls on a weekend or holiday, the payment is typically issued on the preceding business day. As previously mentioned, individuals who receive both Social Security and SSI usually receive their Social Security payment on the third of the month. This coordination ensures that individuals who are eligible for both programs receive their benefits in a timely and coordinated manner.

The eligibility requirements for SSI are more stringent than those for Social Security. To qualify for SSI, individuals must meet certain income and resource limits. The income limit for SSI is generally the same as the federal benefit rate, which is currently \$943 per month for an individual and \$1,415 per month for a couple. The resource limit for SSI is \$2,000 for an individual and \$3,000 for a couple. Resources include assets such as bank accounts, stocks, and bonds, but they do not include certain items such as a home and a car.

SSI benefits can provide crucial financial support to individuals who have limited income and resources. The benefits can be used to cover essential living expenses such as food, housing, and clothing. In addition, SSI recipients may be eligible for other benefits such as Medicaid and food stamps.

Direct Deposit and Payment Options:

The Social Security Administration encourages beneficiaries to receive their payments via direct deposit. Direct deposit is a safe and convenient way to receive Social Security benefits, as it eliminates the risk of lost or stolen checks. With direct deposit, Social Security payments are automatically deposited into the beneficiary’s bank account on the scheduled payment date.

Beneficiaries can sign up for direct deposit online through the SSA’s website, or they can contact the SSA by phone or mail to request a direct deposit form. To sign up for direct deposit, beneficiaries will need to provide their bank account information, including the bank’s routing number and their account number.

In addition to direct deposit, the SSA also offers beneficiaries the option of receiving their payments via a Direct Express® debit card. The Direct Express® card is a prepaid debit card that can be used to access Social Security benefits. Beneficiaries can use the Direct Express® card to make purchases, pay bills, and withdraw cash from ATMs.

The Direct Express® card is a convenient option for beneficiaries who do not have a bank account or who prefer not to receive their payments via direct deposit. To sign up for a Direct Express® card, beneficiaries can contact the SSA by phone or mail.

The SSA is working to eliminate paper checks altogether and transition to electronic payment methods. This transition is intended to save taxpayer money and reduce the risk of fraud and theft.

Impact of Inflation on Social Security Benefits:

Inflation can have a significant impact on the purchasing power of Social Security benefits. As the cost of goods and services rises, Social Security benefits may not be sufficient to cover essential living expenses. That is why Cost-of-Living Adjustments (COLAs) are crucial.

The Social Security Administration provides detailed information on its website about how inflation affects Social Security benefits and how the COLA is calculated. Beneficiaries can use this information to understand how inflation may affect their individual circumstances.

Frequently Asked Questions (FAQ):

-

How is the Social Security payment schedule determined?

The Social Security payment schedule is primarily determined by the beneficiary’s birthdate. Those born between the 1st and 10th of the month receive their payments on the second Wednesday, those born between the 11th and 20th receive payments on the third Wednesday, and those born between the 21st and 31st receive payments on the fourth Wednesday. There are exceptions for those receiving both Social Security and SSI, and those who began receiving benefits before May 1997.

-

What happens if my Social Security payment date falls on a holiday or weekend?

If your Social Security payment date falls on a holiday or weekend, your payment is typically issued on the preceding business day. This ensures that you receive your funds without undue delay.

-

How do I change my direct deposit information for Social Security payments?

You can change your direct deposit information online through the Social Security Administration’s website, or you can contact the SSA by phone or mail to request a direct deposit form. You will need to provide your bank account information, including the bank’s routing number and your account number.

-

Will I receive a paper check if I don’t sign up for direct deposit?

The Social Security Administration is working to eliminate paper checks altogether and transition to electronic payment methods. It is highly recommended to sign up for direct deposit or the Direct Express® debit card.

-

How does inflation affect my Social Security benefits?

Inflation can erode the purchasing power of Social Security benefits. To protect beneficiaries from the effects of inflation, Social Security benefits are adjusted annually to reflect changes in the cost of living. This adjustment is called the Cost-of-Living Adjustment (COLA) and is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).