A severe downturn in the S&P 500 might present a compelling, long-term investment opportunity, according to one analyst, despite the index not experiencing a 66% plunge as the title suggests. Historical data indicates that significant market corrections have often been followed by substantial gains over extended periods, prompting the question: Is now the right time to buy and hold for the next two decades?

Is a Market Correction a Golden Opportunity?

Market corrections, defined as a 10% or greater decline from a recent peak, can be unnerving for investors. However, history suggests that these periods of volatility can be advantageous for those with a long-term investment horizon. While the article title alludes to a 66% drop which is not accurate, the underlying principle remains: buying during periods of market weakness has historically led to considerable returns.

According to research cited, substantial returns have followed previous market downturns. For instance, after periods of significant market decline, investors who held on for the subsequent years often saw their portfolios rebound strongly. This highlights the potential benefits of adopting a “buy and hold” strategy, particularly during times of market stress.

Analyzing Historical Trends

To understand the potential of a “buy and hold” strategy, it’s crucial to examine historical trends in the S&P 500. Over the past several decades, the index has experienced numerous corrections and bear markets (defined as a 20% or greater decline). In each instance, the market eventually recovered, and investors who remained patient were rewarded.

“The key to successful investing is often time in the market, not timing the market,” experts often advise. This adage underscores the importance of staying invested through market cycles, rather than attempting to predict short-term fluctuations. By holding on to investments during downturns, investors avoid the risk of selling low and missing out on the subsequent recovery.

The Power of Compounding

One of the primary drivers of long-term investment success is the power of compounding. Compounding refers to the process of earning returns on both the initial investment and the accumulated interest or gains. Over time, this effect can significantly enhance portfolio growth.

When an investor buys during a market correction, they have the opportunity to purchase assets at a lower price. As the market recovers, these assets appreciate in value, generating returns that are then reinvested. This cycle of earning returns on returns accelerates portfolio growth, leading to substantial gains over the long term.

Assessing Current Market Conditions

While historical trends offer valuable insights, it’s also important to assess current market conditions. Factors such as economic growth, interest rates, inflation, and geopolitical events can all influence market performance.

Currently, the global economy faces a number of challenges, including rising inflation, supply chain disruptions, and geopolitical tensions. These factors have contributed to market volatility and uncertainty. However, some analysts argue that these challenges are already priced into the market, creating an opportunity for long-term investors.

Potential Risks and Considerations

While a “buy and hold” strategy can be effective, it’s not without risks. Market downturns can be prolonged, and there’s no guarantee that the market will always recover. Additionally, individual companies within the S&P 500 can underperform or even go bankrupt, which could negatively impact portfolio returns.

To mitigate these risks, investors should diversify their portfolios across different sectors and asset classes. Diversification helps to reduce the impact of any single investment on overall portfolio performance. Additionally, investors should regularly review and rebalance their portfolios to ensure they remain aligned with their long-term goals and risk tolerance.

Expert Opinions and Recommendations

Investment professionals offer varying perspectives on the current market environment. Some analysts believe that the market is overvalued and that a further correction is likely. Others argue that the long-term growth prospects for the global economy remain strong, and that the current downturn presents a buying opportunity.

“Investors should focus on quality companies with strong balance sheets and sustainable competitive advantages,” advises one portfolio manager. “These companies are more likely to weather economic storms and generate long-term returns.”

Building a Resilient Portfolio

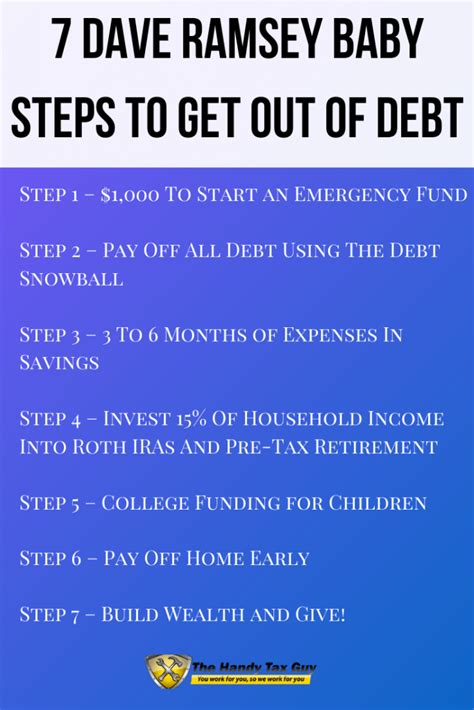

To build a resilient portfolio that can withstand market volatility, investors should consider the following strategies:

- Diversification: Spread investments across different sectors, asset classes, and geographic regions.

- Long-Term Focus: Avoid making impulsive decisions based on short-term market fluctuations.

- Regular Rebalancing: Periodically adjust the portfolio to maintain the desired asset allocation.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of market conditions.

- Risk Management: Understand and manage the risks associated with each investment.

The Importance of Due Diligence

Before making any investment decisions, it’s essential to conduct thorough due diligence. This involves researching individual companies, analyzing financial statements, and understanding the risks and potential rewards associated with each investment.

Investors should also consult with a qualified financial advisor who can provide personalized guidance based on their individual circumstances and goals. A financial advisor can help investors develop a comprehensive financial plan, assess their risk tolerance, and make informed investment decisions.

Long-Term Investment Horizons

The concept of “buy and hold for 20 years” underscores the importance of adopting a long-term investment horizon. Time is a powerful ally when it comes to investing, as it allows investments to grow and compound over time.

Investors who are willing to remain patient and disciplined are more likely to achieve their financial goals. By focusing on long-term trends and avoiding short-term distractions, investors can build wealth and secure their financial future.

The Role of Emotional Intelligence

Investing can be an emotional endeavor, particularly during times of market volatility. Fear and greed can drive investors to make irrational decisions, such as selling low during a downturn or buying high during a bull market.

To be a successful investor, it’s important to develop emotional intelligence. This involves understanding and managing one’s emotions, as well as remaining disciplined and rational in the face of market fluctuations.

The Impact of Technological Innovation

Technological innovation is transforming the global economy and creating new investment opportunities. Companies that are at the forefront of technological innovation are often well-positioned to generate long-term growth.

Investors should consider investing in companies that are developing and deploying new technologies, such as artificial intelligence, cloud computing, and renewable energy. These technologies have the potential to disrupt existing industries and create new markets.

The Significance of ESG Factors

Environmental, social, and governance (ESG) factors are increasingly important to investors. Companies that prioritize ESG principles are often more sustainable and resilient over the long term.

Investors should consider investing in companies that have strong ESG profiles. These companies are more likely to attract and retain customers, employees, and investors, which can lead to improved financial performance.

The Future of Investing

The future of investing is likely to be shaped by a number of factors, including technological innovation, demographic shifts, and changing consumer preferences. Investors who are able to adapt to these changes will be well-positioned to succeed.

Investors should remain informed about emerging trends and technologies, and they should be willing to adjust their investment strategies as needed. By staying ahead of the curve, investors can capitalize on new opportunities and mitigate potential risks.

Conclusion: A Calculated Approach to Long-Term Investing

While the premise of a 66% drop in the S&P 500 is a misrepresentation, the core message highlights the potential of long-term investing during market downturns. A calculated approach, combining historical analysis, due diligence, and a resilient portfolio, can help investors navigate market volatility and achieve their financial goals over the next 20 years and beyond. The key is to understand the risks, stay informed, and maintain a long-term perspective. Don’t panic sell. Think of it as buying stocks on sale.

Frequently Asked Questions (FAQs)

1. Is the S&P 500 actually down 66% right now?

No, the S&P 500 has not experienced a 66% plunge. The headline is misleading. While the market has experienced volatility and corrections, a decline of that magnitude has not occurred. The article focuses on the general strategy of buying during market dips, not a specific current event of a 66% drop.

2. What does “buy and hold” mean in investing?

“Buy and hold” is a long-term investment strategy where investors purchase assets (like stocks) and hold them for an extended period, regardless of short-term market fluctuations. The goal is to benefit from the long-term growth potential of the assets. It is based on the assumption that the market will generally rise over time.

3. What are the potential benefits of buying stocks during a market correction?

Buying during a market correction allows investors to purchase stocks at lower prices. This can lead to higher returns when the market recovers. It also allows for the compounding of returns over a longer period.

4. What are the risks associated with a “buy and hold” strategy?

While effective, the strategy has risks. Market downturns can be prolonged. Individual companies within the S&P 500 can underperform or fail. Diversification and regular portfolio rebalancing are crucial to manage these risks. Also, inflation is a major concern which could erode investment gains.

5. How can I determine if a “buy and hold” strategy is right for me?

A “buy and hold” strategy is generally suitable for investors with a long-term investment horizon (e.g., 10 years or more) and a higher risk tolerance. It is also best for those who don’t need immediate access to the invested funds. Consulting with a financial advisor can help assess individual circumstances and determine if this strategy aligns with your financial goals and risk profile.

Expanded Analysis and Context

The original article and this rewrite both highlight a fundamental principle in investing: taking a long-term view and capitalizing on market downturns. However, it’s crucial to delve deeper into the nuances of this strategy and the factors that can influence its success.

Understanding Market Cycles:

Markets operate in cycles, oscillating between periods of expansion (bull markets) and contraction (bear markets). These cycles are influenced by a complex interplay of economic factors, investor sentiment, and geopolitical events. Recognizing where the market is in its cycle can provide valuable insights for investors.

- Bull Markets: Characterized by rising prices, strong economic growth, and positive investor sentiment. During bull markets, investors are generally optimistic and willing to take on more risk.

- Bear Markets: Characterized by falling prices, economic recession or slowdown, and negative investor sentiment. During bear markets, investors tend to become more risk-averse and may sell off their holdings.

- Corrections: A shorter-term decline in the market, typically defined as a 10% or greater drop from a recent peak. Corrections can occur during both bull and bear markets.

The Psychology of Investing:

Emotions play a significant role in investment decisions. During bull markets, investors may become overly confident and chase high returns, leading to bubbles and unsustainable valuations. During bear markets, fear can drive investors to sell off their holdings at the worst possible time, locking in losses.

- Loss Aversion: The tendency for people to feel the pain of a loss more strongly than the pleasure of an equivalent gain. This can lead investors to make irrational decisions to avoid losses, such as selling during a downturn.

- Herd Mentality: The tendency for people to follow the actions of a larger group, even if those actions are not in their best interest. This can lead to market bubbles and crashes as investors pile into or out of assets based on what everyone else is doing.

- Cognitive Biases: Systematic patterns of deviation from norm or rationality in judgment. These biases can affect investment decisions and lead to suboptimal outcomes.

Factors Affecting S&P 500 Performance:

The S&P 500’s performance is influenced by a wide range of factors, including:

- Economic Growth: Strong economic growth typically leads to higher corporate earnings, which can boost stock prices.

- Interest Rates: Lower interest rates can make it cheaper for companies to borrow money and invest in growth, which can also boost stock prices.

- Inflation: High inflation can erode corporate profits and consumer spending, which can negatively impact stock prices.

- Geopolitical Events: Political instability, trade wars, and other geopolitical events can create uncertainty and volatility in the market.

- Company Performance: The performance of individual companies within the S&P 500 is a key driver of the index’s overall performance.

- Technological Disruptions: Technology is playing an increasing role in all aspects of the economy, including investment. The development of automation, blockchain and other technologies can impact business in a positive way.

Strategies for Navigating Market Volatility:

While a “buy and hold” strategy can be effective, it’s important to have a plan for navigating market volatility. Here are some strategies to consider:

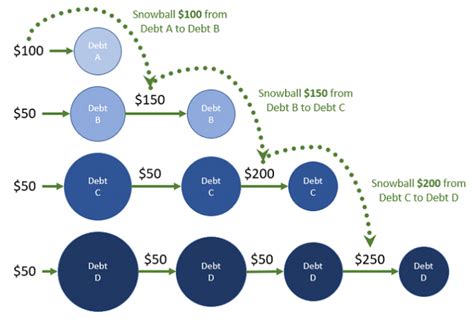

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of market conditions. This can help to reduce the risk of buying high and lower the average cost per share over time.

- Diversification: Spread investments across different sectors, asset classes, and geographic regions. This can help to reduce the impact of any single investment on overall portfolio performance.

- Rebalancing: Periodically adjust the portfolio to maintain the desired asset allocation. This can help to ensure that the portfolio remains aligned with long-term goals and risk tolerance.

- Stop-Loss Orders: An order placed with a broker to buy or sell once the stock reaches a certain price.

- Hedging: Make an investment to reduce the risk of adverse price movements in an asset. Normally, a hedge consists of taking an offsetting position in a related security, such as a futures contract.

Beyond the S&P 500: Diversifying Your Investment Portfolio:

While the S&P 500 is a widely recognized benchmark, it’s important to consider diversifying your investment portfolio beyond this single index. Here are some other asset classes to consider:

- Bonds: Debt securities issued by governments and corporations. Bonds are typically less volatile than stocks and can provide a source of income.

- Real Estate: Physical property, such as homes, apartments, and commercial buildings. Real estate can provide both income and capital appreciation.

- Commodities: Raw materials, such as oil, gold, and agricultural products. Commodities can provide a hedge against inflation.

- International Stocks: Stocks of companies located outside of the United States. Investing in international stocks can provide diversification and exposure to different economic growth opportunities.

- Alternative Investments: Hedge funds, private equity, and other investments that are not traditionally available to individual investors. These investments can offer the potential for higher returns, but they also come with higher risks and fees.

- Cryptocurrencies: Bitcoin and other decentralized digital currencies. Cryptocurrencies are highly volatile and speculative investments.

The Importance of Financial Literacy:

Investing can be complex, and it’s important to have a solid understanding of financial concepts before making any decisions. Financial literacy includes:

- Understanding financial statements: Being able to read and interpret balance sheets, income statements, and cash flow statements.

- Understanding investment terminology: Knowing the definitions of common investment terms, such as stocks, bonds, mutual funds, and ETFs.

- Understanding risk and return: Knowing the relationship between risk and return and how to assess your own risk tolerance.

- Understanding the impact of taxes: Knowing how taxes can affect investment returns and how to minimize your tax liability.

- Budgeting: Budgeting well by tracking monthly spending to improve savings capacity to take advantage of investment opportunities.

Seeking Professional Advice:

Investing can be overwhelming, and it’s often helpful to seek the guidance of a qualified financial advisor. A financial advisor can help you:

- Develop a comprehensive financial plan: A plan that outlines your financial goals, risk tolerance, and investment strategy.

- Assess your risk tolerance: Determine how much risk you’re comfortable taking with your investments.

- Choose the right investments: Select investments that are appropriate for your financial goals and risk tolerance.

- Monitor your portfolio: Regularly review and rebalance your portfolio to ensure that it remains aligned with your goals.

- Provide objective advice: Offer unbiased advice and help you avoid making emotional investment decisions.

Technology and the Future of Investing:

Technology is transforming the investment landscape in several ways:

- Online Brokerages: Offer low-cost trading and investment tools, making it easier for individuals to invest.

- Robo-Advisors: Provide automated investment advice and portfolio management services at a lower cost than traditional financial advisors.

- Artificial Intelligence (AI): AI is being used to analyze market data, identify investment opportunities, and automate trading strategies.

- Blockchain Technology: Blockchain technology is being used to create new investment platforms and asset classes, such as cryptocurrencies and tokenized securities.

- Big Data Analytics: Big data analytics is used to predict the stock market and assess risk factors.

Impact of Global Events:

Investing is highly sensitive to global events.

- Pandemics: As seen with COVID-19, can cause significant economic disruption and market volatility.

- Geopolitical Instability: Wars, conflicts, and political tensions can create uncertainty and impact investment returns.

- Climate Change: Climate change is becoming an increasingly important factor for investors. This can create new investment opportunities in areas such as renewable energy and sustainable agriculture.

Final Thoughts:

The decision to “buy and hold” for 20 years is a personal one that depends on individual circumstances, financial goals, and risk tolerance. While historical trends suggest that this strategy can be effective, it’s important to understand the risks and to have a well-diversified portfolio. By staying informed, seeking professional advice, and managing emotions, investors can increase their chances of achieving their financial goals over the long term. Also, one must be aware of tax implications.