Delaying saving for retirement, even with modest earnings, is the “biggest life mistake” individuals can make, according to personal finance expert Suze Orman. She emphasizes the critical importance of starting early, regardless of income level, to harness the power of compounding interest and secure long-term financial stability.

Suze Orman Warns Against Delaying Retirement Savings: A Critical Financial Mistake

Personal finance guru Suze Orman has issued a stark warning to individuals of all income levels: delaying saving for retirement is the single “biggest life mistake” you can make. In a recent statement, Orman underscored the profound impact of compounding interest and the necessity of starting retirement savings as early as possible, regardless of current earnings. Her advice is particularly relevant in today’s economic climate, where financial security is paramount and the future of Social Security remains uncertain for younger generations.

Orman’s concern is rooted in the understanding that time is the most valuable asset when it comes to retirement planning. The longer one waits to begin saving, the more difficult it becomes to accumulate a substantial nest egg due to the missed opportunities for investment growth and compounding returns. She argues that even small, consistent contributions made early in life can yield significant results over the long term, thanks to the exponential power of compounding.

“The biggest mistake you can ever make in your financial life is to delay saving for retirement,” Orman stated emphatically. She elaborated on the point, explaining that “It’s not about how much money you make; it’s about the time you give your money to grow.” This sentiment highlights the core principle of her advice: prioritizing early savings, even if the initial amounts are modest, is far more advantageous than waiting until later in life when higher contributions are required to catch up.

Orman’s warning comes at a time when many individuals, particularly younger workers, are grappling with financial challenges such as student loan debt, stagnant wages, and rising living costs. These factors often lead to the postponement of retirement savings, as immediate financial needs take precedence. However, Orman cautions against this short-sighted approach, arguing that delaying retirement savings can have severe long-term consequences.

The Power of Compounding Interest

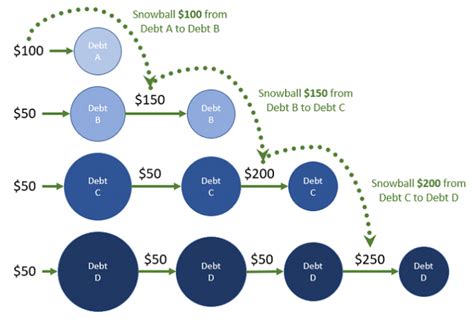

At the heart of Orman’s advice is the concept of compounding interest, which Albert Einstein famously called the “eighth wonder of the world.” Compounding refers to the process of earning interest not only on the initial principal amount but also on the accumulated interest from previous periods. This exponential growth can significantly amplify savings over time, making early contributions particularly valuable.

To illustrate the power of compounding, consider two individuals:

- Person A: Starts saving \$200 per month at age 25, earning an average annual return of 7%.

- Person B: Starts saving \$400 per month at age 35, also earning an average annual return of 7%.

By age 65, Person A, who started saving earlier with smaller contributions, would have accumulated significantly more wealth than Person B. This example demonstrates that the length of time money is invested is often more critical than the amount saved each month, highlighting the importance of starting early, even with modest contributions.

Practical Steps to Start Saving Early

Orman provides practical advice for individuals looking to start saving for retirement early, even if they are facing financial constraints. Some of her recommendations include:

-

Automate Savings: Set up automatic transfers from your checking account to a retirement savings account each month. Automating the process ensures consistency and reduces the temptation to spend the money elsewhere.

-

Take Advantage of Employer-Sponsored Retirement Plans: If your employer offers a 401(k) or other retirement plan, take full advantage of it, especially if there is an employer matching contribution. This is essentially “free money” that can significantly boost your retirement savings.

-

Reduce Expenses: Identify areas where you can cut back on spending to free up more money for savings. Even small reductions in discretionary spending can add up over time.

-

Increase Savings Gradually: As your income increases, gradually increase the amount you save each month. This allows you to adjust your savings rate without making drastic changes to your lifestyle.

-

Invest Wisely: Educate yourself about different investment options and choose investments that align with your risk tolerance and time horizon. Consider consulting with a financial advisor to develop a personalized investment strategy.

The Consequences of Delaying Retirement Savings

The consequences of delaying retirement savings can be significant and far-reaching. Some of the potential repercussions include:

-

Reduced Retirement Income: Delaying savings means less time for investments to grow, resulting in a smaller retirement nest egg and potentially lower income during retirement.

-

Increased Financial Strain: Individuals who delay saving may need to work longer or rely more heavily on Social Security to cover their expenses in retirement, potentially leading to financial strain and a lower quality of life.

-

Missed Opportunities: Delaying savings means missing out on the potential benefits of compounding interest and investment growth, which can significantly impact long-term financial security.

-

Increased Dependence on Others: Individuals who have not saved adequately for retirement may become dependent on family members or government assistance to cover their expenses, potentially creating a burden for others.

-

Lower Standard of Living: Delaying savings may force individuals to accept a lower standard of living during retirement, potentially requiring them to make significant sacrifices to make ends meet.

Addressing Common Objections to Saving Early

Many individuals have valid reasons for delaying retirement savings, such as student loan debt, low wages, or unexpected expenses. However, Orman argues that even in these challenging circumstances, it is still possible to start saving, even if the amounts are small.

Here are some common objections to saving early and potential solutions:

-

“I have too much debt.” Focus on paying down high-interest debt first, but also try to save a small amount each month, even if it’s just \$25 or \$50. Every little bit helps.

-

“I don’t make enough money.” Look for ways to reduce expenses and free up more money for savings. Even small changes, such as cutting back on eating out or entertainment, can make a difference.

-

“I have unexpected expenses.” Build an emergency fund to cover unexpected expenses so you don’t have to dip into your retirement savings. Aim to have at least three to six months’ worth of living expenses in your emergency fund.

-

“I don’t know how to invest.” Start by educating yourself about different investment options or consult with a financial advisor. There are many resources available to help you learn about investing.

-

“I’ll start saving when I make more money.” Don’t wait until you’re earning a higher income to start saving. Start now, even if it’s just a small amount, and gradually increase your savings rate as your income grows.

The Role of Financial Literacy

Orman’s message underscores the importance of financial literacy in making informed decisions about retirement savings. Many individuals lack the knowledge and skills necessary to effectively manage their finances, which can lead to poor financial outcomes.

Financial literacy education should be a priority for individuals of all ages, starting in childhood. By learning about budgeting, saving, investing, and debt management, individuals can develop the skills they need to make sound financial decisions and secure their financial future.

Beyond Personal Responsibility: Systemic Challenges

While Orman’s advice emphasizes personal responsibility, it’s crucial to acknowledge the systemic challenges that can hinder individuals’ ability to save for retirement. These challenges include:

-

Wage Stagnation: Many workers have experienced stagnant wages for decades, making it difficult to save for retirement while also covering essential living expenses.

-

Rising Healthcare Costs: Healthcare costs continue to rise, placing a significant financial burden on individuals and families and potentially diverting funds away from retirement savings.

-

Lack of Access to Retirement Plans: Many workers, particularly those in part-time or low-wage jobs, do not have access to employer-sponsored retirement plans, making it more difficult for them to save for retirement.

-

Social Security Uncertainty: The future of Social Security is uncertain, which can make it difficult for younger generations to plan for retirement.

Addressing these systemic challenges will require policy changes that promote wage growth, control healthcare costs, expand access to retirement plans, and ensure the long-term solvency of Social Security.

The Importance of Planning and Setting Goals

Retirement planning is not just about saving money; it’s also about setting goals and developing a plan to achieve them. Individuals should consider their desired lifestyle in retirement, estimate their expenses, and determine how much they need to save to cover those expenses.

It’s also important to consider factors such as inflation, taxes, and healthcare costs when planning for retirement. These factors can significantly impact the amount of money needed to maintain a comfortable standard of living in retirement.

Seeking Professional Advice

While Orman provides valuable advice and guidance, it’s always a good idea to seek professional advice from a qualified financial advisor. A financial advisor can help you develop a personalized retirement plan that takes into account your individual circumstances, goals, and risk tolerance.

A financial advisor can also provide guidance on investment options, tax planning, and estate planning, helping you make informed decisions about your financial future.

The Changing Landscape of Retirement

The concept of retirement is evolving, with many individuals choosing to work part-time or pursue other activities during their retirement years. This “encore career” can provide both financial and personal fulfillment, allowing individuals to stay active and engaged while also supplementing their retirement income.

It’s important to be flexible and adaptable when planning for retirement, as circumstances can change over time. Be prepared to adjust your plans as needed to ensure that you can achieve your goals and maintain a comfortable standard of living in retirement.

Conclusion: Taking Control of Your Financial Future

Suze Orman’s warning about delaying retirement savings serves as a wake-up call for individuals of all ages. By starting early, even with modest contributions, and taking advantage of the power of compounding interest, you can significantly increase your chances of achieving financial security in retirement.

While there are challenges to saving for retirement, it’s important to remember that you are in control of your financial future. By making smart choices, setting goals, and seeking professional advice, you can take steps to secure your financial well-being and enjoy a comfortable retirement. Don’t wait – start saving for retirement today.

Frequently Asked Questions (FAQ)

-

What exactly does Suze Orman mean by the “biggest life mistake” in relation to finances?

Suze Orman identifies delaying retirement savings as the “biggest life mistake.” She emphasizes that starting to save early, regardless of income, allows individuals to harness the power of compounding interest, which can significantly enhance long-term financial security. Delaying this process means missing out on valuable years of potential growth and ultimately needing to save much more later in life to achieve the same results. As she put it, “It’s not about how much money you make; it’s about the time you give your money to grow.”

-

Why is compounding interest so crucial when it comes to retirement savings?

Compounding interest is crucial because it generates earnings not only on the initial principal but also on the accumulated interest over time, leading to exponential growth. This means that the earlier you start saving, the more time your money has to grow and generate returns, resulting in a substantially larger retirement fund compared to starting later, even with higher contributions. For example, someone who starts saving at 25 will likely accumulate more wealth by 65 than someone who starts at 35, even if the latter contributes more each month.

-

What are some practical steps someone with limited income can take to begin saving for retirement?

Suze Orman suggests several practical steps for those with limited income:

- Automate Savings: Set up automatic transfers from your checking account to a retirement savings account to ensure consistent contributions.

- Employer-Sponsored Plans: Take advantage of employer-sponsored retirement plans like 401(k)s, especially if there’s an employer match.

- Reduce Expenses: Identify areas where you can cut back on spending to free up more money for savings.

- Increase Savings Gradually: As income increases, gradually increase the amount saved each month.

-

What are the potential long-term consequences of delaying retirement savings, according to Suze Orman?

The potential consequences of delaying retirement savings are severe and include:

- Reduced Retirement Income: Less time for investments to grow results in a smaller retirement nest egg.

- Increased Financial Strain: May need to work longer or rely heavily on Social Security, leading to financial strain.

- Missed Opportunities: Missing out on the benefits of compounding interest and investment growth.

- Increased Dependence on Others: Potential reliance on family members or government assistance.

- Lower Standard of Living: Forcing acceptance of a lower standard of living during retirement due to inadequate savings.

-

Besides personal responsibility, what systemic challenges impact an individual’s ability to save for retirement, and how can these be addressed?

Systemic challenges impacting retirement savings include:

- Wage Stagnation: Makes it difficult to save while covering essential living expenses.

- Rising Healthcare Costs: Diverts funds away from retirement savings.

- Lack of Access to Retirement Plans: Many workers lack access to employer-sponsored plans.

- Social Security Uncertainty: The future of Social Security is uncertain.

Addressing these requires policy changes that promote wage growth, control healthcare costs, expand access to retirement plans, and ensure the long-term solvency of Social Security. These changes complement personal efforts to save and provide a more equitable foundation for retirement security.