Tesla is reportedly grappling with a significant inventory buildup, prompting the electric vehicle giant to offer considerable discounts and incentives to stimulate demand and reduce its stock of unsold vehicles. This move raises questions about the sustainability of Tesla’s growth trajectory and the overall health of the electric vehicle market amid rising competition and evolving consumer preferences.

Tesla is increasingly resorting to price cuts and incentives to move its existing inventory, suggesting a potential slowdown in demand for its vehicles. The company has implemented various strategies, including discounts, promotional financing, and other perks, to attract buyers and alleviate the growing pressure from its expanding inventory levels. “Tesla has been ramping up incentives on its existing inventory this month,” Yahoo Finance reported, indicating a proactive approach to address the situation.

Inventory Surge and Demand Concerns

Several factors contribute to Tesla’s inventory challenges, including increased production capacity, macroeconomic headwinds, and intensified competition within the electric vehicle sector. As Tesla’s Gigafactories in various locations continue to ramp up production, the company faces the challenge of matching supply with demand, especially amid global economic uncertainties.

The company’s reliance on price adjustments to stimulate sales indicates that organic demand may not be sufficient to absorb the current production levels. Tesla’s global expansion strategy, while promising in the long term, introduces complexities in managing regional demand variations and logistical challenges.

“The EV pioneer is now having to offer sweeteners to shift the metal,” stated a Yahoo Finance analysis, underscoring the shift from a high-demand environment to one where incentives are necessary to maintain sales momentum. This situation contrasts with previous years when Tesla struggled to keep up with overwhelming demand, leading to long wait times for customers.

Discounts and Incentives

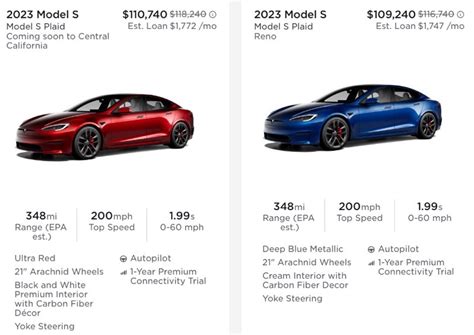

Tesla has introduced a range of incentives to boost sales, including price reductions on existing inventory, attractive financing options, and additional perks such as free Supercharging miles. These incentives aim to make Tesla vehicles more accessible to a broader range of consumers and encourage potential buyers to make a purchase.

According to reports, Tesla is offering discounts on certain Model 3 and Model Y vehicles, with some discounts exceeding several thousand dollars. These price adjustments vary by region and specific vehicle configuration, reflecting Tesla’s effort to tailor its approach to local market conditions.

Moreover, Tesla is providing promotional financing rates to lower the overall cost of ownership, making its vehicles more competitive with traditional gasoline-powered cars. The company is also offering incentives such as free Supercharging miles to sweeten the deal for prospective buyers.

“These [incentives] are likely aimed at clearing out existing inventory as Tesla prepares for potential updates to its vehicle lineup,” according to industry analysts, suggesting that the discounts may be a strategic move to prepare for the introduction of new models or refreshed versions of existing ones.

Impact on Profit Margins

While discounts and incentives can help boost sales volume, they also have implications for Tesla’s profit margins. Reducing prices directly affects the revenue generated per vehicle, potentially impacting the company’s overall profitability.

Tesla has historically maintained relatively high profit margins compared to other automakers, but the increasing reliance on discounts raises concerns about whether the company can sustain these margins in the long term. The balance between maintaining sales volume and preserving profitability is a critical challenge for Tesla as it navigates the evolving market dynamics.

Analysts are closely monitoring Tesla’s financial performance to assess the impact of these incentives on the company’s bottom line. The ability to manage costs effectively and optimize production processes will be crucial for Tesla to mitigate the negative effects of price reductions on its profit margins.

Competition and Market Dynamics

The electric vehicle market is becoming increasingly competitive, with numerous automakers launching new EV models and challenging Tesla’s dominance. Established players like General Motors, Ford, and Volkswagen, as well as emerging EV startups, are vying for market share, creating a more crowded and competitive landscape.

This increased competition puts pressure on Tesla to innovate and differentiate its products to maintain its competitive edge. The company must continue to invest in research and development to develop new technologies, improve vehicle performance, and enhance the overall ownership experience.

Moreover, Tesla faces competition from other EV manufacturers that offer vehicles at lower price points, appealing to more budget-conscious consumers. The availability of more affordable electric vehicles puts pressure on Tesla to offer competitive pricing and incentives to attract customers.

“Tesla isn’t the only one dealing with this, either,” Yahoo Finance noted, indicating that the challenges of managing inventory and stimulating demand are not unique to Tesla but are affecting the broader electric vehicle industry.

Future Outlook

The long-term outlook for Tesla remains positive, driven by the growing demand for electric vehicles and the company’s strong brand reputation. However, Tesla must address the immediate challenges of managing inventory and navigating the increasingly competitive market landscape.

The company’s ability to innovate, optimize production, and effectively manage its cost structure will be critical factors in its future success. Tesla’s investments in battery technology, autonomous driving, and energy solutions position it for long-term growth, but the company must also navigate the short-term challenges effectively.

Analysts predict that Tesla will continue to be a major player in the electric vehicle market, but its growth trajectory may be more moderate than in previous years. The company’s ability to adapt to changing market conditions and maintain its competitive edge will be crucial for its long-term success.

Consumer Sentiment and Market Trends

Consumer sentiment towards electric vehicles remains positive, driven by growing awareness of environmental concerns and the increasing availability of EV models. However, factors such as range anxiety, charging infrastructure limitations, and the higher upfront cost of EVs continue to be barriers to widespread adoption.

Tesla has played a significant role in shaping consumer perceptions of electric vehicles and driving demand for EVs. The company’s innovative technology, stylish designs, and high-performance vehicles have attracted a loyal customer base and helped to mainstream electric mobility.

As the electric vehicle market matures, consumer expectations are evolving, and buyers are becoming more discerning. Factors such as reliability, charging convenience, and overall value are becoming increasingly important in the purchasing decision. Tesla must continue to meet these evolving consumer expectations to maintain its leadership position in the market.

Tesla’s Response and Strategies

Tesla is actively responding to the challenges of inventory buildup and increased competition by implementing various strategies to stimulate demand and optimize its operations. The company is focusing on expanding its Supercharger network, improving its manufacturing efficiency, and developing new technologies to enhance its products and services.

Tesla’s investments in battery technology are particularly important, as they can help to reduce the cost of EVs, improve their range, and enhance their performance. The company’s Gigafactory projects are aimed at increasing battery production capacity and reducing reliance on external suppliers.

Moreover, Tesla is focusing on developing autonomous driving technology, which has the potential to revolutionize the transportation industry. The company’s Autopilot and Full Self-Driving features aim to improve safety, convenience, and overall driving experience.

Tesla is also exploring new business models, such as energy storage solutions and solar products, to diversify its revenue streams and reduce its reliance on vehicle sales. The company’s energy division is growing rapidly, driven by increasing demand for residential and commercial energy storage systems.

Expert Opinions and Analysis

Industry experts and analysts have offered various perspectives on Tesla’s inventory challenges and the broader electric vehicle market dynamics. Some analysts believe that Tesla’s growth trajectory will continue, driven by the increasing demand for EVs and the company’s strong brand reputation.

Other analysts express concerns about Tesla’s ability to sustain its high growth rates in the face of increasing competition and macroeconomic headwinds. They suggest that Tesla may need to adjust its strategy and focus on improving profitability and managing costs more effectively.

“The question is whether this is a short-term issue related to production bottlenecks or a sign of broader demand weakness,” said one industry analyst, highlighting the uncertainty surrounding Tesla’s current situation.

The consensus among experts is that the electric vehicle market will continue to grow in the long term, but the pace of growth may vary depending on factors such as government policies, technological advancements, and consumer preferences. Tesla will need to adapt to these changing market conditions to maintain its leadership position and achieve its long-term goals.

The Global EV Market Landscape

The global electric vehicle market is experiencing rapid growth, driven by increasing awareness of environmental issues, government incentives, and technological advancements. Countries around the world are implementing policies to encourage the adoption of electric vehicles, including tax credits, subsidies, and emission standards.

China is currently the largest electric vehicle market in the world, followed by Europe and North America. The Chinese government has implemented aggressive policies to promote the adoption of EVs, including subsidies for manufacturers and consumers, as well as restrictions on the sale of gasoline-powered vehicles in certain cities.

Europe is also experiencing rapid growth in the electric vehicle market, driven by strict emission standards and government incentives. Several European countries have announced plans to phase out gasoline-powered vehicles in the coming years, creating a strong impetus for the adoption of EVs.

North America is lagging behind China and Europe in terms of electric vehicle adoption, but the market is growing rapidly. The US government has implemented tax credits for EV buyers and is investing in charging infrastructure to support the growth of the market.

Tesla has a strong presence in all three major electric vehicle markets, but it faces increasing competition from local manufacturers. The company must continue to innovate and adapt to local market conditions to maintain its competitive edge and achieve its global growth objectives.

Charging Infrastructure and Range Anxiety

One of the key challenges facing the electric vehicle market is the lack of adequate charging infrastructure. Range anxiety, or the fear of running out of battery power before reaching a charging station, remains a major barrier to widespread adoption of EVs.

Tesla has invested heavily in its Supercharger network, which provides fast and convenient charging for its vehicles. The company continues to expand its Supercharger network globally, but more charging stations are needed to support the growing number of EVs on the road.

Other automakers and charging network operators are also investing in charging infrastructure, but the pace of deployment needs to accelerate to meet the growing demand. Governments also have a role to play in supporting the development of charging infrastructure, through policies and investments.

The availability of convenient and reliable charging infrastructure is essential for overcoming range anxiety and encouraging more consumers to switch to electric vehicles.

Raw Materials and Battery Supply Chain

The production of electric vehicles requires a significant amount of raw materials, including lithium, cobalt, nickel, and graphite. The availability and cost of these raw materials are key factors influencing the growth and profitability of the electric vehicle industry.

Tesla has been working to secure its supply of raw materials by investing in mining projects and establishing partnerships with suppliers. The company is also exploring alternative battery chemistries that use less of these scarce and expensive materials.

The battery supply chain is becoming increasingly complex, with multiple players involved in mining, refining, and manufacturing. Ensuring a sustainable and ethical supply chain is a key challenge for the electric vehicle industry.

Companies are implementing measures to track the origin of raw materials and ensure that they are sourced responsibly. The industry is also working to develop recycling technologies to recover valuable materials from end-of-life batteries.

Regulatory Landscape and Government Policies

Government policies and regulations play a crucial role in shaping the electric vehicle market. Policies such as tax credits, subsidies, and emission standards can significantly influence the demand for EVs and the investment decisions of automakers.

Many countries have implemented policies to encourage the adoption of electric vehicles, including tax credits for EV buyers and subsidies for manufacturers. Some countries have also announced plans to phase out gasoline-powered vehicles in the coming years, creating a strong impetus for the adoption of EVs.

Regulations such as emission standards can also drive the adoption of electric vehicles by making it more expensive to sell gasoline-powered vehicles. These regulations can create a competitive advantage for electric vehicles, which have zero tailpipe emissions.

The regulatory landscape for electric vehicles is constantly evolving, and automakers need to stay informed about the latest policies and regulations to make informed business decisions.

Technological Advancements and Innovation

Technological advancements are driving innovation in the electric vehicle industry, leading to improvements in battery technology, motor performance, and charging infrastructure. These advancements are making electric vehicles more attractive to consumers and more competitive with gasoline-powered vehicles.

Battery technology is a key area of innovation, with researchers working to develop batteries that are more energy-dense, longer-lasting, and cheaper to produce. Solid-state batteries are a promising technology that could potentially offer significant improvements in battery performance and safety.

Motor performance is also improving, with automakers developing more efficient and powerful electric motors. These improvements are leading to faster acceleration and higher top speeds for electric vehicles.

Charging infrastructure is also evolving, with the development of faster charging technologies and more convenient charging locations. Wireless charging is a promising technology that could potentially make it easier to charge electric vehicles.

Economic Factors and Consumer Affordability

Economic factors, such as fuel prices and interest rates, can influence the demand for electric vehicles. Higher fuel prices can make electric vehicles more attractive to consumers, as they offer lower operating costs.

Lower interest rates can also make electric vehicles more affordable, as they reduce the cost of financing a purchase. Government incentives, such as tax credits and subsidies, can also make electric vehicles more affordable for consumers.

Consumer affordability is a key factor influencing the adoption of electric vehicles. As the cost of electric vehicles continues to decline, they will become more accessible to a wider range of consumers.

Environmental Impact and Sustainability

Electric vehicles offer significant environmental benefits compared to gasoline-powered vehicles, as they have zero tailpipe emissions. However, the environmental impact of electric vehicles depends on the source of electricity used to charge them.

If electric vehicles are charged with electricity generated from renewable sources, such as solar and wind power, they can significantly reduce greenhouse gas emissions. However, if electric vehicles are charged with electricity generated from fossil fuels, their environmental benefits are reduced.

The sustainability of electric vehicles also depends on the environmental impact of battery production and disposal. The mining and processing of raw materials for batteries can have negative environmental consequences, and the disposal of end-of-life batteries can also pose environmental challenges.

The electric vehicle industry is working to address these environmental challenges by developing more sustainable battery production processes and recycling technologies.

Social and Cultural Factors

Social and cultural factors can also influence the adoption of electric vehicles. Consumer perceptions of electric vehicles, their social status, and their alignment with personal values can all influence purchasing decisions.

Electric vehicles are often seen as a symbol of environmental consciousness and technological innovation. Consumers who value these qualities may be more likely to purchase an electric vehicle.

Social norms and peer influence can also play a role in the adoption of electric vehicles. If friends and family members own electric vehicles, consumers may be more likely to consider purchasing one themselves.

Frequently Asked Questions (FAQs)

Q1: Why is Tesla offering discounts on its vehicles?

A1: Tesla is reportedly offering discounts to reduce its growing inventory of unsold vehicles. This is likely due to a combination of factors, including increased production capacity, macroeconomic headwinds affecting consumer demand, and heightened competition in the electric vehicle market. According to Yahoo Finance, “Tesla has been ramping up incentives on its existing inventory this month,” suggesting a strategic move to stimulate sales.

Q2: How significant are the discounts Tesla is offering?

A2: The discounts vary by model, configuration, and region. Reports indicate that some Model 3 and Model Y vehicles are being offered with discounts of several thousand dollars. Additionally, Tesla is providing promotional financing rates and incentives such as free Supercharging miles to attract buyers.

Q3: Will these discounts impact Tesla’s profit margins?

A3: Yes, discounts and incentives can put pressure on Tesla’s profit margins. Reducing prices directly affects the revenue generated per vehicle, potentially impacting the company’s overall profitability. Analysts are closely monitoring Tesla’s financial performance to assess the impact of these incentives on the company’s bottom line.

Q4: Is Tesla the only EV company facing inventory challenges?

A4: No, Tesla isn’t the only one. According to Yahoo Finance, “Tesla isn’t the only one dealing with this, either,” indicating that the challenges of managing inventory and stimulating demand are affecting the broader electric vehicle industry due to increased competition and evolving market dynamics.

Q5: What does this inventory surge mean for the future of Tesla and the EV market?

A5: While the long-term outlook for Tesla and the EV market remains positive, the inventory surge highlights the need for Tesla to adapt to changing market conditions. The company’s ability to innovate, optimize production, and effectively manage its cost structure will be crucial for its future success. For the broader EV market, it signifies a shift towards increased competition and the need for companies to offer competitive pricing and incentives to attract customers. The increased inventory across the sector can potentially lead to consolidation and slower growth in the short term as companies adjust to consumer demands and economic conditions.