To be considered among the upper class in your 50s requires a minimum net worth of $2.3 million, according to recent data analyzing wealth brackets in the United States. This figure represents the threshold to be in the top 10% of wealth holders for that age group, highlighting the substantial accumulation necessary to achieve upper-class status.

The benchmark for upper-class status is a moving target heavily influenced by age, location, and lifestyle expectations. While the $2.3 million net worth figure serves as a general guideline for those in their 50s, the actual amount needed can vary significantly based on individual circumstances. Financial experts emphasize that a comprehensive financial plan, tailored to personal goals and risk tolerance, is crucial for building and maintaining wealth.

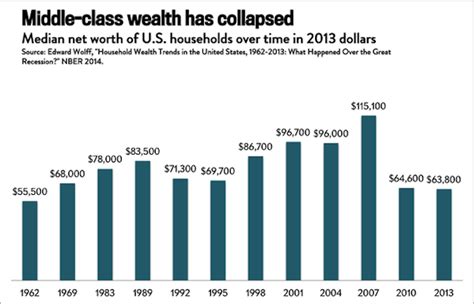

Data from the Federal Reserve and wealth management firms indicates a growing wealth gap in the United States. The top 10% of wealth holders control a disproportionate share of the nation’s assets, making the attainment of upper-class status increasingly challenging for many Americans. This disparity underscores the importance of understanding wealth accumulation strategies and financial planning.

Defining “upper class” often involves more than just a specific net worth. It encompasses a combination of factors, including income, assets, lifestyle, and social standing. However, net worth remains a primary indicator of financial success and a key determinant of one’s position in the wealth distribution.

The path to achieving upper-class status requires a combination of disciplined savings, strategic investments, and careful financial management. Understanding investment options, tax implications, and retirement planning is essential for building a substantial net worth.

Defining Upper Class: More Than Just a Number

The concept of “upper class” is multifaceted, defying a simple numerical definition. While a net worth of $2.3 million places an individual in the top 10% of wealth holders in their 50s, it’s crucial to understand the broader context of what constitutes upper-class status. Financial professionals contend that lifestyle, income streams, asset diversification, and overall financial security are all crucial factors.

“Net worth is just one piece of the puzzle,” says a certified financial planner (CFP) quoted in the original Yahoo Finance article. “It’s important to consider your income, expenses, and long-term financial goals when assessing your overall financial health.” This perspective highlights the limitations of using a single net worth figure as the sole determinant of upper-class status.

A high net worth doesn’t automatically translate to a comfortable or secure retirement. For example, someone with $2.3 million primarily invested in illiquid assets, such as real estate, might face challenges accessing funds for living expenses or unexpected healthcare costs. Similarly, a high net worth coupled with significant debt could indicate a precarious financial situation.

Therefore, defining upper class requires a holistic approach that considers both tangible assets and intangible factors, such as financial literacy, risk management, and long-term financial planning. While the $2.3 million benchmark provides a useful point of reference, it should not be interpreted as the definitive marker of upper-class status.

The Role of Age and Location

The “upper class” net worth benchmark is highly sensitive to age and geographical location. A $2.3 million net worth might provide a comfortable lifestyle in a low-cost-of-living area, but it might not be sufficient to maintain an upper-class lifestyle in an expensive metropolitan area like New York City or San Francisco.

Younger individuals typically have lower net worths due to fewer years of accumulating wealth. As people progress through their careers and approach retirement, their net worths tend to increase. Therefore, the benchmark for upper-class status should be adjusted based on age to reflect these differences.

For instance, the net worth required to be in the top 10% for individuals in their 30s is significantly lower than the $2.3 million required for those in their 50s. Similarly, individuals in their 70s or older may need a higher net worth to maintain their standard of living due to increased healthcare costs and longer life expectancies.

Location also plays a crucial role in determining the adequacy of a given net worth. The cost of housing, transportation, food, and other essential goods and services varies significantly across different regions of the United States. Consequently, a net worth that provides a comfortable upper-class lifestyle in a rural area might be insufficient to maintain a comparable lifestyle in a major urban center.

Financial advisors recommend taking into account these age and location-specific factors when assessing your financial progress and setting financial goals. Comparing your net worth to that of your peers in similar age groups and geographical locations can provide a more realistic assessment of your financial standing.

Factors Influencing Net Worth Accumulation

Several factors contribute to the accumulation of net worth, including income, savings habits, investment strategies, and inheritance. Understanding these factors is crucial for developing a comprehensive financial plan and maximizing your potential for wealth accumulation.

Income is a primary driver of net worth. Individuals with higher incomes generally have more disposable income available for savings and investments. However, income alone is not sufficient to guarantee a high net worth. Responsible financial management and disciplined savings habits are equally important.

Savings habits refer to the proportion of income that is saved and invested rather than spent. Individuals who consistently save a significant portion of their income are more likely to accumulate wealth over time. Automating savings through payroll deductions or automatic transfers to investment accounts can help to develop and maintain disciplined savings habits.

Investment strategies also play a crucial role in net worth accumulation. Investing in a diversified portfolio of stocks, bonds, and other assets can provide the potential for long-term growth. However, it’s important to understand the risks associated with different investment options and to choose investments that align with your risk tolerance and financial goals.

Inheritance can significantly impact an individual’s net worth. Inherited assets can provide a substantial boost to wealth accumulation, particularly for younger individuals who have had less time to accumulate wealth on their own. However, inheritance is not a guaranteed path to wealth and should not be relied upon as the sole source of financial security.

Strategic Investment Approaches

Strategic investment approaches are essential for maximizing wealth accumulation and achieving long-term financial goals. Diversification, asset allocation, and risk management are key components of a sound investment strategy.

Diversification involves spreading your investments across a variety of asset classes, such as stocks, bonds, real estate, and commodities. Diversification helps to reduce risk by minimizing the impact of any single investment on your overall portfolio.

Asset allocation refers to the distribution of your investments across different asset classes based on your risk tolerance, time horizon, and financial goals. A well-diversified portfolio should be tailored to your individual circumstances and rebalanced periodically to maintain your desired asset allocation.

Risk management involves assessing and mitigating the risks associated with your investments. This includes understanding the potential for losses and taking steps to protect your portfolio from significant declines. Risk management strategies can include using stop-loss orders, hedging your investments, and diversifying your portfolio across different geographic regions and industries.

Beyond these core principles, specific investment vehicles can be employed to enhance wealth accumulation. Real estate, for instance, can provide both income and capital appreciation. However, it also requires careful management and carries potential risks. Similarly, alternative investments like private equity or hedge funds can offer higher returns but often come with increased risk and illiquidity. Tax-advantaged accounts, such as 401(k)s and IRAs, play a significant role in maximizing long-term growth by sheltering investment gains from current taxation.

The Impact of the Wealth Gap

The wealth gap in the United States has been widening for decades, creating significant disparities in wealth accumulation opportunities. The top 10% of wealth holders control a disproportionate share of the nation’s assets, while the bottom 50% hold a very small percentage of total wealth. This disparity can make it more challenging for individuals from lower socioeconomic backgrounds to achieve upper-class status.

Several factors contribute to the wealth gap, including income inequality, access to education and healthcare, and systemic biases in the financial system. Individuals with higher incomes have more disposable income available for savings and investments, while those with lower incomes often struggle to meet basic needs.

Access to quality education and healthcare can also impact wealth accumulation. Individuals with higher levels of education tend to earn more over their lifetimes, while access to affordable healthcare can prevent unexpected medical expenses from depleting savings.

Systemic biases in the financial system, such as discriminatory lending practices and unequal access to investment opportunities, can further exacerbate the wealth gap. Addressing these systemic issues is crucial for creating a more equitable society where everyone has the opportunity to build wealth.

The wealth gap also influences the perception of what constitutes “upper class.” As the gap widens, the resources required to achieve and maintain upper-class status increase, making it more difficult for those outside the top wealth brackets to attain that level of financial security.

Lifestyle and Financial Planning

Achieving a certain net worth is only one component of being considered “upper class.” Lifestyle choices and comprehensive financial planning also play vital roles. An upper-class lifestyle often involves significant spending on luxury goods, travel, entertainment, and other discretionary expenses. However, it’s important to balance lifestyle aspirations with responsible financial management.

Financial planning involves setting financial goals, developing a budget, managing debt, and planning for retirement. A well-structured financial plan can help individuals to stay on track towards their financial goals and to make informed decisions about their spending and investments.

Retirement planning is a particularly important aspect of financial planning. Individuals need to accumulate sufficient savings to support their desired lifestyle in retirement. This requires estimating future expenses, projecting investment returns, and planning for potential healthcare costs.

Tax planning is another critical component of financial planning. Minimizing your tax liability can help to maximize your net worth and to achieve your financial goals more quickly. Tax planning strategies can include contributing to tax-advantaged retirement accounts, claiming eligible deductions and credits, and managing your investments in a tax-efficient manner.

Estate planning involves planning for the distribution of your assets after your death. This includes creating a will, establishing trusts, and designating beneficiaries for your retirement accounts and insurance policies. Estate planning can help to ensure that your assets are distributed according to your wishes and to minimize estate taxes.

Ultimately, achieving and maintaining upper-class status requires a combination of financial discipline, strategic investment approaches, and careful financial planning. It’s important to set realistic financial goals, develop a comprehensive financial plan, and to work with a qualified financial advisor to achieve your financial aspirations.

Overcoming Financial Challenges

Even with careful planning and disciplined execution, unexpected financial challenges can arise that threaten to derail your progress toward achieving upper-class status. Job loss, unexpected medical expenses, and economic downturns can all significantly impact your net worth and financial security.

Building an emergency fund is crucial for weathering unexpected financial challenges. An emergency fund should contain enough liquid assets to cover at least three to six months of living expenses. This can provide a financial cushion to help you stay afloat during periods of unemployment or unexpected expenses.

Managing debt is also essential for maintaining financial stability. High levels of debt can strain your budget and make it more difficult to save and invest. Prioritizing debt repayment can help to free up cash flow and reduce your overall financial risk.

Diversifying your income streams can also provide a safety net in case of job loss or economic downturn. Developing multiple sources of income, such as through freelance work or side businesses, can help to cushion the impact of unexpected financial events.

Seeking professional financial advice can also be invaluable in navigating financial challenges. A qualified financial advisor can help you to assess your financial situation, develop a plan to overcome challenges, and stay on track towards your financial goals.

Psychological Aspects of Wealth

The pursuit of wealth and upper-class status is often intertwined with psychological factors, such as ambition, self-esteem, and social comparison. Understanding these psychological aspects can help individuals to maintain a healthy perspective on wealth and to avoid the pitfalls of materialism and excessive competition.

Ambition can be a powerful motivator for achieving financial success. However, it’s important to balance ambition with realism and to avoid setting unrealistic expectations. Chasing wealth solely for the sake of accumulation can lead to burnout and dissatisfaction.

Self-esteem can also be influenced by financial status. Some individuals derive a sense of worth from their net worth or their social standing. However, it’s important to remember that self-esteem should be based on intrinsic qualities, such as character, values, and relationships, rather than external factors.

Social comparison can also play a role in the pursuit of wealth. Comparing yourself to others can lead to feelings of inadequacy and envy. It’s important to focus on your own financial journey and to avoid getting caught up in the comparison game.

Ultimately, a healthy perspective on wealth involves recognizing that money is a tool that can be used to achieve your goals and to improve your quality of life. However, it’s not an end in itself. Focusing on building meaningful relationships, pursuing your passions, and contributing to society can provide a greater sense of fulfillment than simply accumulating wealth.

Conclusion: A Holistic Approach to Financial Well-being

The pursuit of upper-class status, defined by a net worth of $2.3 million for those in their 50s, should be viewed as one aspect of a broader pursuit of financial well-being. While this figure offers a benchmark, true financial security encompasses factors beyond net worth, including income stability, effective financial planning, and a balanced lifestyle. Navigating the complexities of wealth accumulation requires a strategic approach that incorporates disciplined savings, diversified investments, and careful management of both assets and liabilities. Recognizing the impact of age, location, and the widening wealth gap is crucial for setting realistic goals and developing a tailored financial plan. Furthermore, understanding the psychological aspects of wealth—ambition, self-esteem, and social comparison—can help individuals maintain a healthy perspective and avoid the pitfalls of materialism. Ultimately, financial well-being is not solely about achieving a specific net worth but about creating a secure and fulfilling life that aligns with one’s values and priorities.

Frequently Asked Questions (FAQ)

1. What exactly does “net worth” encompass?

Net worth is calculated by subtracting your total liabilities (debts) from your total assets. Assets include things like cash, investments (stocks, bonds, mutual funds), real estate, retirement accounts, and valuable personal property. Liabilities include debts like mortgages, student loans, credit card debt, and other outstanding loans. A higher net worth generally indicates greater financial stability and wealth.

2. Is $2.3 million really enough to be considered upper class?

While $2.3 million places you in the top 10% of wealth holders in their 50s, whether it’s “enough” depends on your lifestyle, location, and financial goals. In expensive cities, it might not stretch as far as it would in lower-cost areas. Furthermore, consider your retirement plans and desired lifestyle. A thorough financial plan will help determine if this net worth is sufficient for your individual needs. It’s important to remember that “upper class” is a subjective term with varying interpretations.

3. How can I realistically increase my net worth?

Increasing your net worth requires a multi-faceted approach. First, focus on increasing your income through career advancement, additional education, or side hustles. Second, prioritize saving a significant portion of your income regularly. Third, invest wisely in a diversified portfolio of assets that aligns with your risk tolerance and financial goals. Fourth, manage your debt effectively by paying down high-interest debt and avoiding unnecessary borrowing. Finally, seek professional financial advice to develop a personalized plan and stay on track.

4. What are some common mistakes that prevent people from building wealth?

Several common mistakes can hinder wealth accumulation. These include:

- Living beyond your means: Spending more than you earn leads to debt and prevents saving.

- Failing to save regularly: Consistent saving is crucial for long-term wealth building.

- Not investing or investing poorly: Letting money sit idle or making risky investment choices can limit growth.

- Carrying high-interest debt: Debt erodes wealth and diverts funds from savings and investments.

- Lack of financial planning: Without a plan, it’s difficult to set goals and track progress.

- Procrastinating on retirement planning: Starting early is essential for maximizing retirement savings.

5. How often should I review and adjust my financial plan?

You should review your financial plan at least annually, or more frequently if you experience significant life changes such as a job change, marriage, divorce, birth of a child, or major illness. Market fluctuations and changes in tax laws can also necessitate adjustments to your plan. Regular reviews ensure your plan remains aligned with your goals and adapts to changing circumstances. Consider consulting with a financial advisor for professional guidance.